Please use a PC Browser to access Register-Tadawul

Arrow Electronics, Inc. (NYSE:ARW) Shares Fly 36% But Investors Aren't Buying For Growth

Arrow Electronics, Inc. ARW | 157.03 | +2.05% |

The Arrow Electronics, Inc. (NYSE:ARW) share price has done very well over the last month, posting an excellent gain of 36%. The last 30 days bring the annual gain to a very sharp 45%.

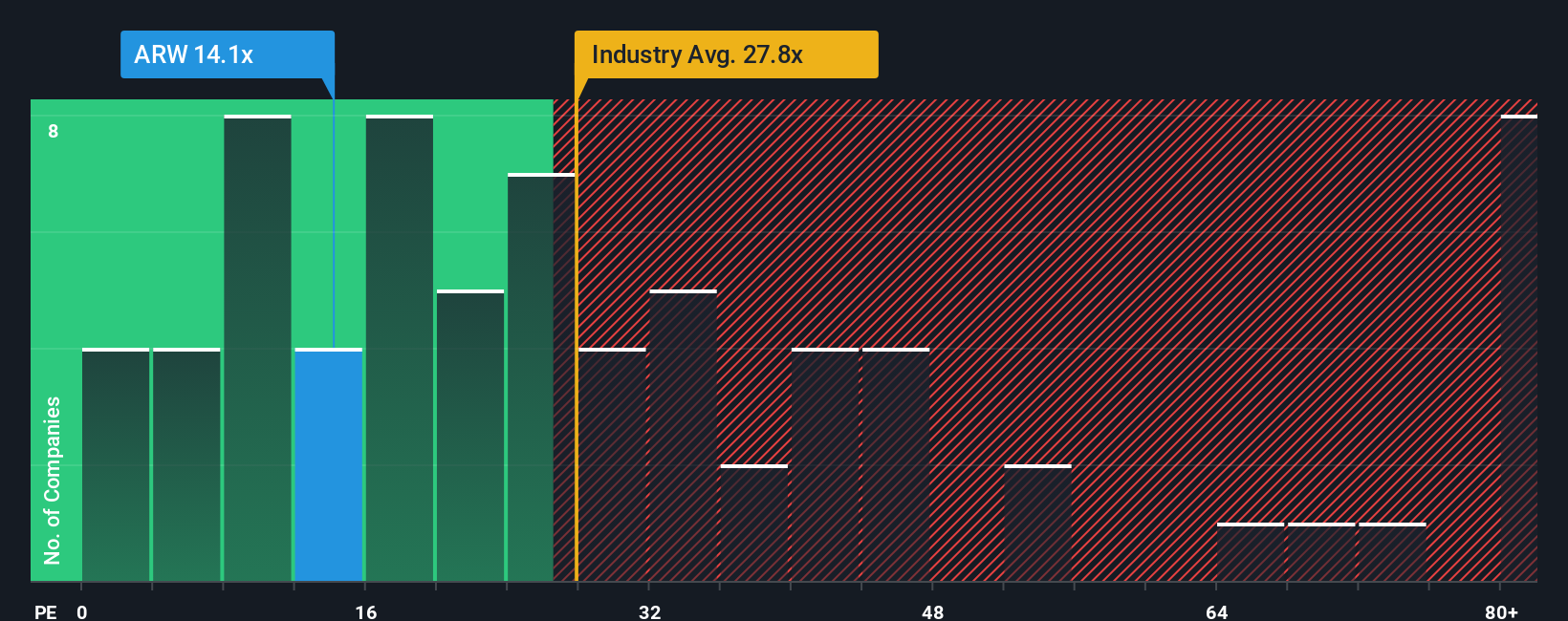

In spite of the firm bounce in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider Arrow Electronics as an attractive investment with its 13.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Arrow Electronics as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Is There Any Growth For Arrow Electronics?

Arrow Electronics' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 50%. However, this wasn't enough as the latest three year period has seen a very unpleasant 49% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 5.9% over the next year. That's not great when the rest of the market is expected to grow by 16%.

In light of this, it's understandable that Arrow Electronics' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Despite Arrow Electronics' shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Arrow Electronics maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Arrow Electronics.

Of course, you might also be able to find a better stock than Arrow Electronics. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.