Please use a PC Browser to access Register-Tadawul

Amgen (NasdaqGS:AMGN) Clinical Trial Success In SCLC Treatment With IMDELLTRA

Amgen Inc. AMGN | 317.74 | +0.11% |

Amgen (NasdaqGS:AMGN) made considerable strides in its oncology portfolio, as evidenced by the successful interim results for its DeLLphi-304 trial assessing IMDELLTRA for small cell lung cancer. These product advancements likely buoyed the company's recent quarterly price increase of 7.31%. Moreover, broader market movements contributed to shifts in Amgen's stock. Notably, the volatile trading activity, which saw the Dow and other indexes rally, subdued inflation data, and mixed economic sentiment due to the tariff news, presented a complex backdrop against which Amgen's pharmaceutical achievements resonated positively, potentially influencing investor confidence.

The recent positive developments in Amgen's oncology portfolio, highlighted by successful interim results in the DeLLphi-304 trial, could contribute to sustaining investor confidence, as reflected in the company's recent stock price increase. Over the past five years, Amgen's total shareholder return, comprising both share price appreciation and dividends, was 42.12%. This long-term performance provides a strong context for evaluating its momentum and resilience against market fluctuations. Compared to a year ago, Amgen's one-year performance outshined the US Biotechs industry, which saw a 17.5% decline, showcasing its relative strength in a challenging sector environment.

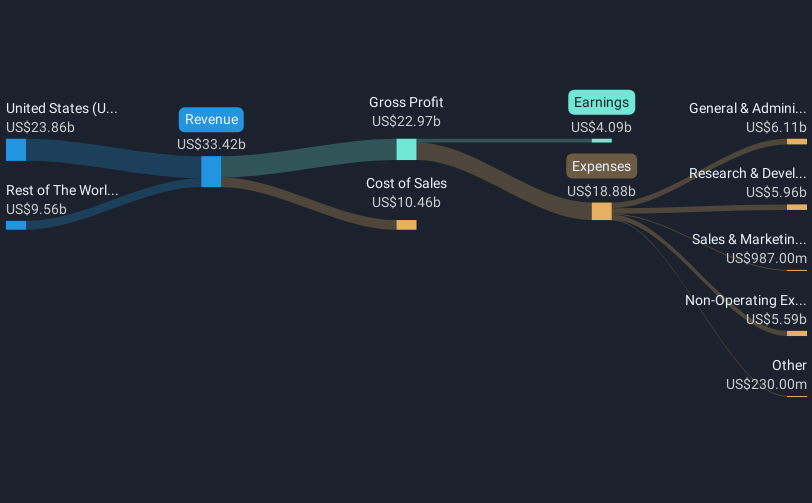

The revenue and earnings forecasts for Amgen may see adjustments due to these product advancements, potentially enhancing growth prospects despite ongoing challenges like declining net prices and patent expirations. Analyst prices target Amgen to $317.64, while the current share price is approximately $291.09, indicating a modest discount to anticipated valuation. These catalysts could bolster revenue, even as the company's earnings forecasts are balanced against expected pricing pressures and increased R&D spending. Investors may benefit from weighing these developments alongside broader industry trends and analyst consensus to better understand Amgen's future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.