Please use a PC Browser to access Register-Tadawul

Applied Digital (APLD) Is Up 30.0% After Investor Optimism Over AI Data Center Strategy Has The Bull Case Changed?

Applied Digital APLD | 27.86 | -9.43% |

- Recently, Applied Digital saw positive market attention as it continued its shift toward developing high-performance computing data centers for the artificial intelligence sector, even in the absence of new formal announcements.

- This reflects a growing perception among investors that the company's focus on AI and HPC infrastructure could strengthen its operational positioning in a rapidly evolving industry.

- We’ll now examine how growing investor confidence in Applied Digital’s AI data center strategy could influence the company’s overall investment thesis.

Applied Digital Investment Narrative Recap

To be an Applied Digital shareholder today, you'd need to believe in the company’s ability to convert its focus on high-performance computing and AI infrastructure into sustained revenue growth, while managing high debt levels and unprofitable operations. The recent uptick in share price highlights market enthusiasm but does not materially change the immediate catalyst: securing and expanding multi-year data center tenant agreements, nor does it ease the biggest risk, which remains the company's high leverage and exposure to rising interest expenses.

Of all recent announcements, the June 2, 2025, lease agreements with CoreWeave stand out as most relevant, locking in approximately US$7 billion in expected revenue over 15 years for the Ellendale campus. This long-term commitment directly supports the company’s growth catalyst by underpinning Applied Digital’s strategy to scale up data center operations for AI workloads and potentially stabilizes future cash flows.

Yet in contrast to market optimism, investors should be aware that substantial debt and interest costs could impact Applied Digital's financial flexibility if...

Applied Digital's narrative projects $586.9 million revenue and $46.6 million earnings by 2028. This requires 38.4% yearly revenue growth and a $290.8 million earnings increase from -$244.2 million.

Exploring Other Perspectives

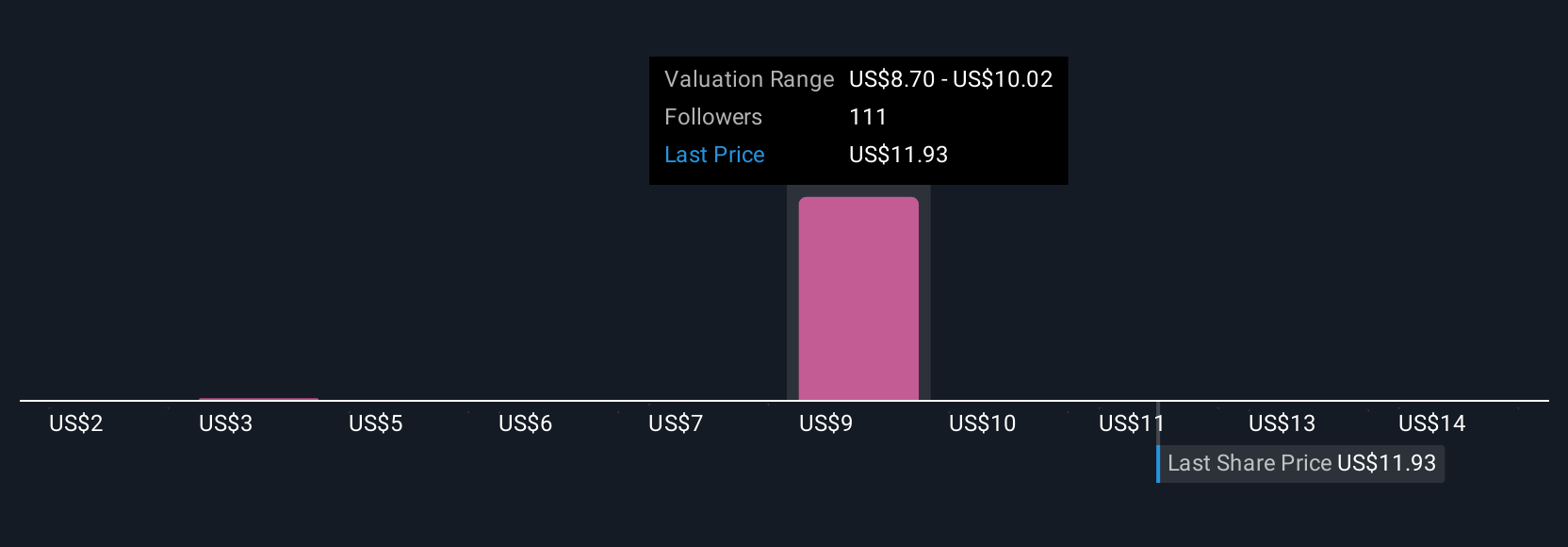

Simply Wall St Community members delivered 21 fair value estimates for Applied Digital ranging from as low as US$2.06 to as high as US$15.33. While views are wide apart, the spotlight remains on long-term revenue from the CoreWeave lease as a defining factor for future performance. Explore several alternative viewpoints right here.

Build Your Own Applied Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Digital research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Applied Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Digital's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.