Please use a PC Browser to access Register-Tadawul

Aptiv (APTV): Valuation Insights as Analyst Optimism and Sector Rotation Drive Investor Interest

Aptiv PLC APTV | 83.38 | +1.21% |

Aptiv (APTV) has been grabbing investor attention lately, and for good reason. Recent analyst updates, along with management's push to diversify its business and improve real-time visibility, have brought the company into focus. After the firm highlighted its strategic initiatives at a major industry conference, analysts from both Wells Fargo and Baird expressed optimism about Aptiv’s direction, even as near-term earnings growth is expected to be fairly modest. This wave of confidence from the analyst community appears to have encouraged more investors to consider where Aptiv fits in their portfolios.

Looking at the broader picture, Aptiv’s stock price has gained significant momentum in the past month, rising about 23% and easily outpacing the broader S&P 500. The stock is up roughly 20% over the past year, showing sustained interest even as three- and five-year returns remain slightly negative. News flow has primarily focused on strategic diversification and sector trends, keeping the discussion centered on valuation as automotive stocks attract renewed attention from institutional managers rotating into the sector.

With analysts expressing fresh optimism but earnings still trailing expectations, some investors may be considering whether to take a closer look at Aptiv or question if the market has already factored in the company’s next phase of growth.

Most Popular Narrative: 4.3% Undervalued

The prevailing narrative suggests Aptiv is currently undervalued by a small margin, with future expectations anchored to resilient operating performance and structural transformation.

Expansion of non-automotive market bookings, especially in aerospace, defense, and industrial sectors, is resulting in faster growth and higher margins compared to core automotive business. This should structurally improve the company's margin profile and earnings stability over time.

Want to know why Aptiv’s growth story is getting so much attention? The calculation behind this fair value projection hinges on some bold top-line and bottom-line assumptions, plus a future profit multiple you might not expect for an auto technology firm. Curious about which trends and numbers analysts believe will support this optimistic price outlook? Don’t miss the details that make this narrative stand out from the crowd.

Result: Fair Value of $86.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as slowing electric vehicle adoption or ongoing global supply challenges could quickly challenge Aptiv’s current growth expectations and optimistic narrative.

Find out about the key risks to this Aptiv narrative.Another View: The DCF Perspective

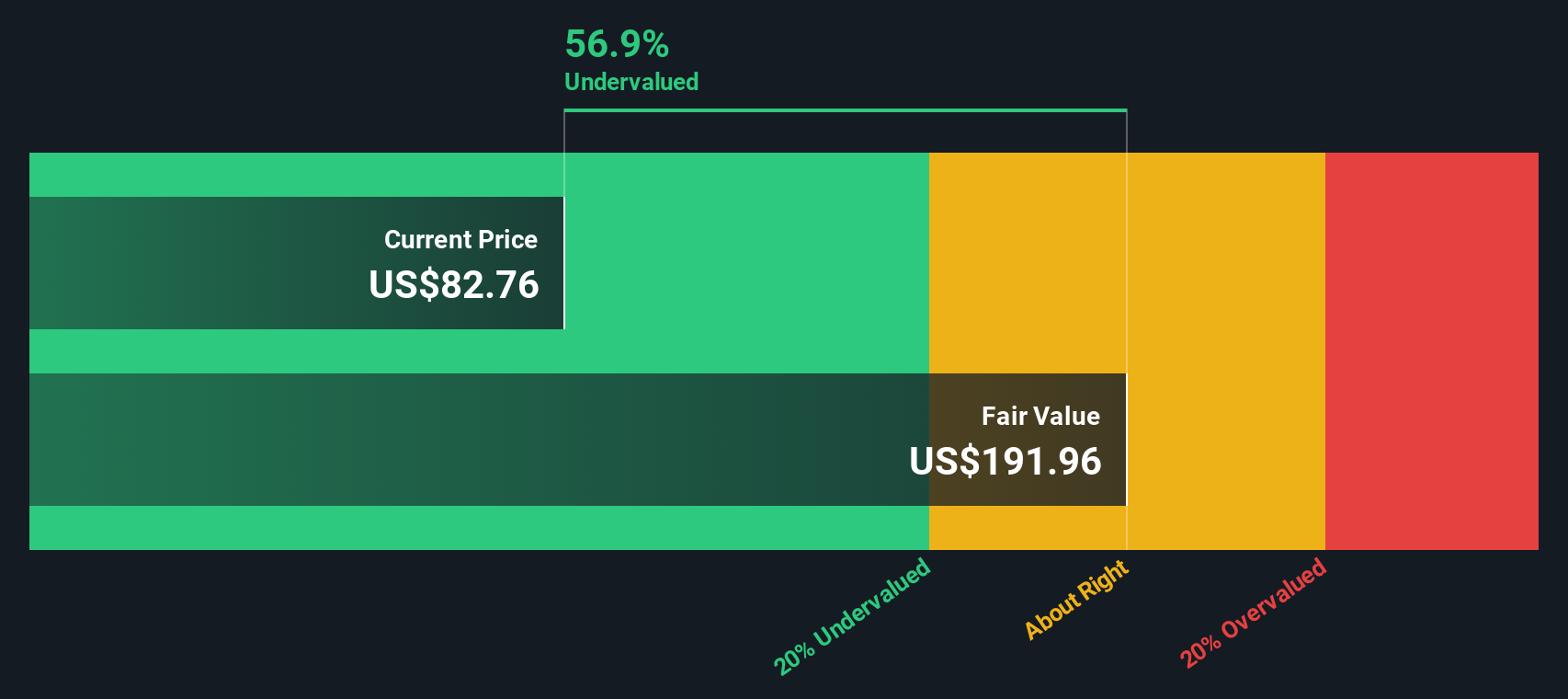

While most analysts rely on price targets based on future earnings, our SWS DCF model tells a far more optimistic story. The model suggests Aptiv is deeply undervalued compared to what the market sees today. But what if the company's growth projections fall short, or market sentiment shifts? Which method should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aptiv Narrative

If you want to take a different angle or conduct your own analysis, it's quick and easy to craft your own view. Do it your way Do it your way.

A great starting point for your Aptiv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Opportunity?

Don’t let your investing journey stop here. The market is pulsing with new opportunities. Take action now and uncover standout stocks that align with your strategy.

- Spot undervalued gems before the crowd by checking out the latest picks with undervalued stocks based on cash flows.

- Tap into tomorrow’s health breakthroughs by scanning companies leading in innovation, data, and medical technology with healthcare AI stocks.

- Catch the next wave of advancements in digital money by seeing which disruptive businesses are shaping finance with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.