Please use a PC Browser to access Register-Tadawul

Assessing Arhaus (ARHS) Valuation After Recent Share Price Gain And Showroom Expansion Plans

Arhaus, Inc. Class A ARHS | 10.81 | -2.17% |

Arhaus (ARHS) has recently drawn investor attention after its latest trading session, with the share price closing at $11.06. That move comes after mixed returns over the past week, month, and past 3 months.

That 4.05% one-day share price gain sits against a year-to-date share price return of a 2.64% decline, while the 1-year total shareholder return of 16.91% suggests momentum has been building over a longer stretch despite recent ups and downs.

If Arhaus has you looking more broadly at the market, this is a good moment to broaden your search with fast growing stocks with high insider ownership.

With revenue and net income growing at about 6% to 7% annually, a value score of 1, and the share price sitting close to analyst targets, you have to ask: is Arhaus undervalued, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 1.5% Undervalued

With Arhaus last closing at $11.06 versus a narrative fair value of about $11.23, the valuation gap is tight but the story behind it is detailed.

The successful execution of showroom expansion in both mature and underpenetrated markets, paired with high-contribution-margin design studio concepts and a growing national footprint, creates a significant runway for revenue growth and EBITDA margin improvement as Arhaus gains market share in a fragmented industry.

Curious how measured revenue growth, steady margins, and a richer earnings base combine to support this valuation? The narrative leans on specific forecasts and a higher future earnings multiple that you might want to stress test against your own expectations.

Result: Fair Value of $11.23 (ABOUT RIGHT)

However, this hinges on U.S. showroom expansion paying off and input or tariff costs staying manageable, because softer demand or rising expenses could quickly pressure margins.

Another Angle On Valuation: Earnings Multiple Tells A Different Story

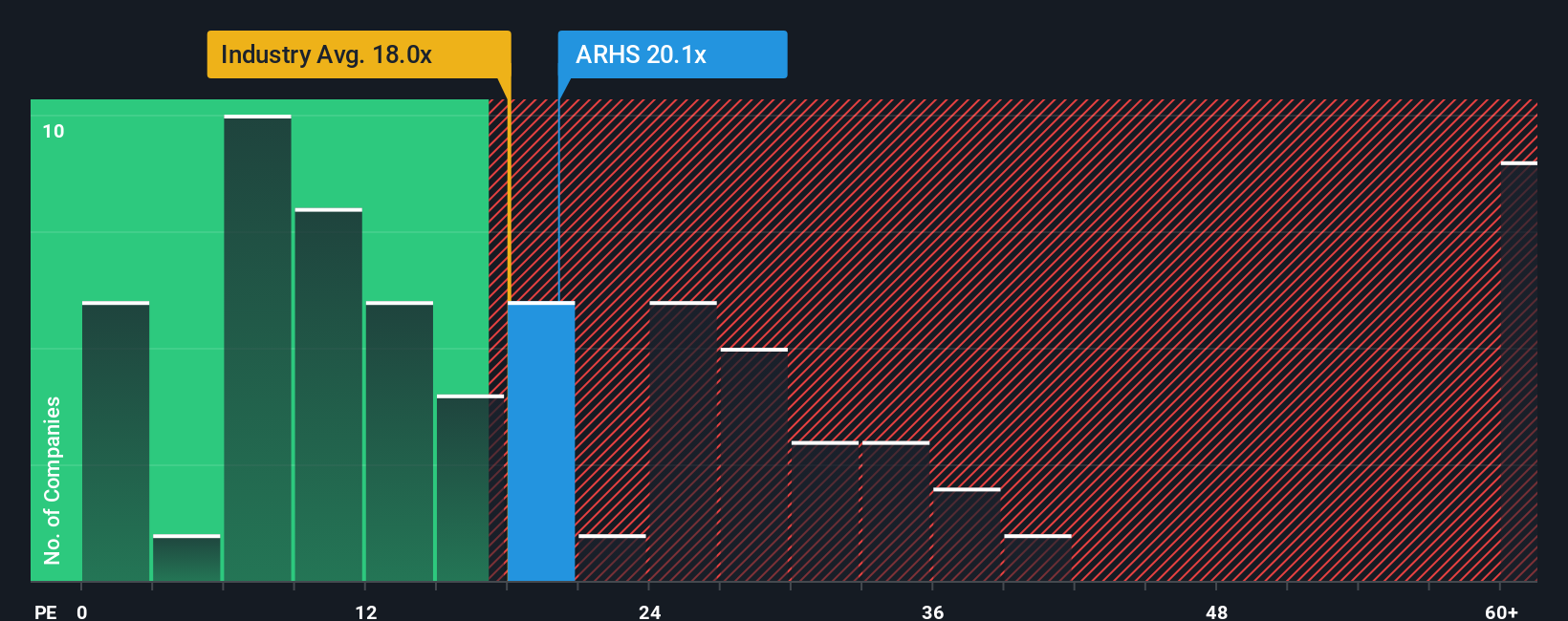

The fair value narrative pegs Arhaus at about $11.23 per share, close to the recent $11.06 price. Yet on an earnings multiple, the picture shifts. The current P/E is 21.2x versus a fair ratio of 13.6x, which implies the market is paying a much richer price for each dollar of earnings than that fair ratio suggests.

That premium also shows up against the US Specialty Retail industry at 20.2x, even though Arhaus screens as cheaper than a peer average of 28.7x. This raises the question of whether this represents a sensible quality premium or a valuation stretch that leaves less cushion if sentiment cools.

Build Your Own Arhaus Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, it is quick to build your own view with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Arhaus.

Looking for more investment ideas?

If Arhaus caught your attention, do not stop there. The Simply Wall St screener can quickly surface more ideas tailored to the style of opportunities you want to focus on.

- Target potential value gaps by checking out these 877 undervalued stocks based on cash flows that might be priced below what their cash flows suggest.

- Spot early movers in transformational tech by scanning these 25 AI penny stocks aiming to benefit from advances in artificial intelligence.

- Boost your income focus by reviewing these 11 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.