ArcBest Corporation (NASDAQ:ARCB) Looks Inexpensive But Perhaps Not Attractive Enough

ArcBest Corporation ARCB | 0.00 |

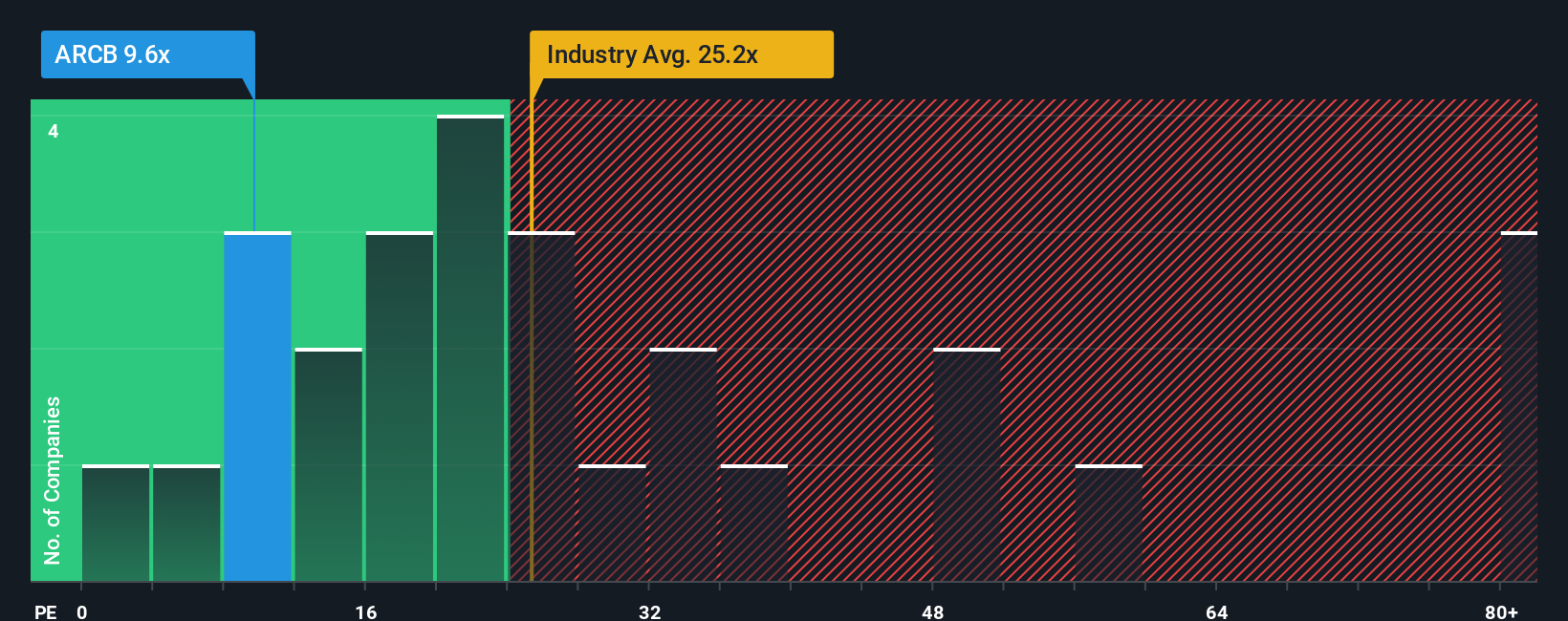

With a price-to-earnings (or "P/E") ratio of 9.6x ArcBest Corporation (NASDAQ:ARCB) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 33x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

ArcBest certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Does Growth Match The Low P/E?

ArcBest's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 51% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 23% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings growth is heading into negative territory, declining 3.4% each year over the next three years. Meanwhile, the broader market is forecast to expand by 10% per year, which paints a poor picture.

With this information, we are not surprised that ArcBest is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of ArcBest's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You might be able to find a better investment than ArcBest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

موصى به

- Simply Wall St 23/11 00:24

هل تؤدي الضغوط التنظيمية المتزايدة إلى تغيير الميزة التنافسية لشركة RXO (RXO) في قطاع النقل بالشاحنات؟

Simply Wall St 24/11 00:26ماذا يعني تجاوز أرباح شركة JB Hunt Transport Services (JBHT) للربع الثالث بالنسبة للمساهمين؟

Simply Wall St 24/11 01:13AI Investments and Resilient Results Could Be a Game Changer for XPO (XPO)

Simply Wall St 24/11 03:1312 سهمًا صناعيًا متداولًا في جلسة ما قبل السوق يوم الاثنين

Benzinga News 24/11 12:05Ryder CFO to Present Company Update at Goldman Sachs Industrials & Materials Conference

Reuters 24/11 11:55Knight-Swift (KNX): Revisiting Valuation After Q3 Earnings Miss and Cautious Outlook

Simply Wall St اليوم 07:23أبرمت شركة مينغزو لوجيستكس هولدينجز المحدودة اتفاقية لشراء وبيع 8 ملايين وحدة بسعر دولار واحد للوحدة

Benzinga News 15 دقيقة