Please use a PC Browser to access Register-Tadawul

Arrow Electronics (ARW): Assessing Valuation After U.S. Sanctions Hit Shanghai and Hong Kong Subsidiaries

Arrow Electronics, Inc. ARW | 113.59 | -1.40% |

The U.S. government has imposed sanctions on Arrow Electronics (ARW) subsidiaries in Shanghai and Hong Kong, citing concerns about the transfer of American electronic components for use in weaponized drones by Iranian-backed groups.

Arrow Electronics’ share price has reacted sharply to the latest sanctions news. It has slid nearly 14% over the past three months and left its one-year total shareholder return at negative 15%. Even with a modest year-to-date gain, the recent selloff signals mounting pressure as investors reassess the company’s risk profile and future growth outlook.

If you want to see which fast-growing stocks with strong management are catching momentum elsewhere, now’s an ideal time to explore fast growing stocks with high insider ownership

The recent slide raises a crucial question for investors: does Arrow Electronics’ discounted share price represent a compelling buying opportunity, or does it reflect concerns that the market has already factored into its valuation?

Most Popular Narrative: 2.8% Undervalued

With the fair value pegged at $116.75 versus Arrow Electronics’ last close of $113.50, the market’s discount is modest but telling. This sets the scene for a deeper look at the drivers behind this consensus view.

“Accelerating adoption of cloud, infrastructure software, cybersecurity, and mid-market as-a-service offerings (notably through ArrowSphere) is increasing Arrow's exposure to higher-margin, recurring revenue streams. This is set to support both revenue growth and margin stability in future quarters.”

Curious how a focus on higher-margin, recurring cloud revenues could tip the scales for Arrow’s future? The real surprise lies in how analysts are betting on a margin rebound and profit boost—numbers that could turn heads if achieved. What are the projections that make this narrative so intriguing? Dive in to uncover the formula behind this price target.

Result: Fair Value of $116.75 (UNDERVALUED)

However, increasing digitalization and evolving global trade tensions could disrupt Arrow’s growth trajectory. These factors may introduce new challenges for long-term revenue and margin stability.

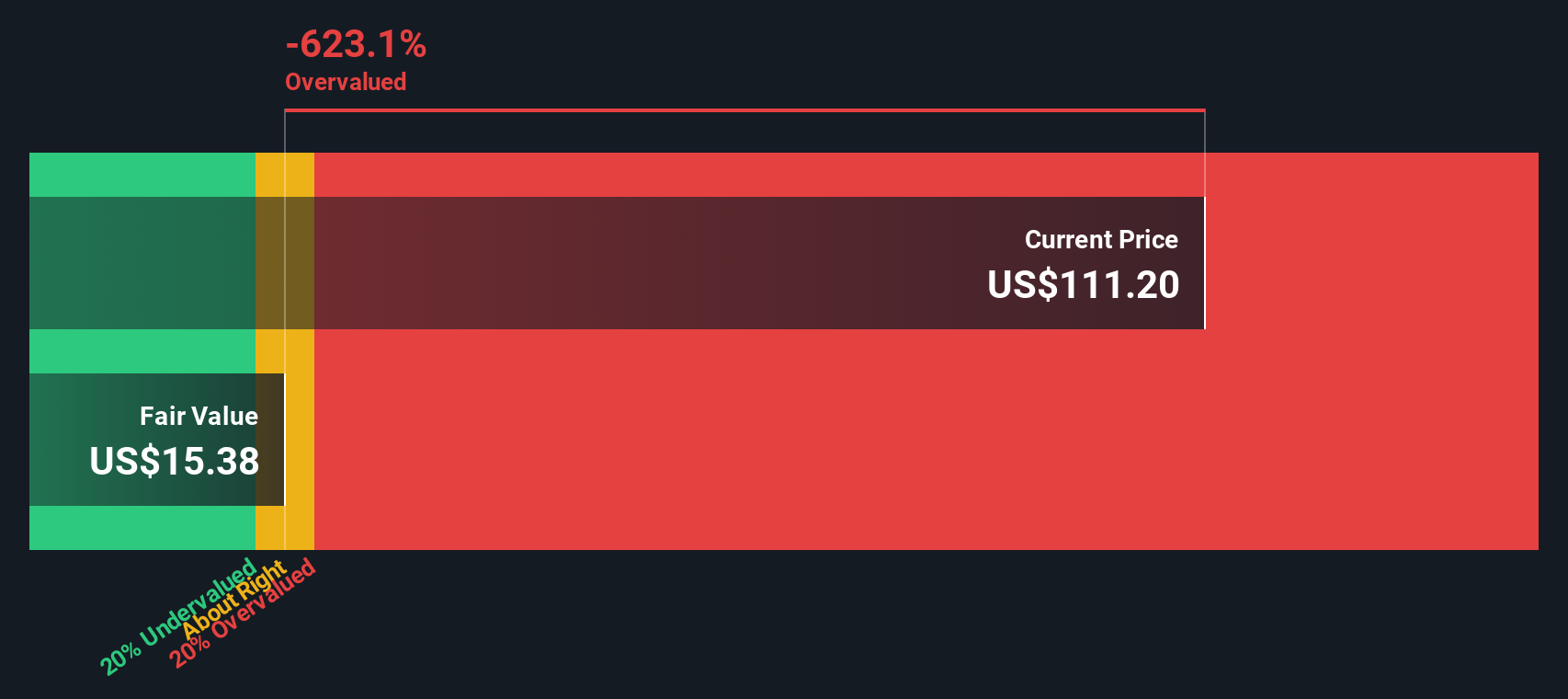

Another View: SWS DCF Model Challenges the Consensus

Looking at the numbers through the SWS DCF model paints a different picture. This approach values Arrow Electronics at just $18.97 per share, far below both the analyst consensus and current market price. Such a wide gap raises real questions: are the consensus growth assumptions too optimistic, or is the DCF model missing something critical?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arrow Electronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arrow Electronics Narrative

If you see the numbers differently or want to dig in on your own terms, you can craft a fresh Arrow Electronics narrative in just a few minutes. Do it your way

A great starting point for your Arrow Electronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your opportunities. Some of the most exciting stocks may be just a click away with the right investment screeners from Simply Wall St.

- Maximize your portfolio’s income potential by jumping into these 19 dividend stocks with yields > 3% with generous yields and strong fundamentals.

- Uncover game-changing innovation when you jump aboard these 24 AI penny stocks making rapid progress with artificial intelligence and next-generation technology.

- Tap into untapped growth by targeting these 891 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.