Please use a PC Browser to access Register-Tadawul

Apellis Turns GAAP Profitable As Syfovre Sales Shift Story To Execution

Apellis Pharmaceuticals, Inc. APLS | 22.28 | -2.28% |

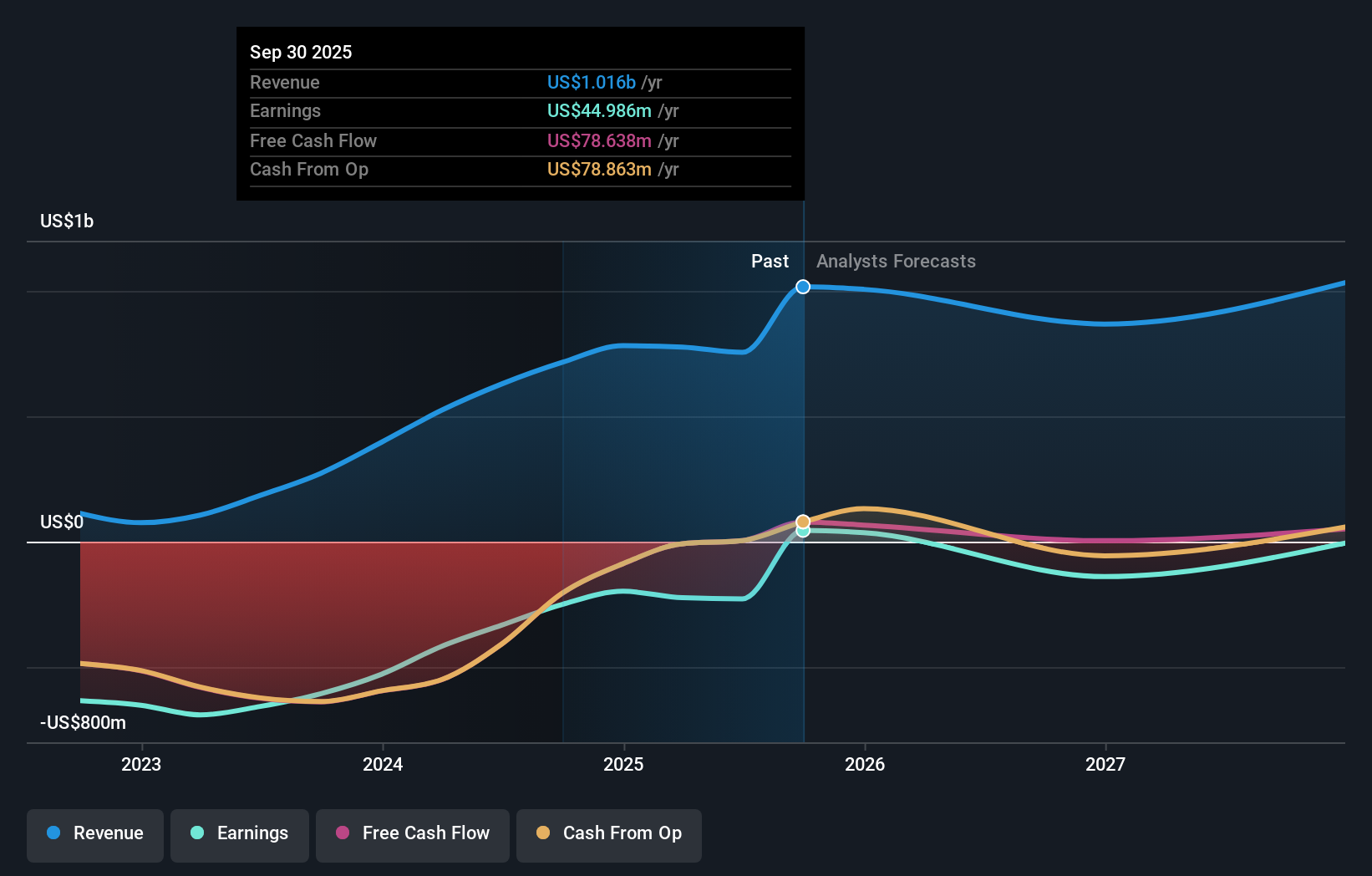

- Apellis Pharmaceuticals (NasdaqGS:APLS) reports GAAP profitability as it ramps commercial sales of Syfovre.

- The company shifts from a primarily clinical stage focus to a commercial model centered on its approved therapy for geographic atrophy.

- This transition marks a new phase for Apellis as a growth stage biotech with revenue tied directly to product sales.

For you as an investor, the key point is that Apellis has moved from relying mainly on development activities to generating revenue from Syfovre, its treatment for geographic atrophy. That puts the business more in line with a commercial biotech model, where performance increasingly reflects real world demand and product uptake.

Looking ahead, the company’s ability to sustain GAAP profitability and build on Syfovre sales will likely be an important focus for the market. You may want to watch how Apellis balances reinvestment in its pipeline with the cash flows that come from being a commercial stage business.

Stay updated on the most important news stories for Apellis Pharmaceuticals by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Apellis Pharmaceuticals.

Quick Assessment

- ✅ Price vs Analyst Target: At US$21.99, the share price sits below the US$34.50 analyst target range midpoint.

- ✅ Simply Wall St Valuation: Simply Wall St models Apellis as undervalued, trading about 77.2% below its estimated fair value.

- ❌ Recent Momentum: The 30 day return of about 11.9% decline shows recent negative share price momentum.

Check out Simply Wall St's in depth valuation analysis for Apellis Pharmaceuticals.

Key Considerations

- 📊 GAAP profitability and commercial Syfovre sales mean the story now hinges more on execution than pure clinical progress.

- 📊 Keep an eye on Syfovre revenue, profit margins and how much cash is recycled into the rest of the pipeline.

- ⚠️ Recent share price volatility and flagged short term price swings are worth bearing in mind around any news driven moves.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Apellis Pharmaceuticals analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.