Please use a PC Browser to access Register-Tadawul

AppFolio (APPF) Valuation Check After Shelf Registration Earnings Update And New Revenue Guidance

AppFolio Inc Class A APPF | 172.23 | -2.35% |

Why AppFolio is back on investors’ radar

AppFolio (APPF) has drawn fresh attention after filing an approximately US$80.8 million shelf registration tied to an ESOP related Class A share offering, following recent earnings and 2026 revenue guidance.

After AppFolio set 2026 revenue guidance and reported full year numbers, the 30 day share price return of 20.42% decline and year to date share price return of 21.98% decline suggest momentum has cooled, even though the 3 year total shareholder return of 44.58% remains positive.

If AppFolio's recent pullback has you comparing opportunities in software and automation, it could be a good time to scan 28 robotics and automation stocks as another potential source of ideas.

With the shares down around 20% over the past month and about 22% year to date, even as AppFolio guides to over US$1.1b in 2026 revenue, is this a reset that opens a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 42.4% Undervalued

AppFolio's most followed narrative pegs fair value at about $311.83 per share, well above the recent $179.73 close, putting a spotlight on what assumptions sit underneath that gap.

Elevated labor shortages and ongoing economic pressures in real estate are driving property management customers to adopt technology for cost reduction and efficiency, supporting consistent customer acquisition and minimizing churn, which will have a positive impact on revenue and retention rates. The growing shift toward digital transformation and cloud-based SaaS across the industry expands AppFolio's addressable market, fueling sustained customer growth, higher subscription sales, and potential long-term earnings expansion.

Want to see how this story translates into a higher fair value than today’s price? The crux is the balance between growth, margins, and the future earnings multiple backing that target.

Result: Fair Value of $311.83 (UNDERVALUED)

However, the story could change if U.S. property management growth slows or if competitors narrow AppFolio’s AI edge, which could pressure revenue potential and limit assumed margin resilience.

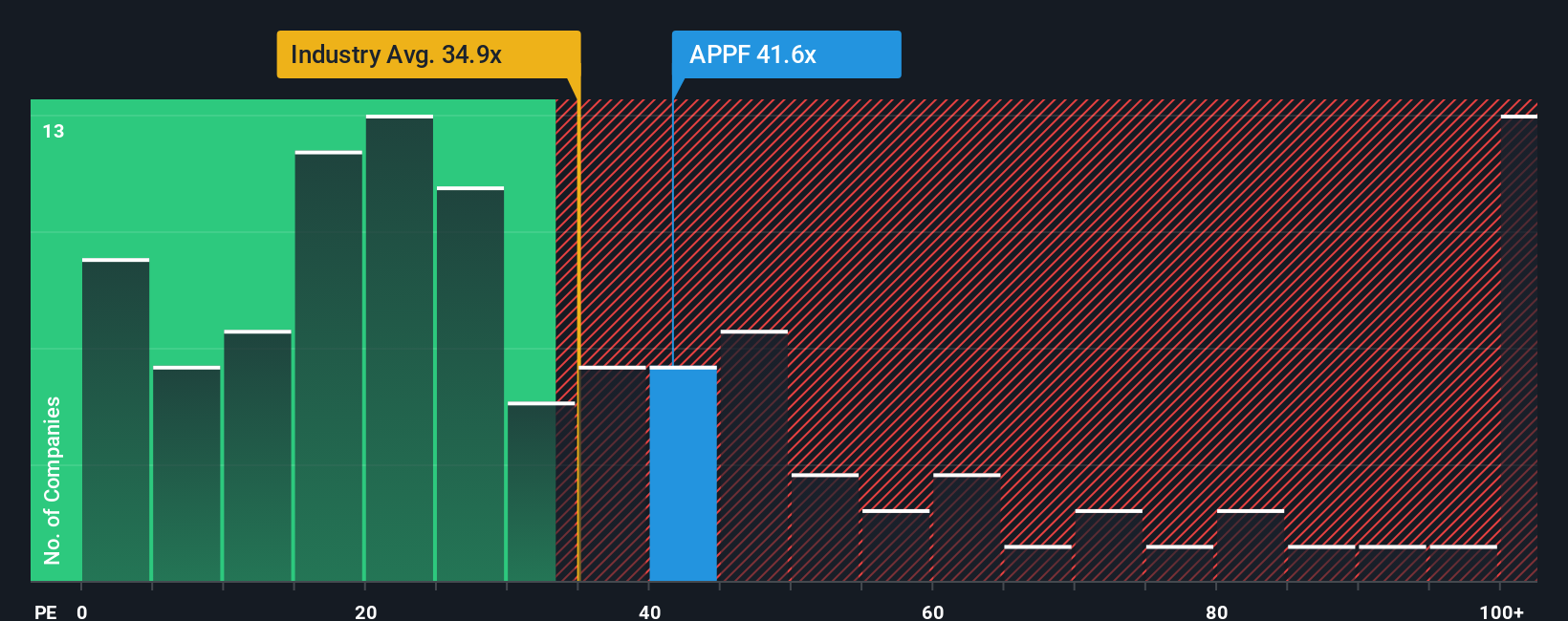

Another View: High P/E Puts Market Expectations Front And Center

That 42.4% discount to fair value sits alongside a very different signal from the earnings multiple. AppFolio trades on a P/E of 45.9x, compared with a fair ratio of 31.2x, the US Software industry at 25.7x, and peers at 17.8x.

In plain terms, the market is already paying a premium price for each dollar of earnings, well above what similar businesses trade on and above the fair ratio the market could move toward. The question for you is whether AppFolio’s future delivery justifies that gap, or if you see more valuation risk than upside.

Build Your Own AppFolio Narrative

If some of these assumptions do not quite fit how you see AppFolio, you can weigh the same data yourself and build a custom view in just a few minutes, then Do it your way.

A great starting point for your AppFolio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If AppFolio is just the starting point for you, now is the moment to widen your watchlist while these themes are front of mind.

- Spot potential value opportunities early by scanning 53 high quality undervalued stocks that stand out on both quality and price.

- Prioritize resilience by focusing on 86 resilient stocks with low risk scores that may help steady your portfolio through different market conditions.

- Get ahead of the crowd by reviewing our screener containing 25 high quality undiscovered gems before everyone else starts paying attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.