Please use a PC Browser to access Register-Tadawul

Amplitude (AMPL): Evaluating Valuation After New AI Product Rollouts and Expanded Beta Launch

Amplitude Inc Class A AMPL | 7.08 | -1.12% |

Amplitude (AMPL) just introduced the public launch of its Model Context Protocol server and expanded the beta of its AI Agents to all customers. These new tools highlight Amplitude’s ongoing effort to make insights from behavioral data even more accessible within familiar AI environments.

Amplitude’s shares have been volatile this year, with a 1-day share price bump of 1.6% following its latest product rollout and a 7-day gain of 4.6%. Still, momentum has fizzled since late summer. The 90-day share price return stands at -20.3% despite a respectable 11.3% total shareholder return over the past year, pointing to improving fundamentals but mixed investor sentiment recently.

If you’re interested in discovering more innovative software names in growth mode, the next logical step is to explore See the full list for free.

With improving fundamentals and expanding AI-driven offerings, Amplitude's stock trades at a sizable discount to analyst targets. Could this be a window to buy in ahead of a turnaround, or is the market already counting on growth?

Most Popular Narrative: 35.3% Undervalued

With Amplitude's narrative-implied fair value standing well above its last close, the valuation gap is catching renewed interest among growth-focused investors. The difference suggests optimism about the company's pathway to scale and profitability that the market may not yet be fully pricing in.

*The continued investment and leadership in AI-driven analytics, supported by multiple strategic talent acquisitions and rapid product innovation (for example, AI agents, Guides, Surveys), position Amplitude to capitalize on the growing enterprise need for automated, actionable insights. These factors create opportunities to increase ACV and command premium pricing, ultimately supporting margin expansion and stronger earnings.*

Want to know what’s fueling this big disconnect between price and fair value? The blueprint includes ambitious revenue growth targets, sharply rising margins, and premium client wins. Only the full narrative unpacks the bold financial assumptions making this premium price seem plausible. Stay tuned for details hidden behind the headline projection.

Result: Fair Value of $15.67 (UNDERVALUED)

However, sluggish monetization of AI products or an overreliance on large enterprise deals could quickly erode optimism around Amplitude’s turnaround story.

Another View: Multiples Analysis

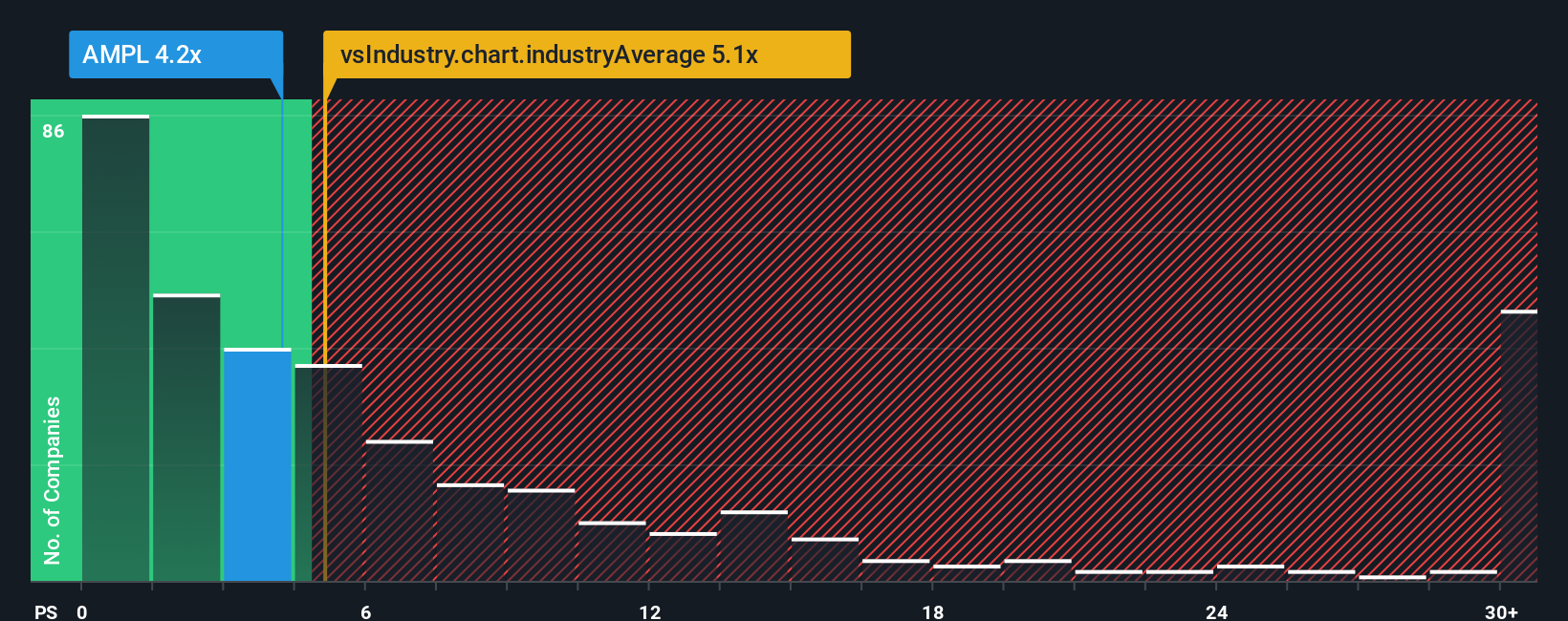

Looking at Amplitude from the lens of sales multiples, things are a bit more complicated. Its current sales ratio of 4.2x is higher than peers at 3.7x, but actually sits below the wider US software sector average of 5.2x. The fair ratio, where valuations may rebalance, is estimated at 4.3x. This tight spread means value opportunity could be limited, or that the door may close quickly if the market's mood changes. What do these competing signals suggest about risk and upside now?

Build Your Own Amplitude Narrative

If you'd rather interpret Amplitude's numbers for yourself or develop your own investment thesis, you can quickly build a unique perspective in just minutes with Do it your way.

A great starting point for your Amplitude research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why settle for one stock story when the next big winner might be just a click away? Don’t risk missing out on unique market moves.

- Capture growth potential with these 27 AI penny stocks to position yourself at the forefront of artificial intelligence innovation.

- Lock in passive income by reviewing these 17 dividend stocks with yields > 3%, which yields over 3% from stable, shareholder-friendly companies.

- Seize value opportunities by scanning these 877 undervalued stocks based on cash flows, where current prices may lag behind future cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.