Please use a PC Browser to access Register-Tadawul

Are Analysts’ Renewed Optimism on Crescent Energy (CRGY) a Vote of Confidence in Its Post-Divestiture Strategy?

Crescent Energy Company Class A CRGY | 10.71 | +0.56% |

- In late January 2026, analysts at Piper Sandler, Wells Fargo and Jefferies updated their views on Crescent Energy, reaffirming positive stances while adjusting their assessments of the company’s prospects amid a pressured oil backdrop.

- Together, these reports spotlight Crescent Energy’s post-divestiture execution and capital allocation discipline, putting management’s ability to strengthen the balance sheet and asset base under a brighter spotlight.

- We’ll now examine how this cluster of analyst updates, especially around Crescent’s execution after divestitures, shapes the company’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Crescent Energy's Investment Narrative?

To own Crescent Energy today, you need to be comfortable with a story centered on execution and balance sheet repair in a sector that is still heavily tied to commodity prices. The recent cluster of analyst updates from Piper Sandler, Wells Fargo and Jefferies reinforces that view: they acknowledge pressure on the oil macro and trim price targets, but still highlight Crescent’s post‑divestiture progress and disciplined capital allocation. In the near term, the key catalyst remains the upcoming Q4 2025 earnings on February 25, where investors will look for cleaner results after one‑off losses, better margin trends and clarity on dividend sustainability, given thin profit margins and interest coverage. The analyst commentary does not radically reset the story, but it does sharpen the focus on whether Crescent’s improving operations can keep pace with a softer commodity backdrop.

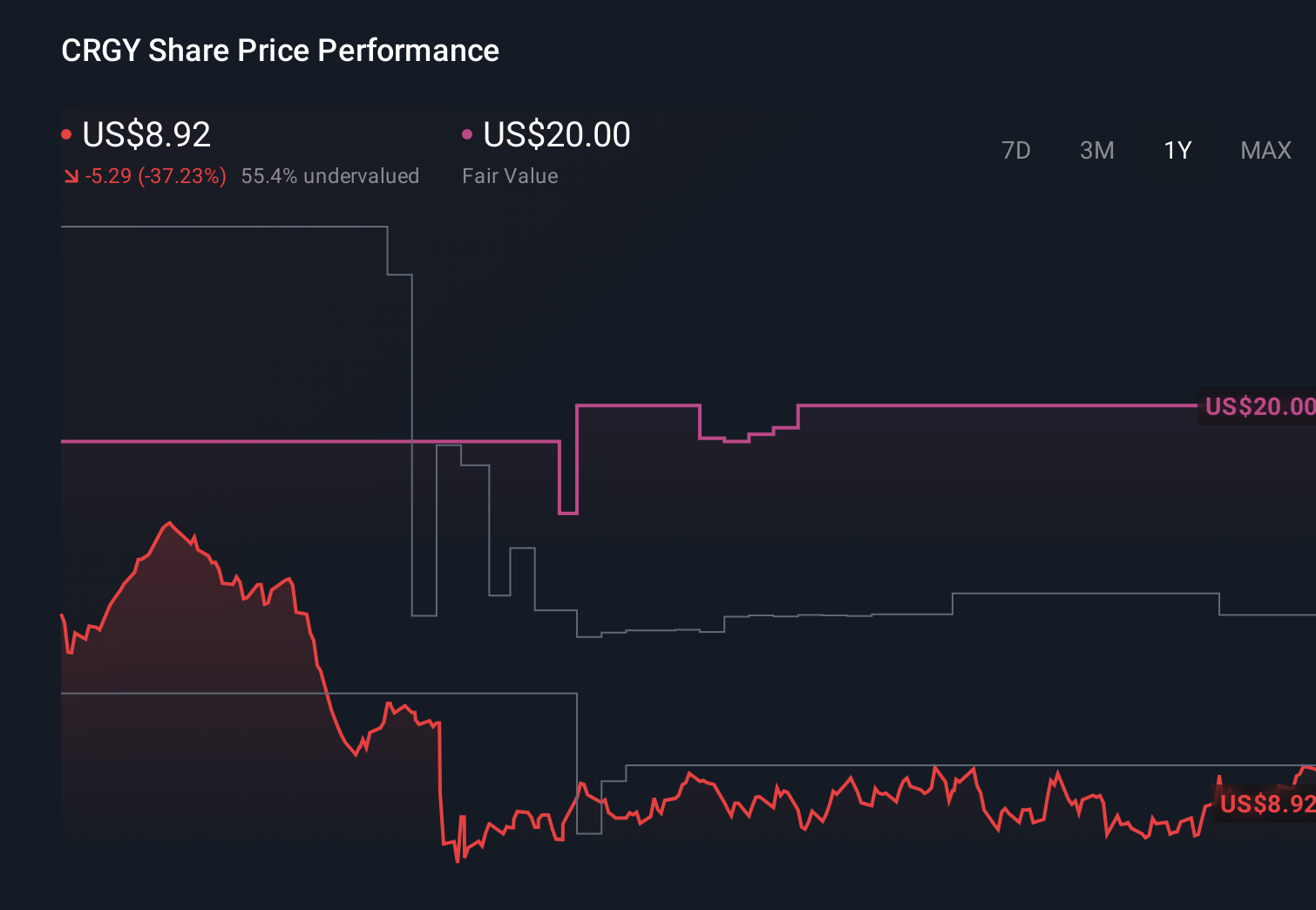

However, one risk in particular could matter more than many shareholders might expect. Crescent Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Five Simply Wall St Community fair value estimates span roughly US$12 to almost US$47.49, reflecting sharply different views on Crescent’s upside. Before leaning toward any camp, you should weigh that optimism against the near term earnings risk from softer oil pricing and Crescent’s currently thin margins, which could influence how quickly the company can improve its balance sheet and support its dividend.

Explore 5 other fair value estimates on Crescent Energy - why the stock might be worth over 4x more than the current price!

Build Your Own Crescent Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crescent Energy research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Crescent Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crescent Energy's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.