Please use a PC Browser to access Register-Tadawul

Assessing Arrow Electronics (ARW) Valuation After Recent Share Price Momentum

Arrow Electronics, Inc. ARW | 134.83 | +1.77% |

Arrow Electronics stock: recent move and key fundamentals

Arrow Electronics (ARW) has drawn closer investor attention after a recent share price move, prompting a closer look at how its current performance metrics and business profile line up for longer term holders.

At a share price of US$132.91, Arrow Electronics has seen firm near term momentum, with a 30 day share price return of 17.61% and a 1 year total shareholder return of 13.60%, while the 3 year total shareholder return of 0.29% suggests much flatter longer term progress.

If Arrow’s recent move has you reviewing your watchlist, this could be a useful moment to widen the net and check out high growth tech and AI stocks as potential comparison ideas.

With Arrow trading at US$132.91 and sitting above an analyst price target of US$108.25, plus an intrinsic value estimate suggesting a premium, you have to ask: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 23% Overvalued

Arrow Electronics last closed at $132.91, compared with a most widely followed fair value estimate of $108.25, putting the current price above that narrative view.

The normalization of customer inventory levels and broad-based backlog growth, especially in mass market segments, point to improving order patterns and sustainable sales momentum, increasing the likelihood of stronger operating leverage and earnings growth as volumes return across regions.

Curious what kind of revenue path and margin profile sits behind that fair value, and how earnings and share count assumptions fit together? The narrative spells out a detailed road map for how Arrow could get there, including how much profit power is being penciled in a few years from now and what kind of earnings multiple that might support.

Result: Fair Value of $108.25 (OVERVALUED)

However, there are still pressure points, including potential distributor disintermediation and uneven demand recovery, that could challenge revenue, margins and the current valuation story.

Another view on Arrow’s valuation

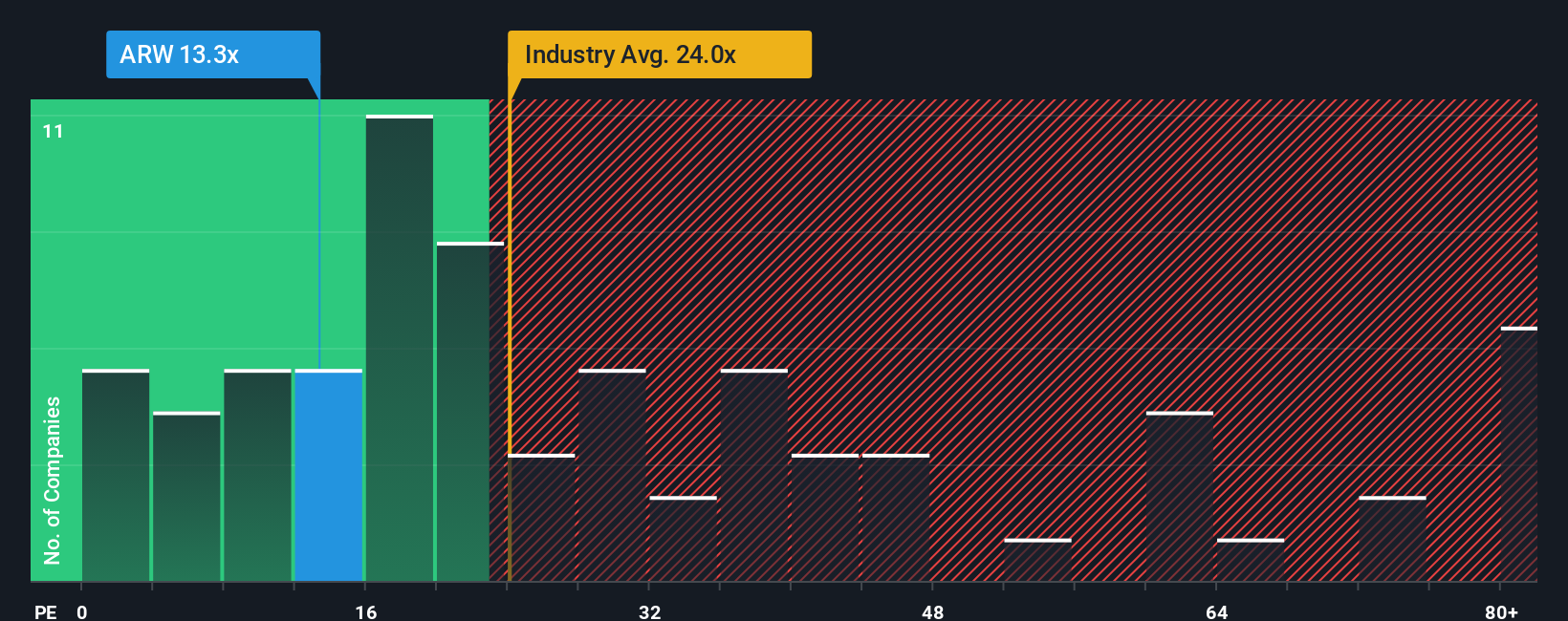

That narrative-based fair value of $108.25 paints Arrow as 23% overvalued, yet the current P/E of 14.4x looks quite different. It sits below peers at 18.9x and below a fair ratio of 17.7x. This points to less valuation risk than the headline discount suggests. Which signal appears more relevant?

Build Your Own Arrow Electronics Narrative

If you see Arrow’s story differently or prefer to test your own assumptions against the numbers, you can sketch out a complete narrative in minutes, starting with Do it your way.

A great starting point for your Arrow Electronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Arrow has your attention, do not stop here. You could miss other opportunities that fit your style even better. Use the Screener to widen your field of vision.

- Spot potential mispricings by scanning these 866 undervalued stocks based on cash flows that line up with your return expectations and risk tolerance.

- Ride major technology shifts by filtering for these 24 AI penny stocks shaping everything from automation to next generation software.

- Lock in potential portfolio income by tracking these 14 dividend stocks with yields > 3% that might suit your yield and payout preferences.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.