Please use a PC Browser to access Register-Tadawul

Amprius Technologies (AMPX) Is Up 16.6% After S&P Global BMI Index Inclusion Reflects Battery Sector Momentum

Amprius Technologies, Inc. Common Stock AMPX | 10.91 | -4.63% |

- Amprius Technologies, Inc. was added to the S&P Global BMI Index in September 2025, reflecting the company’s growing presence in advanced battery technology for mobility applications.

- Unique industry recognition and rapid forecasted revenue expansion have drawn new attention from investors, particularly due to the company's success in silicon battery technology and sector partnerships.

- We’ll explore how the S&P Global BMI Index inclusion and continued revenue gains influence Amprius Technologies’ overall investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Amprius Technologies Investment Narrative Recap

To be an Amprius Technologies shareholder, you need confidence in surging demand for advanced silicon battery technology, especially in aviation and drones. The company’s addition to the S&P Global BMI Index increases its visibility but does not materially reduce its dependency on the drone and aviation sectors, which remains the primary short-term catalyst and also the main source of revenue risk.

Among the recent announcements, the September $35 million purchase order for SiCore™ cells from a major UAS manufacturer stands out. This directly reinforces the company’s near-term growth but also underscores its heavy revenue concentration, as thousands of new orders are still anchored in the drone sector.

Yet amid soaring revenue, investors should also be aware that a slowdown in orders from one of Amprius’s major drone customers could...

Amprius Technologies is projected to reach $306.6 million in revenue and $13.4 million in earnings by 2028. This outlook assumes an 89.8% annual revenue growth rate and a $52.1 million increase in earnings from the current -$38.7 million position.

Uncover how Amprius Technologies' forecasts yield a $13.00 fair value, in line with its current price.

Exploring Other Perspectives

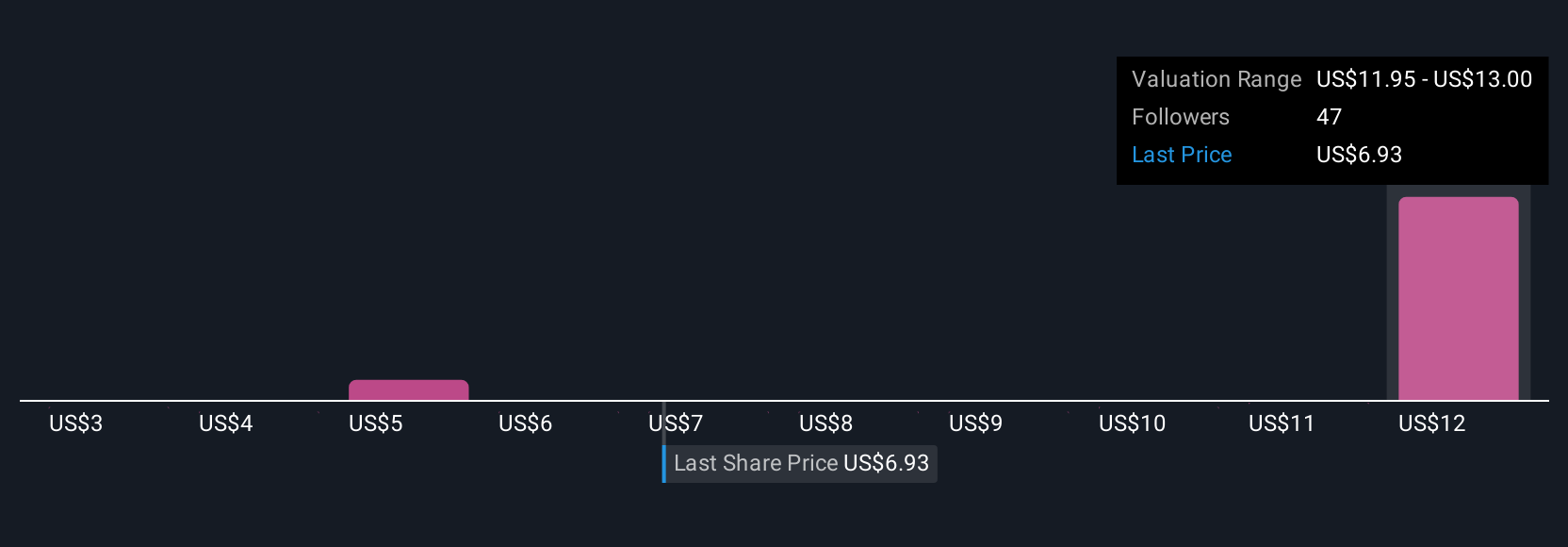

Seven private investors in the Simply Wall St Community assigned fair values for Amprius ranging from US$2.52 to US$13. These diverse views contrast sharply with the real possibility that revenue is highly concentrated in just a few aviation and drone contracts, highlighting the importance of considering multiple viewpoints.

Explore 7 other fair value estimates on Amprius Technologies - why the stock might be worth less than half the current price!

Build Your Own Amprius Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amprius Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Amprius Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amprius Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.