Please use a PC Browser to access Register-Tadawul

Assessing Allegro MicroSystems (ALGM) Valuation as Investors React to Recent Stock Price Movement

ALLEGRO MICROSYSTEMS, INC. ALGM | 27.11 | -4.81% |

Most Popular Narrative: 21.2% Undervalued

According to the most widely followed narrative, Allegro MicroSystems is currently considered undervalued, with a significant discount relative to its estimated fair value. The narrative points to a combination of sector momentum, strong demand signals, and internal innovations as drivers for this outlook.

"Channel inventory reductions are largely complete, and forward demand signals are robust (order backlog, strong bookings, customer inventory replenishment discussions), highlighting a likely reacceleration in shipments and top-line growth as restocking trends emerge, especially in automotive and industrial segments."

Curious why so many see upside for Allegro MicroSystems? Discover the financial playbook behind this attractive valuation, from expanding profit margins to game-changing growth forecasts. These are the bold analyst assumptions that could redefine expectations. Think you already know what is fueling this price target? Dive in to see what most investors miss about the company’s future performance.

Result: Fair Value of $37.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition in China and Allegro’s heavy reliance on automotive demand could quickly undermine this optimistic outlook if market trends change direction.

Find out about the key risks to this Allegro MicroSystems narrative.Another View: Multiples Raise Questions

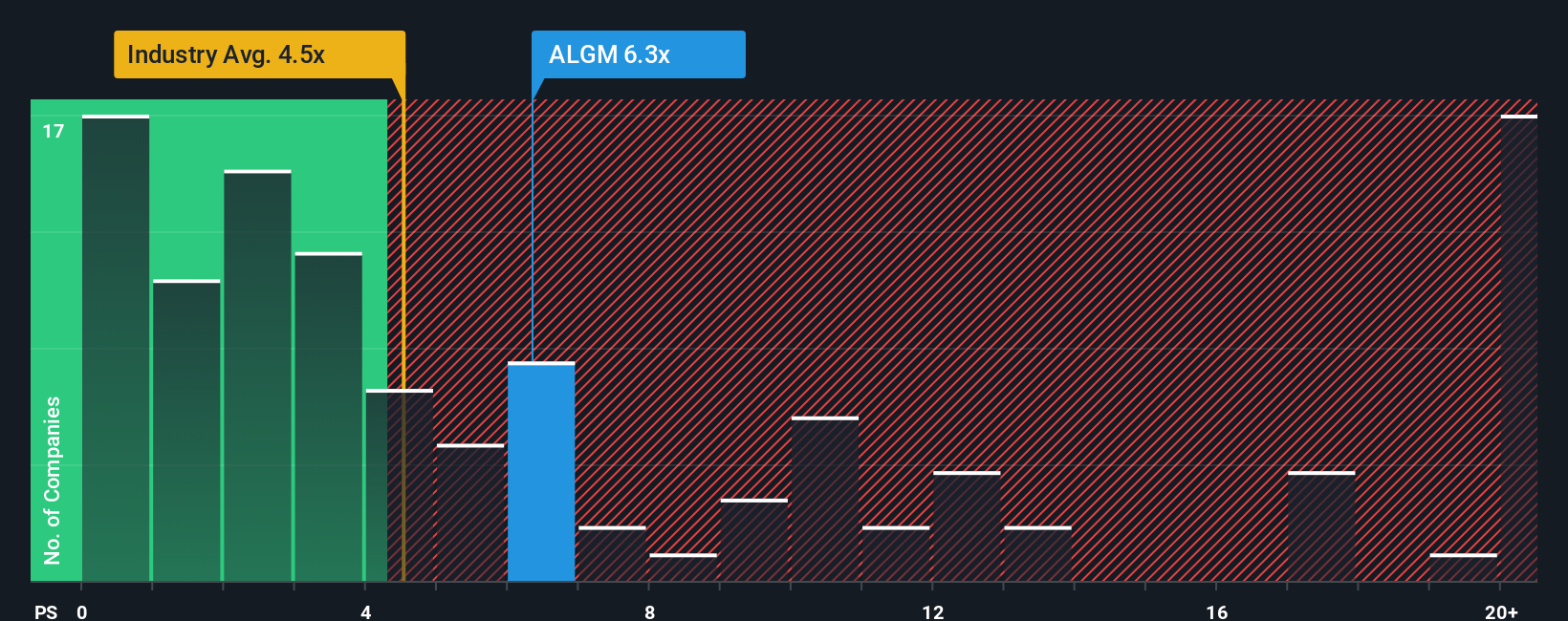

While one perspective sees Allegro MicroSystems as undervalued, a look at how its price stacks up to industry norms tells a different story. This method actually suggests the stock might be a bit pricey. Which view reflects reality?

Build Your Own Allegro MicroSystems Narrative

If you find yourself questioning these takes or if you prefer taking a hands-on approach to research, it is quick and simple to craft your own view of Allegro MicroSystems. Just a few minutes is all it takes. Do it your way

A great starting point for your Allegro MicroSystems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit your strategy to just one stock when other game-changing opportunities are ready for you? Make your next move count by tapping into fresh trends with the right tools.

- Chase high-yield growth by evaluating top performers offering dividend stocks with yields > 3% that consistently deliver impressive returns.

- Spot breakthrough potential among innovative companies at the forefront of artificial intelligence by checking out AI penny stocks.

- Lead the pack in the digital finance revolution by researching forward-thinking businesses in cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.