Please use a PC Browser to access Register-Tadawul

Are Biohaven (BHVN) Lawsuit Allegations a Test of Management Transparency and Investor Trust?

Biohaven Pharmaceutical Holding Company Ltd. BHVN | 11.03 11.03 | -2.22% 0.00% Pre |

- Pomerantz LLP announced that a class action lawsuit was filed in the United States District Court for the District of Connecticut against Biohaven Ltd. and certain officers, alleging violations of federal securities laws between March 24, 2023 and May 14, 2025.

- This legal action brings renewed scrutiny to Biohaven’s leadership and disclosure practices, raising questions about potential impacts on stakeholder confidence.

- We’ll examine how these legal challenges could influence Biohaven’s investment narrative, especially in regard to executive accountability and transparency.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Biohaven's Investment Narrative?

For Biohaven shareholders, the bull case has long revolved around breakthrough neuroscience assets moving through the clinic, with a focus on late-stage catalysts like the upcoming FDA decision on troriluzole and the progression of BHV-8000 in Parkinson’s. The company continues to post heavy losses, over US$221 million last quarter, and has yet to generate meaningful commercial revenue, keeping progress on clinical and regulatory fronts as the main draw for investors looking for future upside. Now, with a fresh class action lawsuit alleging securities law violations, questions have emerged about management transparency and executive accountability. However, the recent sharp share price rise suggests the market isn't yet pricing in major risk to short term catalysts, such as key pivotal trial readouts or the FDA’s action later this year. Even so, this new legal overhang could introduce volatility and put even more pressure on management as they try to hit crucial milestones with a relatively inexperienced board and tight cash runway.

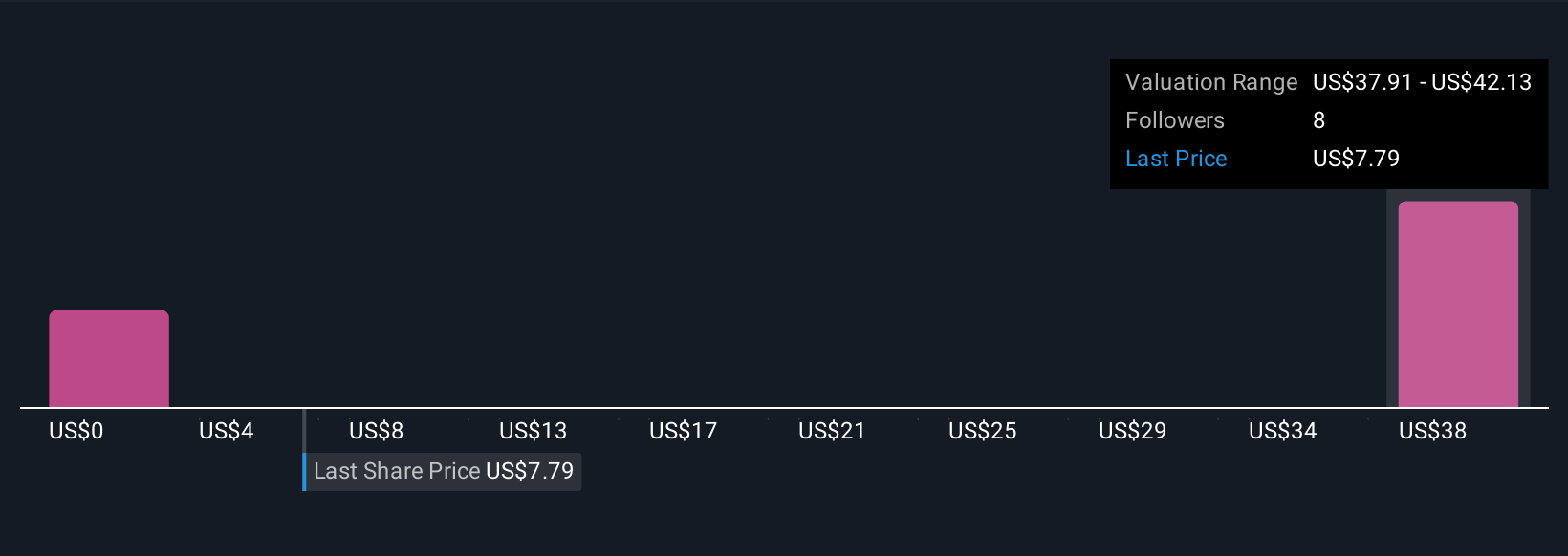

But investor confidence in management is a key issue that could resurface if legal risks start to build further. Our expertly prepared valuation report on Biohaven implies its share price may be too high.Exploring Other Perspectives

Explore 6 other fair value estimates on Biohaven - why the stock might be worth over 3x more than the current price!

Build Your Own Biohaven Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Biohaven research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Biohaven research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Biohaven's overall financial health at a glance.

No Opportunity In Biohaven?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.