Please use a PC Browser to access Register-Tadawul

Are LGI Homes' (LGIH) January Closings and Monte Vista Launch Reinforcing Its Land-Light Strategy?

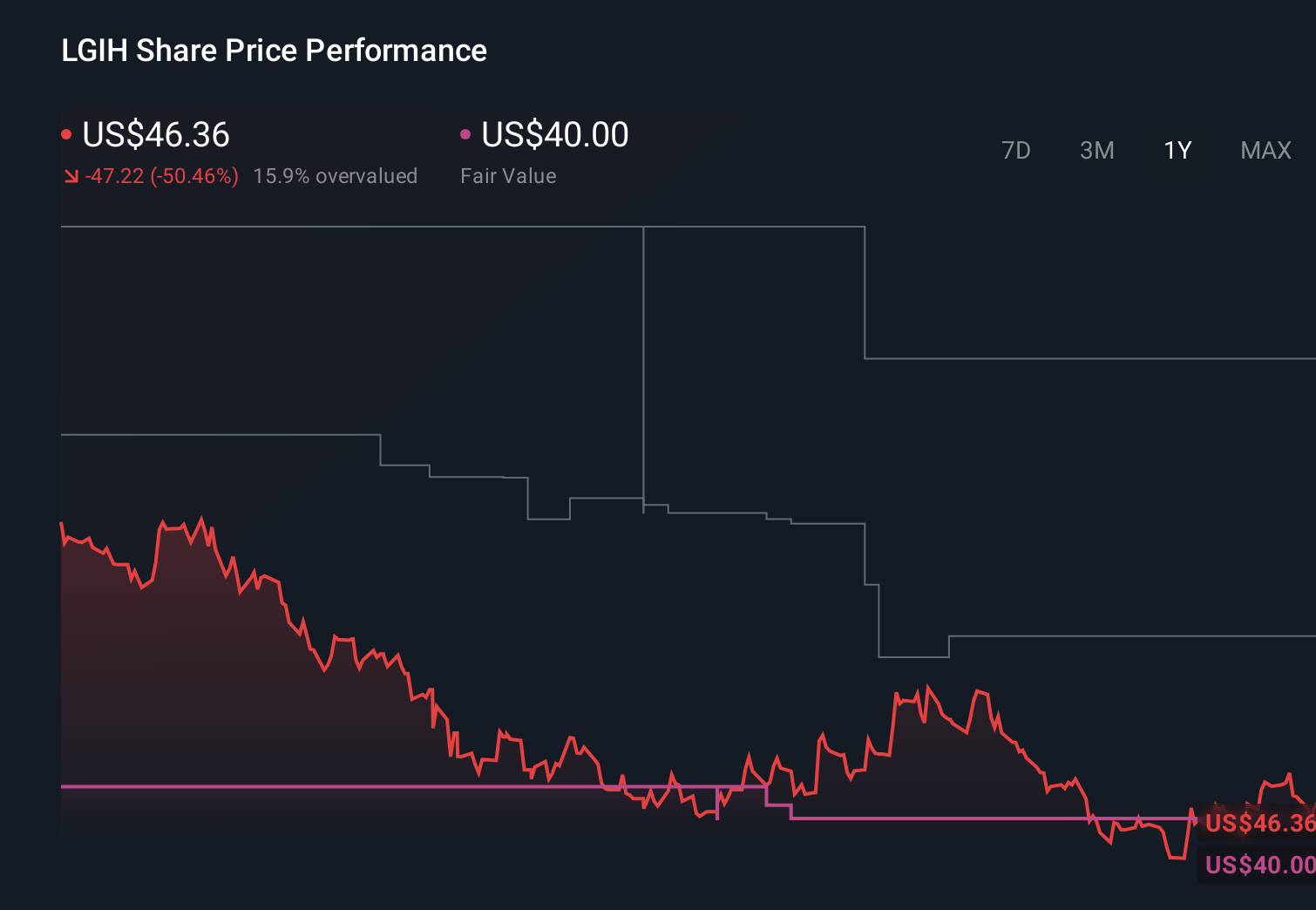

LGI Homes, Inc. LGIH | 55.46 | +3.82% |

- LGI Homes recently reported that it closed 218 homes in January 2026, including 16 leased single-family rental homes, and ended the month with 140 active selling communities.

- The company also unveiled its Monte Vista Collection community near Modesto, California, featuring five single-story floor plans, four of which are brand-new designs bundled with its CompleteHome Plus™ upgrade package at no additional cost.

- Next, we’ll examine how January’s closings data and the Monte Vista community launch shape LGI Homes’ existing investment narrative.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

LGI Homes Investment Narrative Recap

To own LGI Homes, you need to believe its entry-level focus and community expansion can convert long-term housing demand into consistent closings and earnings, despite affordability headwinds and recent margin pressure. January’s 218 closings and 140 active communities modestly support the near term catalyst of stabilizing sales pace, but do little to ease the key risk of ongoing pressure on first time buyers and potential constraints from a shrinking lot pipeline.

The Monte Vista Collection launch near Modesto is especially relevant because it highlights LGI’s continued push into new markets with upgraded, move in ready homes bundled through its CompleteHome Plus package. For the current catalyst of rebuilding volume and supporting margins, this type of community expansion shows how LGI is still leaning on differentiated product and new floor plans to attract cost conscious buyers even as cancellation rates and affordability remain key watchpoints.

Yet behind LGI’s new communities, investors should also recognize how persistent affordability pressure could still undermine...

LGI Homes' narrative projects $2.8 billion revenue and $178.8 million earnings by 2028.

Uncover how LGI Homes' forecasts yield a $67.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

While consensus sees moderate growth, the most optimistic analysts once projected revenue of about US$4.0 billion and earnings near US$299.3 million by 2028, so January’s community and closings data could either bolster that aggressive expansion thesis or reinforce concerns about heavy speculative inventory risk, depending on how trends evolve.

Explore 2 other fair value estimates on LGI Homes - why the stock might be worth as much as 10% more than the current price!

Build Your Own LGI Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LGI Homes research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free LGI Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LGI Homes' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- Find 51 companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.