Please use a PC Browser to access Register-Tadawul

Arrow Electronics (ARW): Evaluating Valuation After Expanding Clavister Cybersecurity Distribution Across Europe

Arrow Electronics, Inc. ARW | 113.59 | -1.40% |

Arrow Electronics (NYSE:ARW) is expanding its role in the European cybersecurity market by distributing Clavister's full portfolio beyond Sweden and into 11 additional countries. This strategic move leverages Arrow's reach and partnerships.

This distribution expansion comes just after Arrow’s leadership team announced upcoming presentations at major tech and AI conferences, keeping the company in the spotlight. Arrow’s recent momentum has not yet translated into share price gains, with a 1-year total shareholder return of -6.1%. However, its 5-year performance remains solidly positive. Investors appear cautious in the near term. Arrow’s strategic moves and long-term growth track record suggest there could be upside as confidence rebuilds.

If you’re interested in uncovering other tech leaders with growth ambitions, check out our latest picks in See the full list for free.

With Arrow Electronics’ fundamentals holding steady and its stock trailing analyst targets by a narrow margin, the question now is whether investors are looking at an undervalued opportunity or if the market has already factored in the company’s growth potential.

Most Popular Narrative: 3% Undervalued

With Arrow Electronics trading at $108.16 and the most widely followed narrative setting fair value at $112, the gap hints at modest upside potential ahead. This sets the stage for a closer look at the core drivers behind this outlook.

Accelerating adoption of cloud, infrastructure software, cybersecurity, and mid-market as-a-service offerings (notably through ArrowSphere) is increasing Arrow's exposure to higher-margin, recurring revenue streams, which is expected to support both revenue growth and margin stability in future quarters.

Eager to see what’s really propelling Arrow’s fair value calculation? The real story is hidden inside confident growth projections and profit margin shifts debated by analysts. Don’t miss which set of financial assumptions this upbeat outlook is built on to discover the full narrative for the exact catalysts and numbers moving the target price.

Result: Fair Value of $112 (UNDERVALUED)

However, shifts in customer sourcing or prolonged inventory cycles could undermine Arrow’s growth momentum. This could potentially pose a challenge to the current bullish outlook.

Another View: Market Multiples Perspective

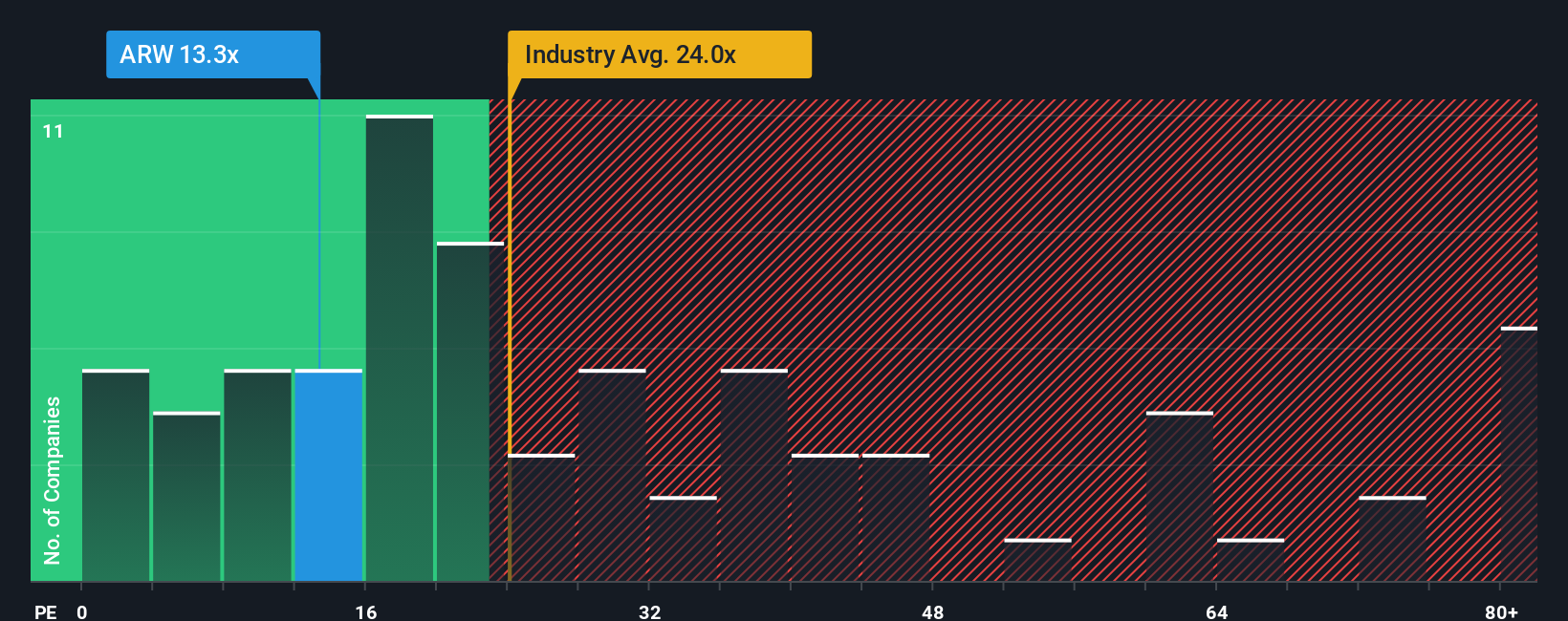

Looking beyond fair value estimates, Arrow Electronics stands out on its price-to-earnings ratio of 11.7x. This figure is well below the US Electronic industry’s average of 23.9x and its peers’ 17x mark. The ratio is also much lower than the fair ratio of 21.2x that the market could revert toward. This discount signals investors may be underestimating Arrow’s true worth, but does it represent a genuine value opportunity or highlight risks that others see?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arrow Electronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arrow Electronics Narrative

If you see the story differently or want to dive into the numbers firsthand, you can shape your own view in just a few minutes. Do it your way

A great starting point for your Arrow Electronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Now is the perfect time to seize other smart investment opportunities using the Simply Wall Street Screener. Don’t wait and risk missing a hidden gem; take action now!

- Uncover stocks delivering robust passive income by checking out these 16 dividend stocks with yields > 3%, which offers regular yields above 3% for consistent cash flow potential.

- Catch the next wave of healthcare innovation and see which companies are harnessing artificial intelligence via these 31 healthcare AI stocks before Wall Street spots them.

- Boost your portfolio with high-upside names by targeting these 3588 penny stocks with strong financials, which stand out for their strong financial foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.