Please use a PC Browser to access Register-Tadawul

Applied Industrial Technologies (AIT) Valuation Check After Recent Share Price Pause

Applied Industrial Technologies, Inc. AIT | 279.84 | +0.47% |

Recent share performance and business profile

Applied Industrial Technologies (AIT) has been relatively steady over the past 3 months, with the stock showing a small positive total return despite weaker performance over the month and year to date.

For context, the company reports annual revenue of US$4,754.03m and net income of US$403.79m, reflecting its role as a large distributor of industrial motion, power, control, and automation technology solutions across multiple regions.

Recent trading has been choppy, with a 1-day share price return of 2.32% decline and a 7-day share price return of 9.77% decline, while the 1-year total shareholder return of 1.44% and 5-year total shareholder return of 254.26% point to momentum that has eased but remains strong over the longer term.

If this kind of long run compounding interests you, it may be a good moment to widen your search and scan fast growing stocks with high insider ownership for potential next ideas.

With AIT trading around US$256.26, a modest 1 year total return and analyst targets sitting higher, the real question is whether the recent pause reflects an undervalued industrial compounder or a market that has already priced in future growth.

Most Popular Narrative: 15.5% Undervalued

Applied Industrial Technologies' most followed narrative points to a fair value around $303.33, compared with the last close of $256.26, framing a valuation gap that rests on earnings growth and higher margin assumptions.

The accelerating build out of data center, semiconductor, and advanced manufacturing infrastructure is increasing demand for industrial automation, robotics, and flow control solutions, positioning Applied Industrial Technologies to capture higher margin sales and expand its addressable market, supporting long term revenue and margin growth.

Curious what earnings power that growth story implies by the late 2020s? The narrative leans on steadier revenue expansion, firmer margins, and a richer future P/E multiple. The detailed path between those ingredients and the fair value line is where the real intrigue sits.

Result: Fair Value of $303.33 (UNDERVALUED)

However, this hinges on acquisitions delivering, as well as on slower legacy markets and Mobile Fluid Power headwinds not undermining those margin and earnings assumptions.

Another angle on value

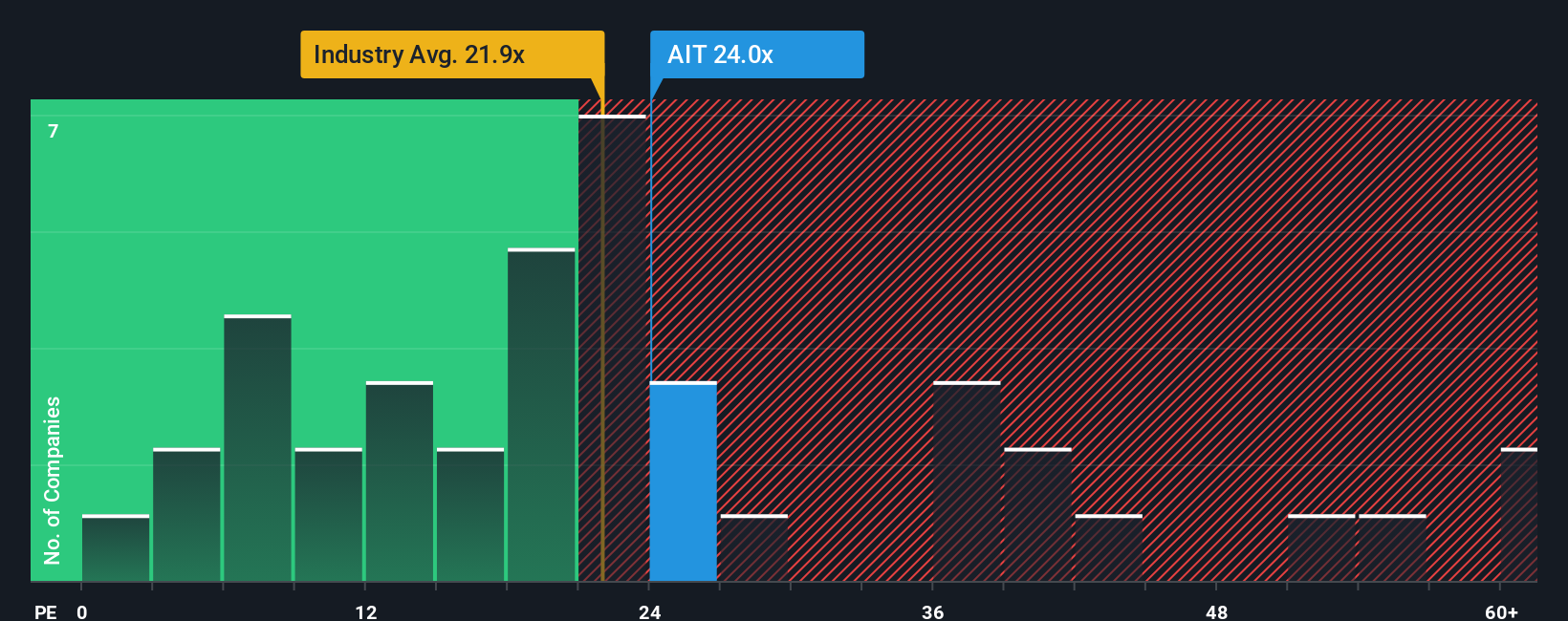

While the narrative and analyst price target suggest AIT is 15.5% undervalued, the current P/E of 23.9x sits above the US Trade Distributors industry at 22.8x, the peer average at 21x, and our fair ratio of 21.9x. That pricing leans richer, so is the market already paying up for this story?

Build Your Own Applied Industrial Technologies Narrative

If you see the numbers differently, or prefer to test the assumptions yourself, you can create your own view in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Applied Industrial Technologies.

Looking for more investment ideas?

If you stop at just one company, you risk missing other opportunities that might fit your style even better, so put a few fresh names on your radar.

- Target reliable income potential by scanning these 14 dividend stocks with yields > 3% that could help anchor your portfolio with consistent cash returns.

- Spot emerging trends early by checking out these 24 AI penny stocks that are plugged into the growth of artificial intelligence.

- Hunt for price gaps by reviewing these 877 undervalued stocks based on cash flows where current market prices differ from underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.