Please use a PC Browser to access Register-Tadawul

AppFolio (APPF): Valuation Insights Following Strategic Expansion in Real Estate Performance Management

AppFolio Inc Class A APPF | 179.72 | +1.33% |

AppFolio (APPF) recently took the spotlight at its FUTURE conference by introducing Real Estate Performance Management, a fresh approach aimed at helping property managers shift focus from pure efficiency to real outcomes.

Momentum around AppFolio has been choppy this year, with a recent slide in its 30-day share price return. However, the longer view paints a strong picture: while there has been some pullback since summer highs, shareholders have still enjoyed a healthy 24.7% total return over the past 12 months and an impressive 125% over three years. This suggests that innovation like Real Estate Performance Management is fueling long-term confidence.

If these kinds of strategic moves have you searching for your next opportunity, it’s a perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

The real question for investors is whether AppFolio's recent product momentum and solid long-term returns signal a stock that is undervalued right now, or if the market has already priced in the company's future growth.

Most Popular Narrative: 27.5% Undervalued

According to the most popular narrative, AppFolio’s fair value is set at $330.20, well above the recent close of $239.55. This sizable gap sets up a lively debate about the key growth drivers and financial expectations supporting a higher price target.

Accelerating adoption of AI-powered workflow automation within property management, demonstrated by a 46% increase in industry intent to use AI and 96% of customers engaging with AI solutions, positions AppFolio to continue expanding unit counts, drive top-line revenue growth, and support future increases in net margins through productivity gains.

Want to know what’s fueling this premium valuation? The narrative hints at an aggressive growth outlook and margin dynamics not seen in most software firms. Curious which forecasts justify a price miles above today’s level? Unlock the full narrative to see what’s behind that bullish fair value.

Result: Fair Value of $330.20 (UNDERVALUED)

However, persistent competition from rivals offering similar AI solutions and AppFolio’s focus on the domestic market could limit its long-term growth potential.

Another View: What Do Market Comparisons Say?

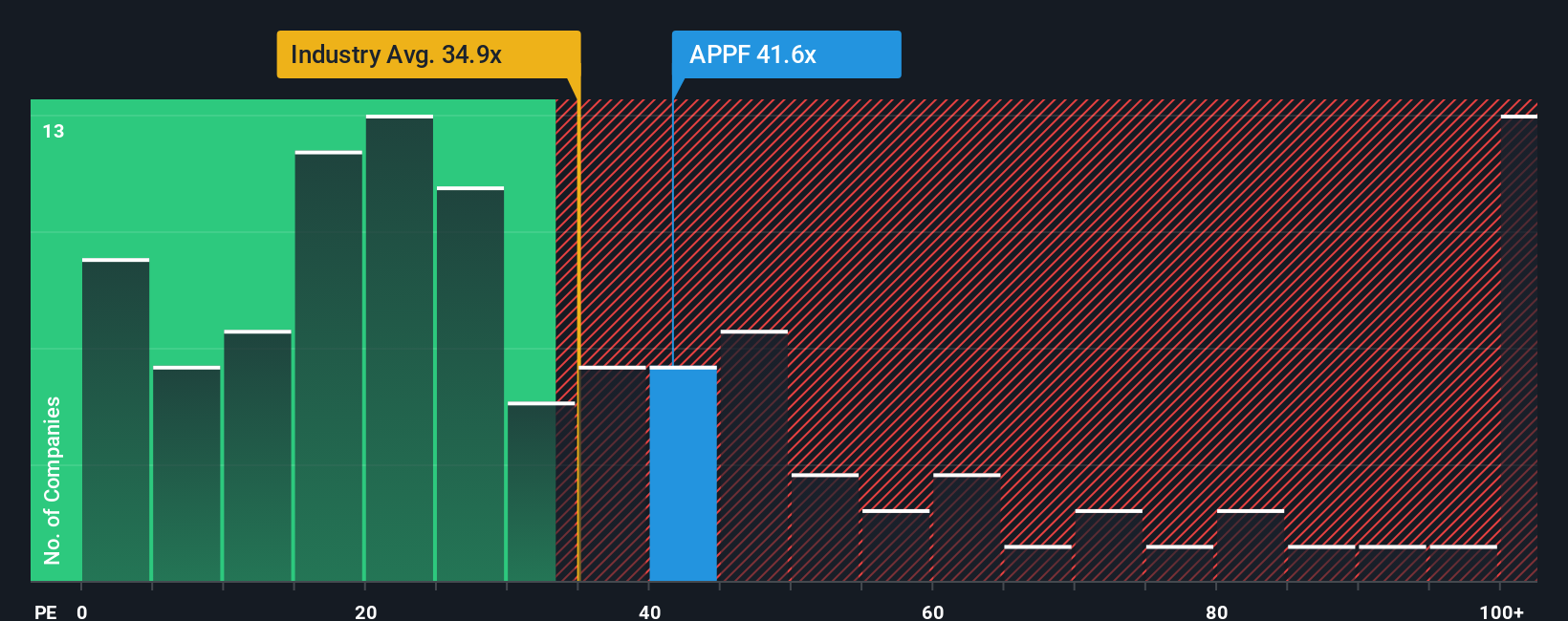

Looking at how AppFolio is valued against its peers and industry, the company trades at a price-to-earnings ratio of 42.3x. This is well above the US Software industry average of 34.3x and the peer group's 16x. It is also much higher than the fair ratio of 25.8x suggested by our analysis. This premium points to elevated expectations, but also a risk that any slowdown or stumble could trigger a sharp correction. Could the market be too optimistic on future growth?

Build Your Own AppFolio Narrative

If you have a different perspective or want to put the data to the test yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your AppFolio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

The market is always changing, and new opportunities appear every day. Give yourself an edge by acting now and finding smart alternatives for your portfolio.

- Tap into potential high-yield returns by checking out these 17 dividend stocks with yields > 3%, ideal for anyone seeking stronger cash flow from market leaders.

- Leverage the artificial intelligence surge and stay ahead of market trends by researching these 27 AI penny stocks shaping tomorrow’s industries.

- Secure a bargain and uncover hidden value before the crowd by scanning these 875 undervalued stocks based on cash flows for stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.