Please use a PC Browser to access Register-Tadawul

Appian (APPN): Examining Valuation Following Recent 31% Share Price Surge

Appian Corporation Class A APPN | 25.14 | +2.44% |

Appian (APPN) shares have been tracking modest gains lately, catching the attention of investors looking into software stocks. With the company’s revenue showing growth, there is ongoing curiosity about how its fundamentals align with recent market moves.

Appian’s share price has just surged nearly 31% in a single day, with momentum accelerating over the past month for a breakout 29.99% return. Still, the one-year total shareholder return remains negative at -7.7%. This highlights that while sentiment has clearly shifted in the short-term, long-term holders are still waiting for a sustained turnaround.

If Appian’s run has sparked your curiosity, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares posting rapid gains, but the stock still trading below its analyst price target, the real question is whether Appian’s fundamentals offer a genuine buying opportunity or if recent momentum has already priced in future growth.

Most Popular Narrative: 8% Overvalued

With Appian’s fair value pegged at $35.40 and shares closing at $38.36, the narrative suggests the current price is ahead of fundamentals. The following excerpt highlights a major driver for the valuation outlook.

Broad enterprise demand for application modernization and workflow automation is accelerating, with AI seen as a catalyst that dramatically lowers modernization costs and complexity, positioning Appian's platform for increased adoption, larger deal sizes, and improved revenue growth over the coming years.

Want the inside story on this premium? The narrative hinges on expectations for sustained platform growth, operational leverage, and a profit margin transformation. Find out what controversial growth assumptions back this view and how the numbers truly stack up. Don’t miss what’s driving this stance. Dive into the full details.

Result: Fair Value of $35.40 (OVERVALUED)

However, there are concerns that rapid AI advances and strong competition from larger tech firms could threaten Appian’s profit potential and future revenue growth.

Another View: Looking at Sales Valuation

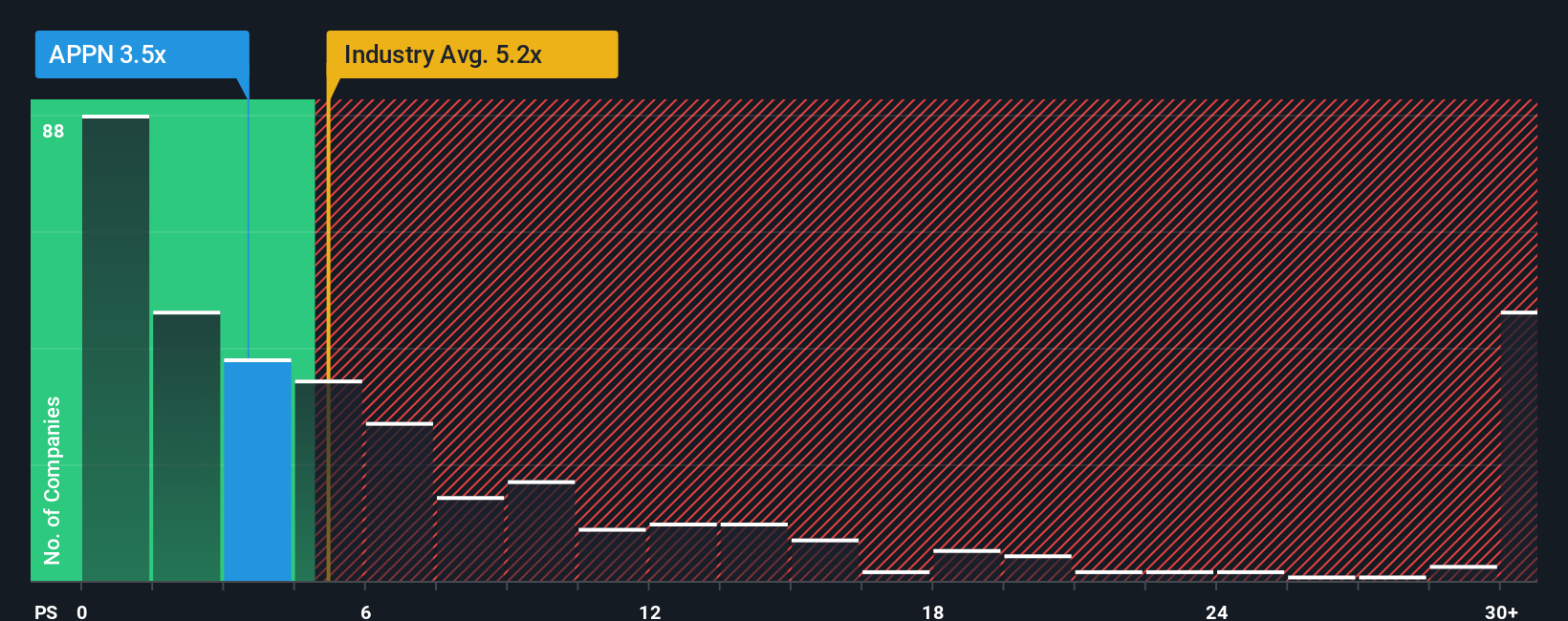

Stepping away from fair value estimates, Appian’s price-to-sales ratio is 4.1x. This figure looks attractive compared to the US Software industry’s 5.1x and is also below its fair ratio of 4.5x. Investors might see this as a relatively better deal, but it raises the question of whether this compensates for the significant profit uncertainties ahead.

Build Your Own Appian Narrative

If you have a different take or want to shape your own story from the latest market and valuation data, you can craft a personalized view in just a few minutes. Start by selecting Do it your way.

A great starting point for your Appian research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Sharpen your portfolio by actively targeting standout opportunities that others are missing. Get ahead with these curated screens and grab your advantage before everyone else jumps in:

- Tap into explosive long-term growth by uncovering these 25 AI penny stocks, which are shaping the transition to artificial intelligence across industries.

- Boost your quest for reliable income as you check out these 17 dividend stocks with yields > 3%, offering yields greater than 3% and potential for resilient payouts.

- Seize the latest trend in digital assets by moving early on these 82 cryptocurrency and blockchain stocks, leading innovation in the crypto and blockchain revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.