Please use a PC Browser to access Register-Tadawul

Assessing Aptiv’s (APTV) Valuation After a Strong Year and Recent Share Price Pullback

Aptiv PLC APTV | 76.09 | -1.05% |

Aptiv (APTV) has quietly outperformed this year, and that makes its recent pullback more interesting than worrying. With shares up roughly 38% over the past year, investors are reassessing risk and reward.

The recent dip sits against a backdrop of solid momentum, with a roughly 30% year to date share price return and a 1 year total shareholder return near 38%, even as longer term total returns remain negative. This hints at a still cautious reset in expectations.

If Aptiv has you rethinking the auto space, it could be worth seeing how other auto manufacturers are positioned for the next leg of the cycle.

With earnings rebounding, modest revenue growth, and shares still trading at a steep discount to analyst targets and some intrinsic value estimates, is Aptiv a mispriced opportunity, or has the market already baked in the next leg of growth?

Most Popular Narrative: 20.5% Undervalued

With Aptiv last closing at $78.09 against a narrative fair value near $98, the story hinges on whether accelerating earnings can justify a rerating.

Analysts expect earnings to reach $1.9 billion (and earnings per share of $8.41) by about September 2028, up from $1.0 billion today. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, down from 17.7x today. This future PE is lower than the current PE for the US Auto Components industry at 17.7x.

Curious how a jump in profitability, slower top line assumptions, and a lower future earnings multiple can still add up to upside? Unpack the full playbook behind this valuation.

Result: Fair Value of $98.24 (UNDERVALUED)

However, softer global auto demand or execution hiccups around the EDS separation could quickly challenge the upbeat growth and valuation narrative around Aptiv.

Another Lens on Valuation

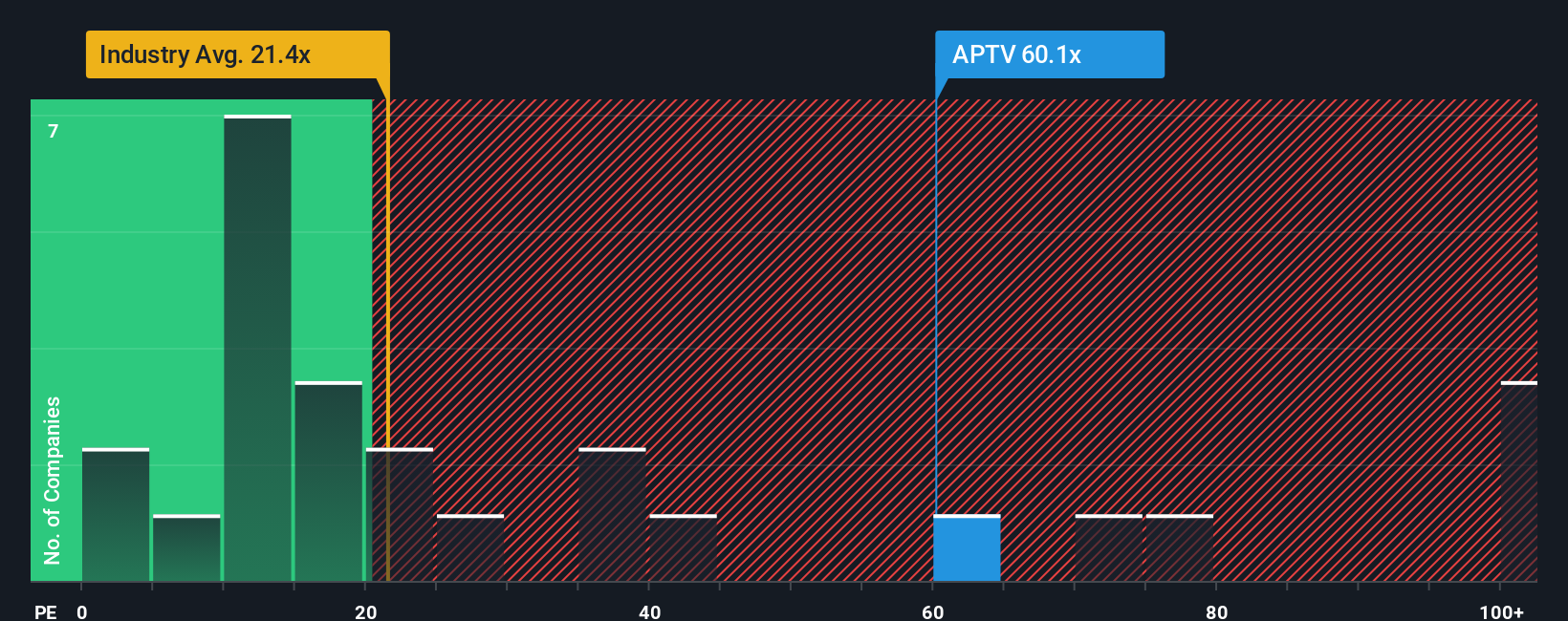

On earnings, Aptiv looks stretched, trading at a price to earnings ratio of 57.2x versus a fair ratio closer to 46.7x, and well above both the Auto Components industry at 21.3x and the peer average of 34.4x. Is this optimism justified, or is it setting up downside if growth wobbles?

Build Your Own Aptiv Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalized Aptiv view in just minutes: Do it your way.

A great starting point for your Aptiv research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity. Use the Simply Wall Street Screener to uncover focused, data driven ideas before the market fully catches on.

- Tap into future market leaders by reviewing these 25 AI penny stocks positioned at the intersection of innovation, automation, and scalable digital infrastructure.

- Target quality at a discount with these 915 undervalued stocks based on cash flows that pair strong fundamentals with prices the market has not fully appreciated yet.

- Boost your income potential using these 14 dividend stocks with yields > 3% offering attractive yields backed by businesses with sustainable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.