Please use a PC Browser to access Register-Tadawul

ANI Pharmaceuticals (ANIP): Assessing Valuation After Recent Share Price Momentum

ANI Pharmaceuticals, Inc. ANIP | 78.66 | +0.29% |

ANI Pharmaceuticals (ANIP) has quietly kept its momentum, with shares edging higher over the past week and delivering strong gains this year. That strength invites a closer look at what is driving the move.

With the share price now at $82.83, the recent 7 day share price return of just over 3 percent sits against a much stronger year to date share price return and a standout multi year total shareholder return record. This suggests positive momentum is still broadly intact even after a bumpy quarter.

If ANI Pharmaceuticals has you rethinking your healthcare exposure, this could be a good moment to explore other ideas with healthcare stocks.

So with earnings still growing briskly, the share price well below analyst targets and a solid multi year track record, is ANI Pharmaceuticals an underappreciated value in healthcare, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 24.6% Undervalued

Compared with ANI Pharmaceuticals latest close of $82.83, the most followed narrative points to a meaningfully higher fair value anchored in long term growth.

The analysts have a consensus price target of $99.0 for ANI Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $77.0.

Want to see what kind of earnings ramp and margin uplift could justify that valuation spread? The narrative leans on ambitious compounding, disciplined profitability and a punchy future multiple. Curious how those ingredients combine into a fair value well above today’s price?

Result: Fair Value of $109.88 (UNDERVALUED)

However, sustaining this upside depends on Cortrophin Gel maintaining momentum and on generics margins holding up as exclusivity fades and competition intensifies.

Another Take on Valuation

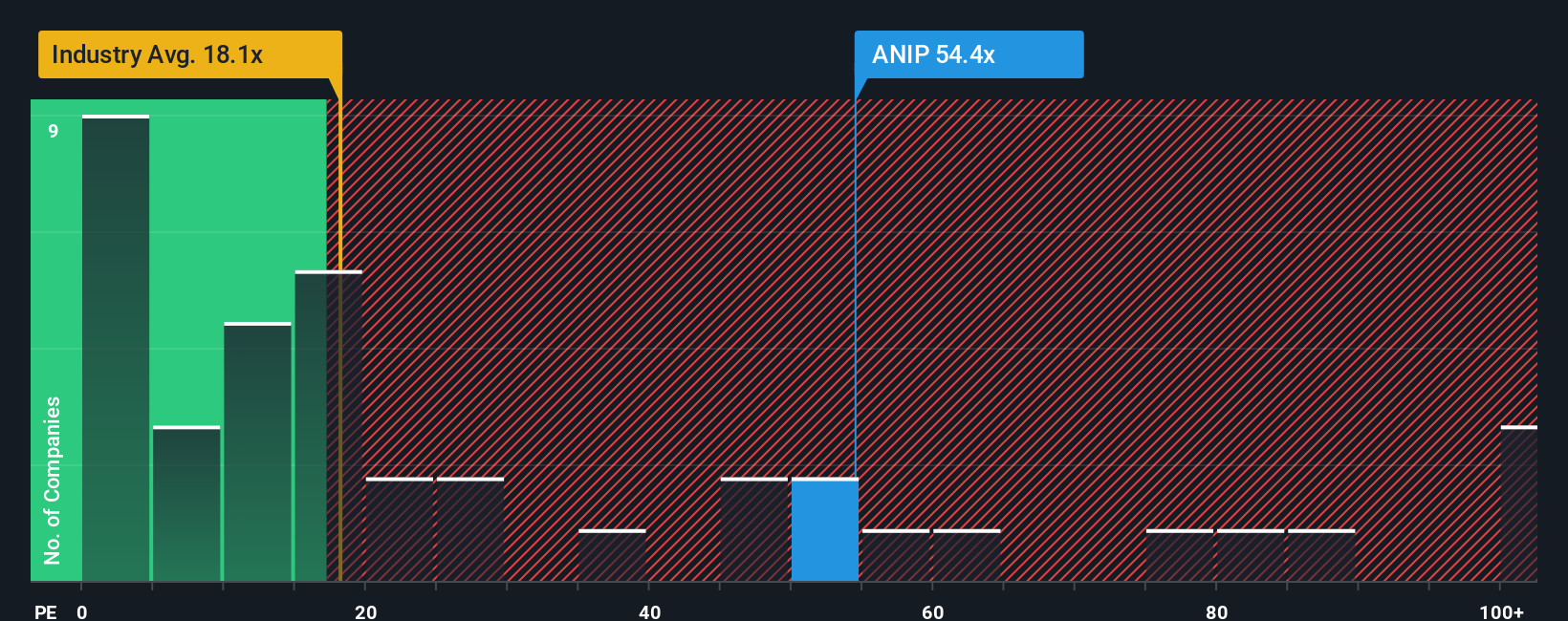

Analysts and narratives lean toward upside, but the current price to earnings ratio of 50.7 times looks stretched next to the US pharmaceuticals industry at 20 times, peers at 18.6 times, and a fair ratio of 20.7 times. Is the growth story strong enough to keep that premium intact?

Build Your Own ANI Pharmaceuticals Narrative

If you are not fully convinced by this view, or prefer hands on research, you can build a tailored thesis for ANI Pharmaceuticals in minutes: Do it your way.

A great starting point for your ANI Pharmaceuticals research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single company when a whole universe of opportunities is within reach. Use the Simply Wall Street Screener to explore more potential investments.

- Explore higher income potential by reviewing these 13 dividend stocks with yields > 3% that could contribute to your portfolio’s cash flow before they attract broader attention.

- Focus on breakthrough innovation with these 24 AI penny stocks that are harnessing artificial intelligence to reshape various industries.

- Identify potentially attractive entry points using these 919 undervalued stocks based on cash flows that may currently be trading below some estimates of intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.