Please use a PC Browser to access Register-Tadawul

Applied’s IRIS Automation Acquisition Could Be a Game Changer for Applied Industrial Technologies (AIT)

Applied Industrial Technologies, Inc. AIT | 261.74 | -0.42% |

- In May 2025, Applied Industrial Technologies acquired IRIS Factory Automation and integrated it into its Engineered Solutions segment, a move aimed at strengthening its automation offerings in response to heightened demand across technology, food & beverage, pulp & paper, and oil & gas markets.

- This integration is expected to reinforce Applied's growth initiatives in automation, as favorable order trends in key industrial sectors may help offset recent softness in fluid power components.

- We'll explore how Applied's expansion in automation through the IRIS acquisition could shape the company's evolving investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Applied Industrial Technologies Investment Narrative Recap

Owning Applied Industrial Technologies hinges on believing that the company can capture ongoing demand for automation and engineered solutions, offsetting persistent challenges in legacy markets and integrating acquisitions efficiently. The recent IRIS Factory Automation acquisition directly supports Applied’s short-term automation growth catalyst, but does not materially reduce the risk tied to weakness in core fluid power OEM markets, which still weighs on the outlook. For investors, the renewed emphasis on automation adds meaningful support to the company’s evolving story, though the biggest risk remains stagnant demand in its traditional customer base.

Among recent updates, Applied’s August 2025 earnings release stands out: the company reported rising annual sales and net income, with modest growth from the prior year. This consistent performance, in tandem with ongoing dividend increases and buyback activity, highlights the company’s focus on shareholder returns. However, as automation gains traction, sustaining growth amid a muted backdrop in legacy sectors remains a key challenge for the business.

Yet, while automation may provide some relief, the persistent demand softness in key end markets is still a critical factor investors should watch, especially if...

Applied Industrial Technologies' outlook anticipates $5.3 billion in revenue and $475.0 million in earnings by 2028. This reflects a 4.9% annual revenue growth rate and an $82.0 million increase in earnings from the current $393.0 million.

Uncover how Applied Industrial Technologies' forecasts yield a $303.33 fair value, a 16% upside to its current price.

Exploring Other Perspectives

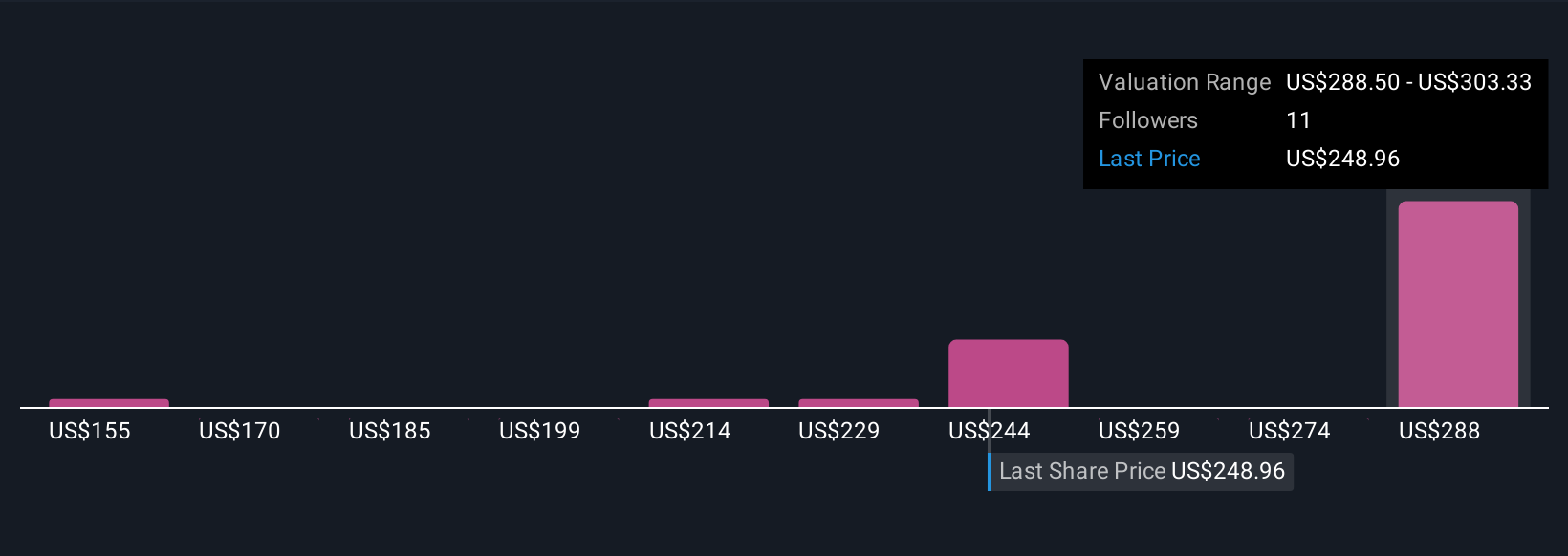

Four fair value estimates from the Simply Wall St Community range from US$155 to US$303 per share, reflecting wide-ranging opinions. Against this diversity, the company’s reliance on automation growth highlights how differing expectations around industrial demand and technological adoption can significantly affect performance outcomes; see how your views compare with others.

Explore 4 other fair value estimates on Applied Industrial Technologies - why the stock might be worth as much as 16% more than the current price!

Build Your Own Applied Industrial Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Industrial Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Applied Industrial Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Industrial Technologies' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.