Please use a PC Browser to access Register-Tadawul

Are Prairie Operating's (PROP) Drilling Innovations Shaping a New Era for Production Efficiency?

Prairie Operating Co. PROP | 1.68 | -1.75% |

- Prairie Operating Co. recently provided a comprehensive operational update on its 2025 drilling and completion schedule, reporting successful initial production from recently acquired and developed wells as well as progress on multiple Niobrara and Codell pad projects.

- The company’s introduction of its first U-turn wells and the achievement of strong early well results have increased attention on operational efficiencies and anticipated production growth milestones.

- We’ll examine how Prairie’s move toward innovative drilling techniques and early production performance influences its overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Prairie Operating's Investment Narrative?

The heart of the Prairie Operating story is a belief in its capacity to deliver significant production growth through ambitious drilling programs and technological progress, particularly across the Niobrara and Codell formations. The company’s new operational update moves the needle by confirming promising initial results from recently acquired wells and outlining tangible milestones for the rest of 2025. Short term, attention pivots to execution, specifically, the swift commercialization of U-turn and multi-bench wells, and whether these innovative approaches translate to increased output and cash generation. That said, with the share price down sharply year-to-date and heightened volatility since being dropped from key indices, it’s worth weighing fresh operational momentum against clear risks. These include the company’s short cash runway, history of shareholder dilution, and a compressed timeline to profitability. The latest news could potentially improve sentiment and reduce uncertainty around these bottlenecks, but it remains to be seen if early production gains will be sufficient to shift long-standing concerns. On the other hand, shareholder dilution remains a tangible risk that investors should keep in mind.

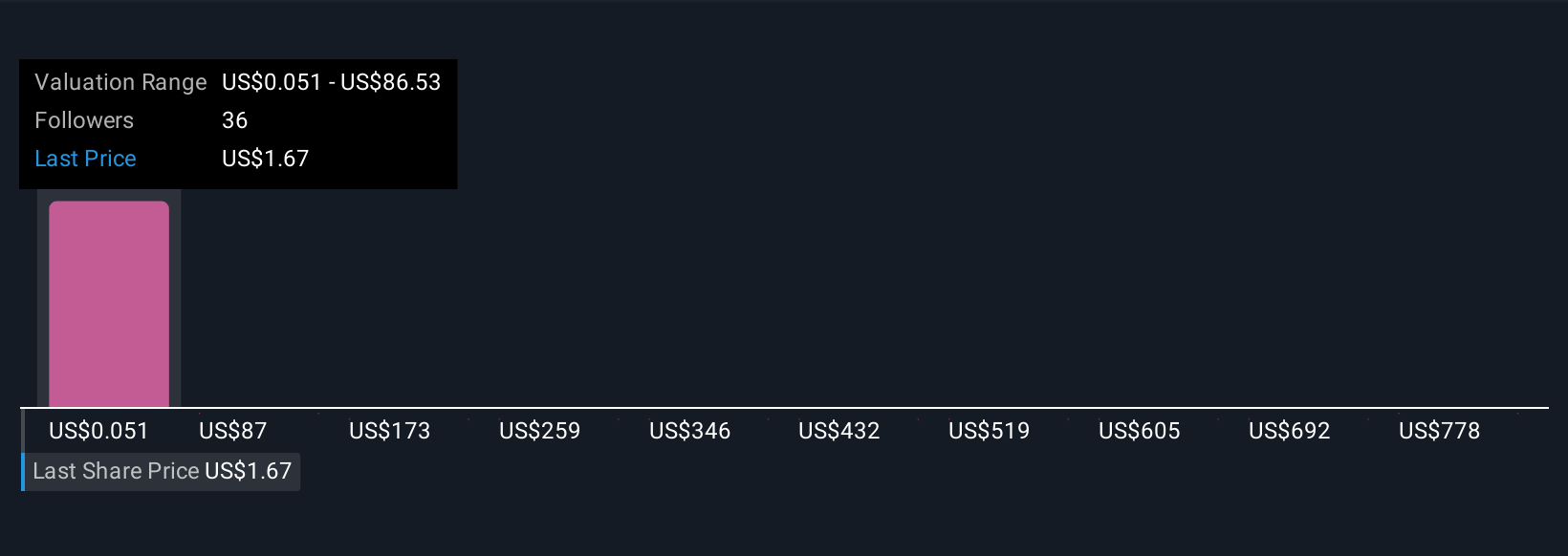

According our valuation report, there's an indication that Prairie Operating's share price might be on the cheaper side.Exploring Other Perspectives

Explore 21 other fair value estimates on Prairie Operating - why the stock might be worth less than half the current price!

Build Your Own Prairie Operating Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prairie Operating research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Prairie Operating research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prairie Operating's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.