Please use a PC Browser to access Register-Tadawul

Assessing American Healthcare REIT (AHR) Valuation After Recent Strength in Share Price and Financials

American Healthcare REIT, Inc. AHR | 47.76 | +1.19% |

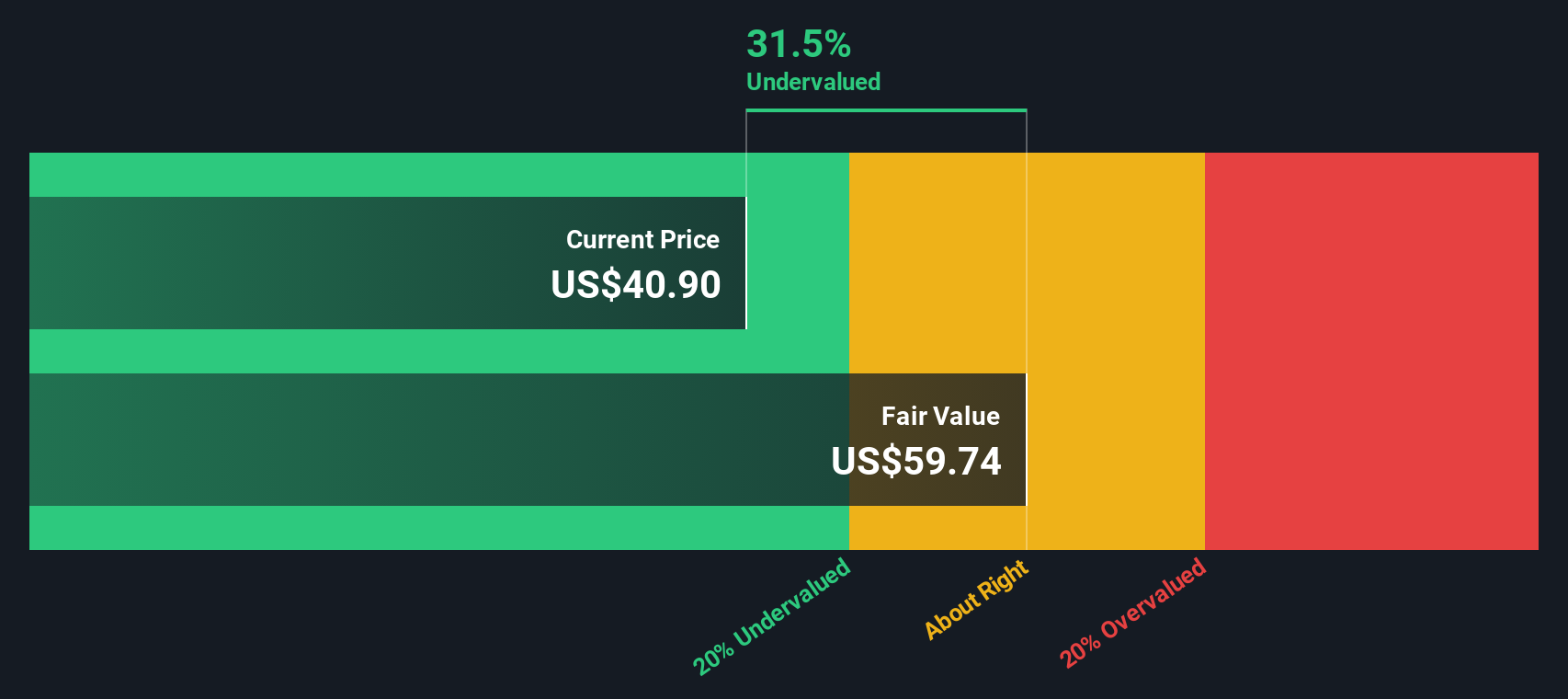

Most Popular Narrative: 6.2% Undervalued

The prevailing narrative sees American Healthcare REIT trading below its fair value, with consensus viewing the stock as modestly undervalued. This points to the potential for continued upside if the company's underlying assumptions hold true.

“The combination of a rapidly growing 80+ demographic and a multi-year period of low new supply in senior housing and skilled nursing is expected to drive a persistent supply-demand imbalance. This should fuel both occupancy gains and rent growth across American Healthcare REIT's portfolio. This dynamic should underpin above-trend revenue and net operating income growth over the next decade.”

Curious about the calculations that lead to this bullish fair value? Behind the narrative are bold forecasts on revenue growth, earnings, and profit margins. These assumptions hinge on unique demographic trends and operational strategies. Want to know how these projections stack up to industry expectations, and just what kind of financial leap analysts are making? The full narrative reveals the numbers driving this compelling valuation call.

Result: Fair Value of $46.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain. Occupancy could level off, and tougher comparisons may curb growth, potentially altering the upbeat narrative for American Healthcare REIT.

Find out about the key risks to this American Healthcare REIT narrative.Another View: What Does the DCF Say?

While analyst targets suggest American Healthcare REIT might be fairly priced, our SWS DCF model presents a different perspective and suggests the company could be undervalued. Do fundamentals really support the market’s optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Healthcare REIT Narrative

If you see things differently or would rather dig into the numbers yourself, you can quickly build your own perspective and narrative in just a few minutes. Do it your way

A great starting point for your American Healthcare REIT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next investment breakthrough. The right stock can change your portfolio's trajectory, so do not let great opportunities pass you by. Check out these powerful stock themes that could put you a step ahead.

- Accelerate your search for big yield by checking out companies offering reliable income with dividend stocks with yields > 3%.

- Tap into the future of medicine by finding innovative players at the intersection of tech and healthcare through healthcare AI stocks.

- Set your sights on high-potential value by scanning stocks that might be priced below their true worth with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.