Please use a PC Browser to access Register-Tadawul

Ashland EPA Green Light Puts Agrimer Eco-Coat In Crop Care Focus

Ashland Inc. ASH | 64.80 | +2.50% |

- Ashland (NYSE:ASH) received US EPA approval for its Agrimer Eco-Coat polymer seed coating.

- The eco-focused technology is now cleared for commercial use in global agricultural markets.

- The approval marks an expansion of Ashland's presence in crop care solutions.

Ashland, known for specialty materials and chemical solutions, is adding more weight to its agricultural offerings with Agrimer Eco-Coat now cleared for broader use. For investors watching the mix of chemistry and sustainability in crop care, this move places Ashland in a segment where environmental regulations and product performance both matter.

The EPA approval gives Ashland room to pursue new customer relationships across agricultural markets that are looking for seed treatments with an environmental focus. Investors may want to watch how the company integrates this product into its broader portfolio and how it is adopted by seed producers and large farming operations over time.

Stay updated on the most important news stories for Ashland by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Ashland.

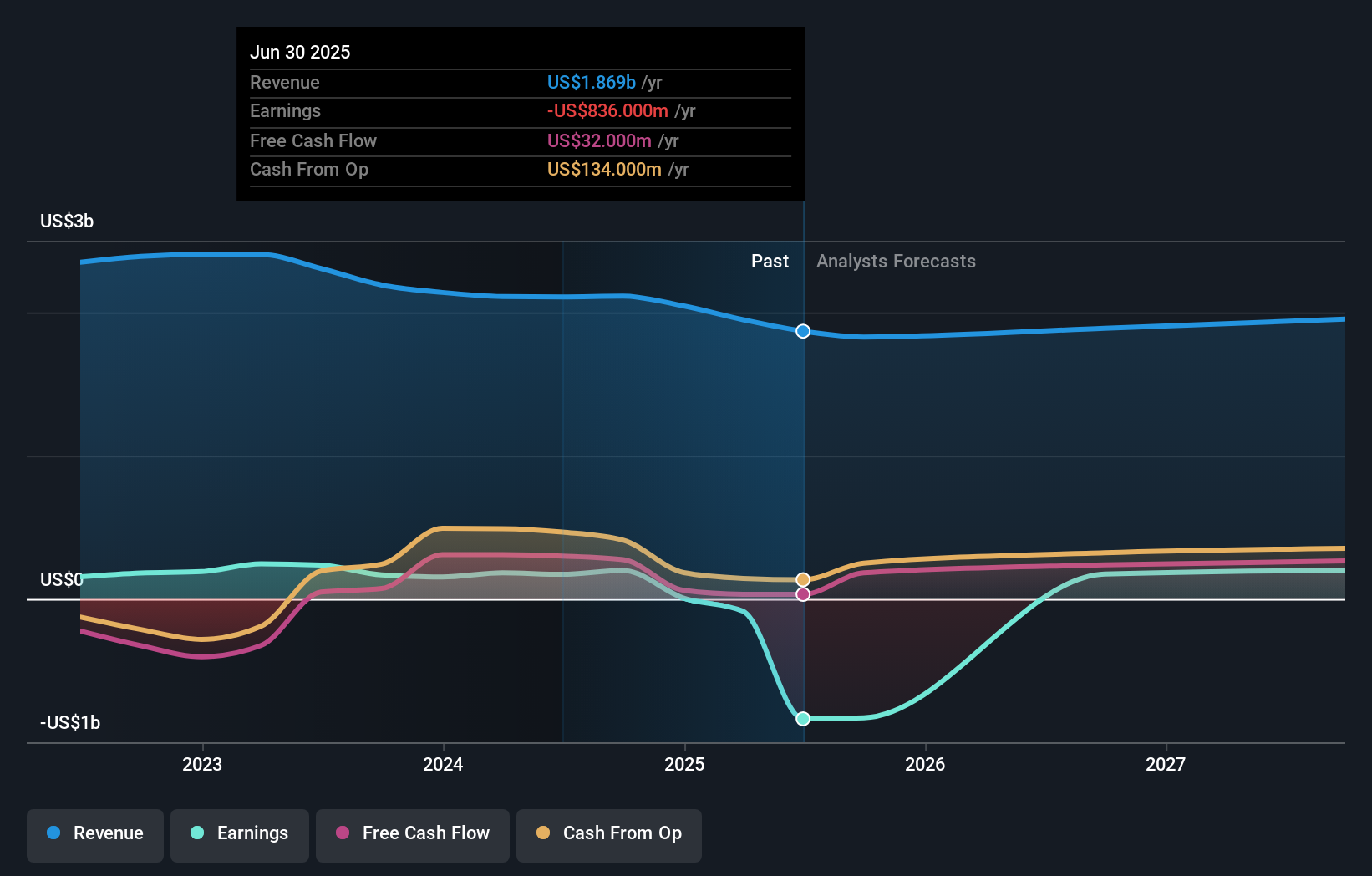

The EPA approval gives Ashland a clearer commercial path for Agrimer Eco-Coat at a time when the company is leaning on "innovation-driven and globalized product lines" to support its 2026 sales outlook of US$1,835 million to US$1,905 million. The seed coating, built on Transformed Vegetable Oils technology, fits directly into the push for more sustainable crop care inputs, an area where global players such as BASF, Corteva and Syngenta are also active. For you as an investor, the key angle is that Ashland is adding another specialized, regulation-cleared product that could help diversify its revenue mix beyond its core personal care and life sciences portfolio.

How This Fits Into The Ashland Narrative

- The approval supports the narrative focus on sustainable, high-value specialty chemicals by extending Ashland's eco-focused offerings into crop care solutions.

- It slightly challenges the idea that growth must come mainly from personal care and pharmaceutical end markets, by opening a path in agricultural applications where demand patterns and pricing can differ.

- The narrative emphasizes emerging-market demand in personal care and pharma, while this seed-coating opportunity in regions such as Latin America may not be fully reflected in existing storylines about Ashland's growth drivers.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Ashland to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Commercial traction for Agrimer Eco-Coat is not guaranteed and will depend on customer adoption in competitive seed-treatment markets where large incumbents already have distribution and long-standing relationships.

- ⚠️ Bringing a new, eco-focused technology to scale can involve regulatory, formulation and manufacturing complexities, which may limit the near term financial contribution relative to investor expectations.

- 🎁 The EPA decision broadens Ashland's addressable market in agriculture by allowing use across food and non food pesticide formulations, supporting the company's focus on more sustainable specialty solutions.

- 🎁 If growers in the US, Latin America and Europe adopt the product in their seed-treatment programs, Agrimer Eco-Coat could gradually become a recurring revenue contributor tied to annual planting cycles.

What To Watch Going Forward

From here, the key things to watch are how quickly Ashland converts this regulatory milestone into commercial contracts, and whether major seed producers or crop protection companies start highlighting Agrimer Eco-Coat in their own offerings. You may also want to track how management discusses the agricultural portfolio on future earnings calls, including any commentary on volumes, pricing, or margins related to eco-focused crop care products. This can help you judge whether the product is staying niche or starting to matter within Ashland's broader specialty-chemicals mix.

To ensure you're always in the loop on how the latest news impacts the investment narrative for Ashland, head to the community page for Ashland to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.