Please use a PC Browser to access Register-Tadawul

ASGN (ASGN) Margin Compression Challenges Market Valuation Narrative Despite Discounted Share Price

On Assignment, Inc. ASGN | 48.07 | +0.94% |

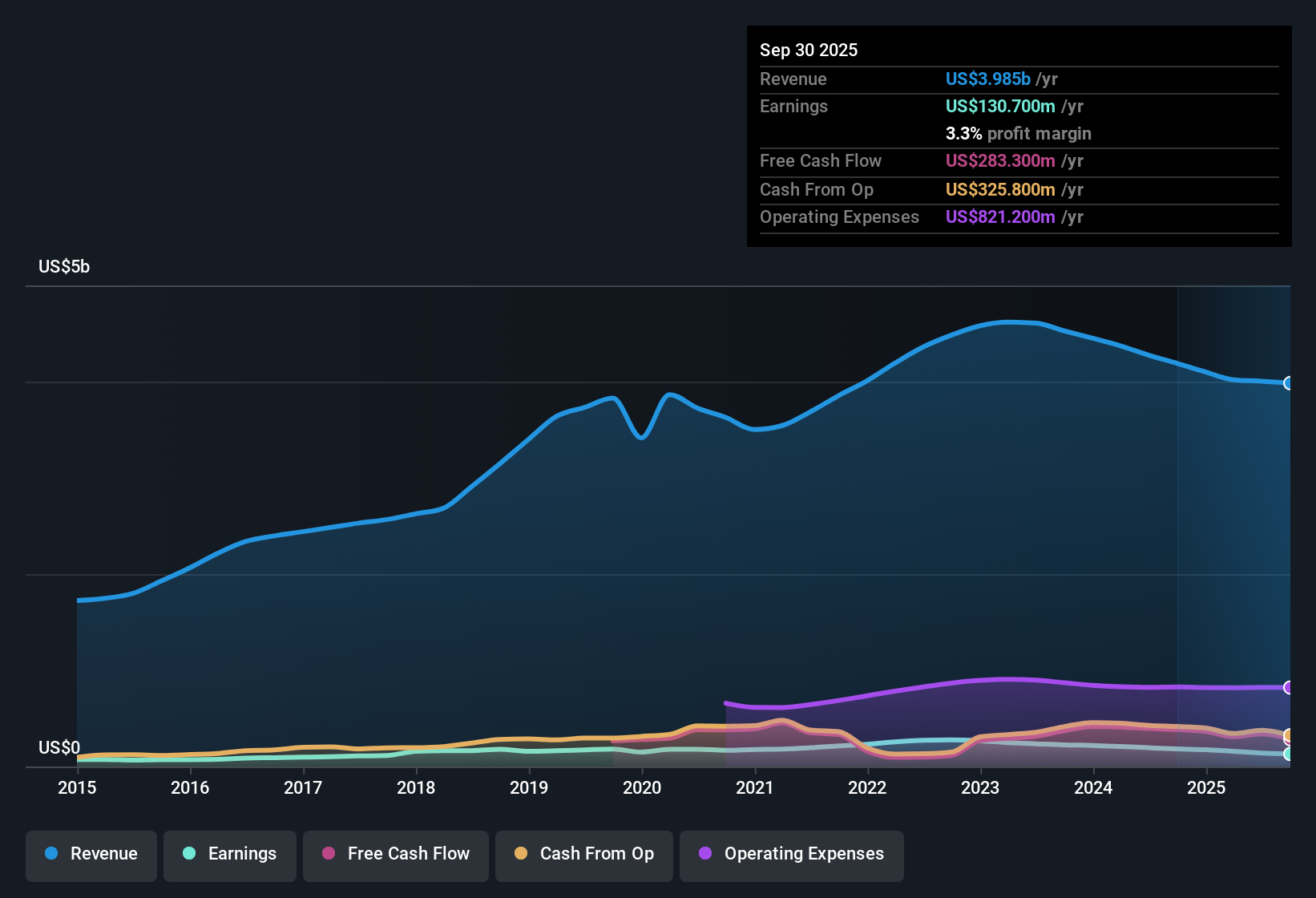

ASGN (ASGN) posted a net profit margin of 3.3%, down from 4.4% last year, marking a period of declining profitability for the company. Over the last five years, earnings have dropped by an average of 4.8% annually, and earnings growth turned negative over the most recent twelve months. Still, with quality earnings intact and analysts forecasting annual EPS growth of roughly 13% going forward, ASGN’s relatively low Price-To-Earnings ratio of 15.6x and trading price below fair value offer investors potential rewards, especially as revenue is set to increase modestly at 2.1% per year.

See our full analysis for ASGN.Next, we’ll see how these earnings results line up with the main narratives driving sentiment across the market and within the Simply Wall St investment community.

Margins Pressured by Wage Inflation and Segment Mix

- ASGN’s federal segment gross margins fell by 140 basis points over the past year, driven partly by a greater mix of lower-margin software license revenues and the ongoing loss of higher-margin government work.

- Analysts' consensus view notes these pressures highlight a vulnerability to contract mix shifts and competitive bidding. They also indicate that strategic investments in AI and cloud consulting could help reverse the trend by growing a higher-margin pipeline for consulting and recurring services.

- Consensus narrative underscores that persistent IT talent shortages support staffing pricing power, which may help offset wage inflation. At the same time, the gradual internal adoption of AI is beginning to yield productivity gains that could, over time, restore margins.

- However, rising SG&A to $216.8 million from $205.6 million year-over-year shows that ongoing cost pressures remain a headwind for near-term margin recovery.

- For a deeper look at analysts' balanced perspective on these margin shifts and how AI investments come into play, see the full Consensus Narrative. 📊 Read the full ASGN Consensus Narrative.

Analysts See Modest Recovery Ahead Despite Revenue Slip

- ASGN’s year-over-year total revenues declined 1.4%, and commercial segment sales fell 2.4%, but forward estimates project annual revenue growth of roughly 2.1% and profit margin improvement from 3.5% to 4.5% over the next three years.

- Consensus narrative highlights that while the company’s core assignment staffing business declined sharply (down 13.9% YoY), federal demand in cloud, AI, and cybersecurity is expected to drive more stable, recurring revenues, providing a foundation for gradual margin and earnings growth.

- Analysts expect earnings per share to rise to $4.34 by 2028 (up from $140.1 million current earnings to $193.8 million), assuming stability in federal contracting and successful execution of digital modernization roadmaps.

- The consensus also notes that ongoing automation and tougher competition could pose risks, but the steady federal backlog and strategic partnerships with tech leaders set up long-term resilience.

Valuation Discount Leaves Room for Upside

- At a Price-To-Earnings ratio of 15.6x, ASGN trades well below its peer group’s average (23.1x) and the US IT industry average (30.1x), with shares trading at $46.49 compared to a DCF fair value of $84.50.

- Consensus narrative points out that although the analyst price target of $53.17 is only about 14% above the current price, the large gap between market price and DCF fair value means the market is heavily discounting near-term risks. If ASGN’s shift toward higher-margin consulting delivers, this multiple could rerate.

- Peer discounts are underpinned by recent negative earnings growth and modest forward growth projections, but the current valuation already prices in a great deal of caution around macro risk and competitive threats.

- Consensus sentiment remains neutral; long-term upside exists if margin expansion and strategic investments pay off, even if near-term results remain uninspiring.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ASGN on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Share your perspective and build your own view of ASGN in just a few minutes. Do it your way

A great starting point for your ASGN research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

ASGN’s inconsistent earnings growth, margin compression, and reliance on federal contracts highlight its vulnerability to market shifts and cyclical slowdowns.

If you want to avoid similar volatility, use our stable growth stocks screener (2098 results) to focus on companies that deliver consistent revenue and earnings growth, regardless of macro headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.