Please use a PC Browser to access Register-Tadawul

Assessing Arlo Technologies's Valuation as AI-Powered Subscriptions Drive Renewed Investor Interest

ARLO TECHNOLOGIES, INC. ARLO | 13.71 | -2.59% |

Arlo Technologies (ARLO) is quickly finding its way back onto the radar for investors, even without a single headline-grabbing announcement. What is fueling this attention? The company’s expanding subscriber base is now shifting into higher-priced, AI-enabled service tiers, adding momentum to both its net margins and its earnings outlook. This movement is making some market watchers reconsider how the stock has been valued and whether its growth path is being fully recognized yet.

This recent surge in attention comes as Arlo Technologies continues a pattern of positive momentum over the past year. The stock has climbed 65% year to date and delivered a 52% return for shareholders over the past 12 months, with gains building steadily in recent months. While the pace may not match the explosive rallies seen elsewhere in tech, Arlo’s steady operational progress, from launching new AI-driven security features to capitalizing on consumer demand for smart home upgrades, has set the stage for ongoing debate about its real worth.

So, with renewed momentum and investors paying attention again, is this an opportunity to buy into Arlo Technologies at an attractive valuation, or is the market already pricing in its future growth?

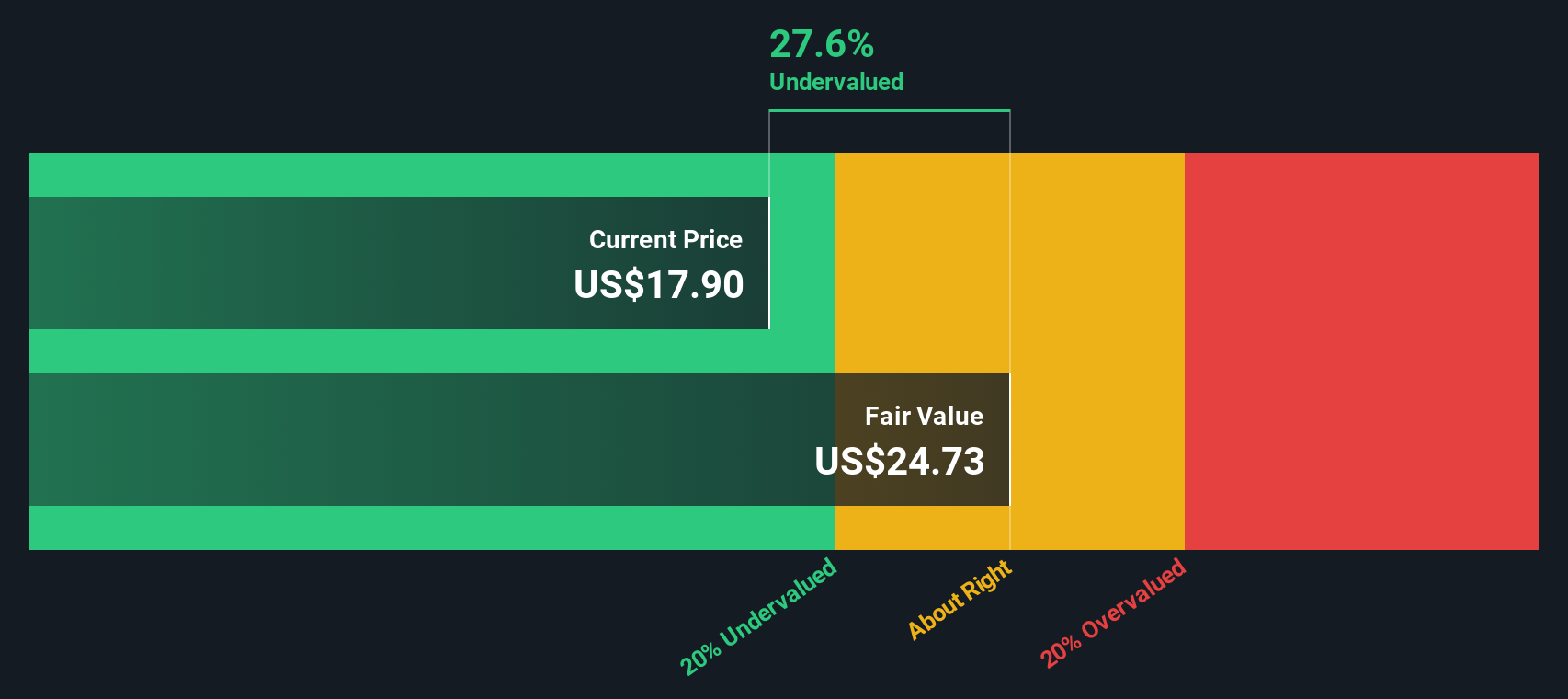

Most Popular Narrative: 22.1% Undervalued

According to the most widely followed narrative, Arlo Technologies is viewed as significantly undervalued, with its current share price trading well below the consensus estimate of fair value based on future growth expectations.

Continual migration of subscribers to higher-priced AI-driven service tiers (Arlo Secure 6), along with the corresponding increase in ARPU (now over $15, up 26% y/y), reinforces the long-term shift to recurring, high-margin (85% non-GAAP service margin) subscription revenue. This supports expanding net margins and greater earnings visibility.

Curious what’s powering this optimistic price target? There is one bold change in Arlo’s business model that analysts believe will rewrite its future. The answer ties back to the company’s ability to turn subscribers into a much more profitable stream of recurring revenue. How high do analysts see earnings and margins going in just a few years? The full narrative reveals the exact growth drivers and surprising financial jumps that shape this valuation.

Result: Fair Value of $23.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and potential international market setbacks could undermine Arlo's growth story and challenge the optimistic outlook analysts currently hold.

Find out about the key risks to this Arlo Technologies narrative.Another View: What Does the SWS DCF Model Say?

Looking beyond earnings multiples, our SWS DCF model offers a different lens. This analysis also suggests Arlo Technologies is attractively priced. However, does this method capture the whole story or overlook hidden risks?

Build Your Own Arlo Technologies Narrative

If you want to dig deeper, or have your own view on Arlo Technologies, you can build a custom narrative using your own insights in just a few minutes. Do it your way

A great starting point for your Arlo Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself a real edge by pinpointing stocks with potential before the crowd catches on. Here are three smart ways to stretch your research further:

- Target high potential opportunities by spotting undervalued stocks based on cash flows that show strength based on cash flow fundamentals and long-term upside.

- Tap into companies transforming the world of medicine with AI breakthroughs by using our healthcare AI stocks.

- Catch early trends in digital finance by tracking cryptocurrency and blockchain stocks that are poised to shape the future of payments and decentralized tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.