Please use a PC Browser to access Register-Tadawul

April 2025 Penny Stocks To Watch For Promising Opportunities

EVgo Inc Ordinary Shares - Class A EVGO | 3.00 | -3.54% |

The U.S. stock market recently experienced a dip following a four-day winning streak, with major indices like the S&P 500 and Nasdaq Composite seeing declines as investors brace for upcoming earnings reports and economic data. For those considering investments beyond the well-known giants, penny stocks—often representing smaller or emerging companies—continue to present intriguing opportunities despite their somewhat outdated label. By focusing on financially sound options within this category, investors might uncover potential gems that offer both stability and growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.39 | $355.42M | ✅ 4 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.22 | $1.2B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $1.17 | $20.8M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.20 | $9.6M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.87 | $48.95M | ✅ 4 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.69 | $356.14M | ✅ 5 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.81 | $5.88M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.59 | $79.56M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.501 | $15.72M | ✅ 3 ⚠️ 5 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.7133 | $64.15M | ✅ 4 ⚠️ 1 View Analysis > |

Let's dive into some prime choices out of the screener.

EVgo (NasdaqGS:EVGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EVgo, Inc. operates a direct current fast charging network for electric vehicles in the United States with a market cap of approximately $836.26 million.

Operations: The company's revenue segment includes Retail - Gasoline & Auto Dealers, generating $256.83 million.

Market Cap: $836.26M

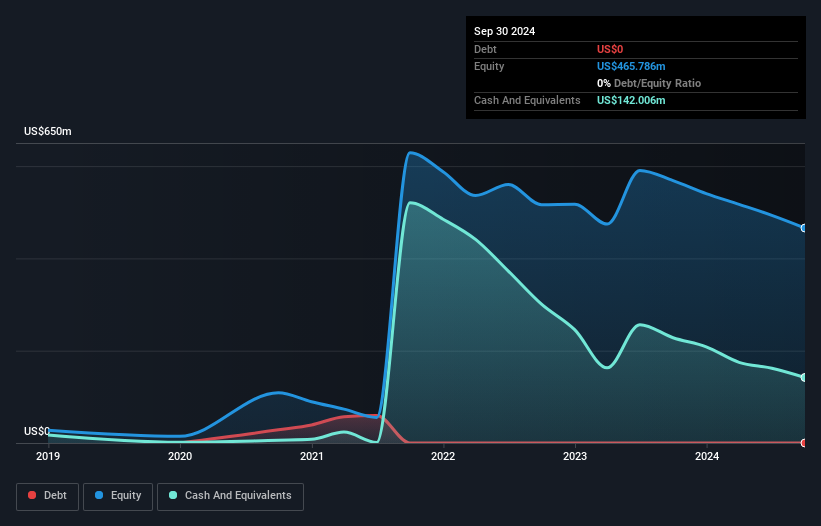

EVgo, Inc. recently expanded its charging network through a collaboration with Toyota, opening new fast-charging stations in California. Despite this growth, EVgo remains unprofitable with losses increasing over the past five years at a rate of 42% annually. The company reported fourth-quarter revenue of US$67.51 million but still faces challenges as short-term assets exceed liabilities while long-term liabilities remain uncovered by current assets. Although EVgo's cash runway is sufficient for over a year based on free cash flow, profitability is not expected in the near future. Additionally, EVgo was dropped from the S&P Retail Select Industry Index recently.

Stitch Fix (NasdaqGS:SFIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stitch Fix, Inc. operates an online personal styling service offering apparel, shoes, and accessories for various demographics through its website and mobile app in the United States, with a market cap of approximately $431.47 million.

Operations: The company's revenue is primarily generated from its online retail segment, totaling $1.27 billion.

Market Cap: $431.47M

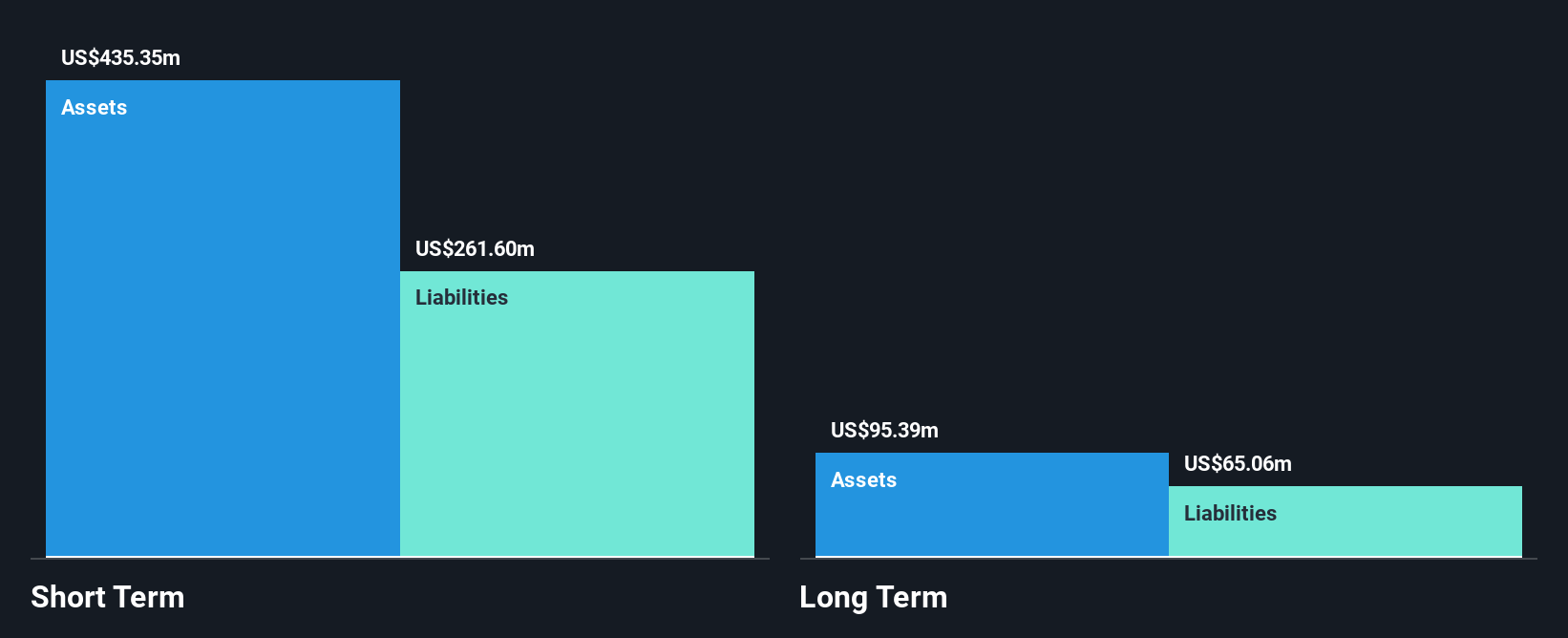

Stitch Fix, Inc. is navigating the challenges of being a penny stock with a market cap of US$431.47 million and annual revenue expected between US$1.225 billion and US$1.240 billion for 2025, despite experiencing declining sales year-over-year. The company is currently unprofitable but maintains a strong cash position with sufficient runway for over three years without debt obligations, supported by positive free cash flow. While management's average tenure suggests inexperience, the board is seasoned, providing some stability in governance as the company trades at significant value below its estimated fair value amidst industry volatility.

TETRA Technologies (NYSE:TTI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc. operates as an energy services and solutions company through its subsidiaries, with a market cap of approximately $356.14 million.

Operations: The company generates revenue through its Water & Flowback Services segment, which contributed $287.81 million, and its Completion Fluids & Products segment, which accounted for $311.30 million.

Market Cap: $356.14M

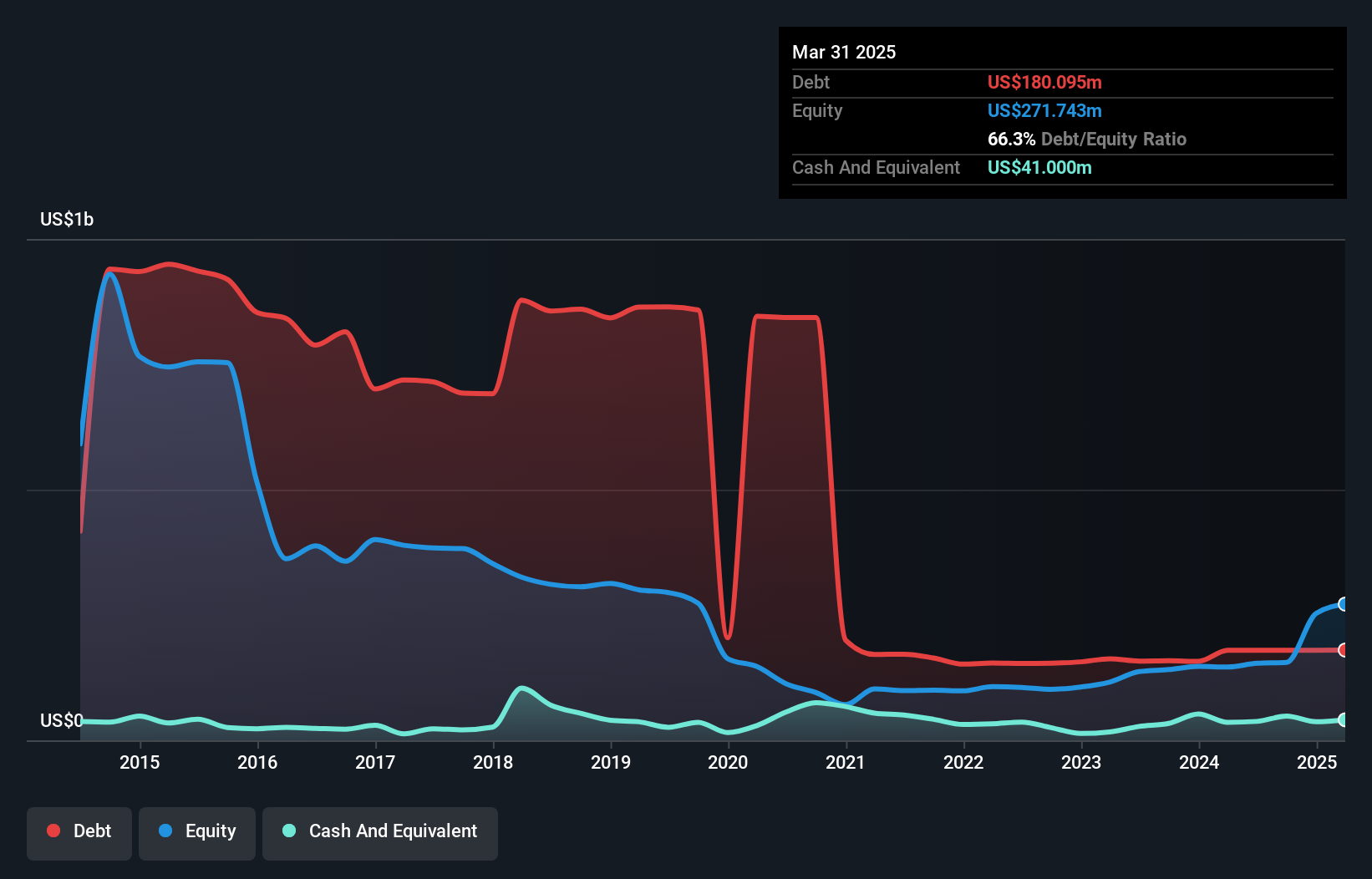

TETRA Technologies, Inc. stands out in the penny stock arena with a market cap of US$356.14 million and strong revenue streams from its Water & Flowback Services and Completion Fluids & Products segments. The company's earnings have surged by 345.5% over the past year, exceeding industry growth rates, while maintaining high-quality earnings without significant shareholder dilution. TETRA's debt is well-covered by operating cash flow; however, interest payments are not fully covered by EBIT. Recent expansion in the Evergreen Unit highlights potential for increased bromine and lithium production, though uncertainties remain around lithium processing commercialization efforts amidst a competitive landscape.

Next Steps

- Reveal the 763 hidden gems among our US Penny Stocks screener with a single click here.

- Interested In Other Possibilities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.