Please use a PC Browser to access Register-Tadawul

Assessing AbbVie (ABBV) Valuation as Analysts Debate Future Growth Expectations

AbbVie, Inc. ABBV | 223.43 | +2.01% |

AbbVie’s latest share price of $236.56 reflects a year in which momentum has been steady, with a 1-year total shareholder return of 25% signaling the market’s ongoing confidence in the company’s fundamentals and future prospects. While price gains have been incremental, the story behind the numbers suggests that investors are gradually warming to AbbVie’s growth outlook.

If you’re looking to get a sense of what’s happening across the healthcare space, the See the full list for free. is a great way to spot other standout performers.

But with AbbVie’s share price hovering just above analyst targets, it raises the question: Is Wall Street underestimating its potential, or has every bit of future growth already been factored in for would-be buyers?

Most Popular Narrative: 4.1% Overvalued

With the current share price of $236.56 exceeding the consensus fair value of $227.22, the most widely followed narrative frames AbbVie as trading slightly above what analysts consider “fair.” This sets up an intriguing debate over whether today’s price fully reflects future growth or hides surprises.

Bullish analysts cite a substantial extension of Rinvoq’s U.S. patent runway through favorable settlement, delaying generic entry until 2037, four years beyond prior expectations. They model this as adding $11 to $24 per share in value. Upward price targets reflect top- and bottom-line beats in recent quarters and raised 2025 guidance, led by momentum in key growth drivers such as Skyrizi and the neuroscience portfolio. This occurs despite ongoing macro headwinds for the aesthetics business.

Wonder what’s powering analysts’ optimism? This narrative rests on ambitious earnings, revenue, and profit margin improvements that could send estimates soaring or falling flat. What high-stakes forecasts are hiding beneath the headlines? Dive into the numbers powering this narrative to uncover what’s really driving that fair value calculation.

Result: Fair Value of $227.22 (OVERVALUED)

However, risks such as loss of patent exclusivity and increased regulatory scrutiny could quickly undermine the bullish growth narrative.

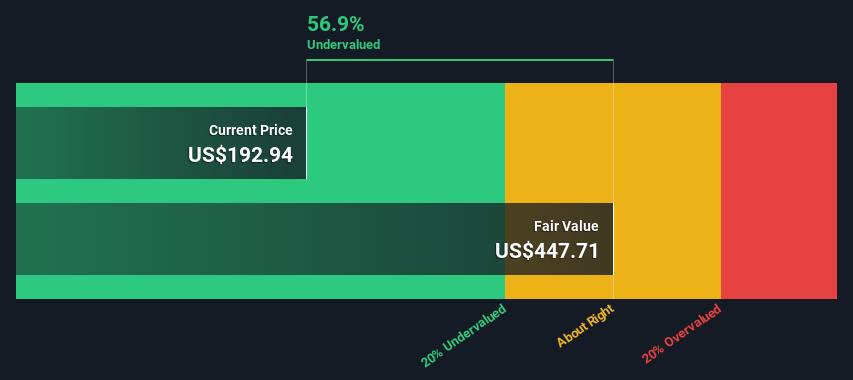

Another View: Deep Discount on Cash Flows

While most analysts see AbbVie as overvalued using price-to-earnings comparisons, our DCF model gives a drastically different result. It suggests the shares are trading at a steep 46% discount to estimated fair value. Could the market be overlooking the company’s future cash flow power?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AbbVie for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AbbVie Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd and seize tomorrow’s potential by using the Simply Wall Street Screener to find stocks with growth stories too good to miss.

- Uncover high-potential opportunities by targeting these 910 undervalued stocks based on cash flows and spot companies primed for a rebound before the market catches on.

- Ride the momentum of technology disruption by tapping into these 24 AI penny stocks, where machine learning and intelligent automation are transforming entire industries.

- Lock in consistent income streams when you check out these 19 dividend stocks with yields > 3% built to deliver yields above 3% for steady compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.