Please use a PC Browser to access Register-Tadawul

Assessing Artisan Partners (APAM) Valuation After Earnings Beat And Special Dividend Announcement

Artisan Partners Asset Management, Inc. Class A APAM | 41.60 | -0.55% |

Earnings beat and dividend announcement draw focus to Artisan Partners Asset Management

Artisan Partners Asset Management (APAM) is back on investor watchlists after reporting quarterly results ahead of analyst expectations, alongside a variable quarterly dividend and a special dividend tied to recent cash generation.

The company posted fourth quarter revenue of US$335.5 million and net income of US$94.8 million, compared with US$297 million and US$69.7 million a year earlier. Diluted earnings per share from continuing operations were US$1.32, up from US$0.97.

For the full year to December 31, 2025, revenue was US$1,196.7 million versus US$1,111.8 million in the prior year, while net income came in at US$290.3 million compared with US$259.7 million. Full year diluted earnings per share from continuing operations were US$4.05, up from US$3.66.

Alongside the earnings release, the board declared a total dividend of US$1.58 per Class A share, split between a variable quarterly dividend of US$1.01 and a special dividend of US$0.57. The variable component represents approximately 80% of cash generated in the December 2025 quarter and is scheduled for payment on February 27, 2026 to shareholders of record on February 13, 2026.

The company indicated that, subject to board approval each quarter, it currently expects to pay a quarterly dividend of approximately 80% of cash generated from operations. It also noted that, based on projections and subject to change, some portion of dividend payments may constitute a return of capital for tax purposes.

Artisan Partners’ share price has moved around recent news, with a 7.58% year to date share price return and a 1 day decline of 1.94% after the earnings and dividend announcement. Total shareholder return of 8.50% over the past year and 49.96% over three years suggests momentum has built over a longer period even if shorter term moves have been mixed.

If this mix of earnings beats and high cash distributions has your attention, it could be a good moment to widen your watchlist and check out fast growing stocks with high insider ownership.

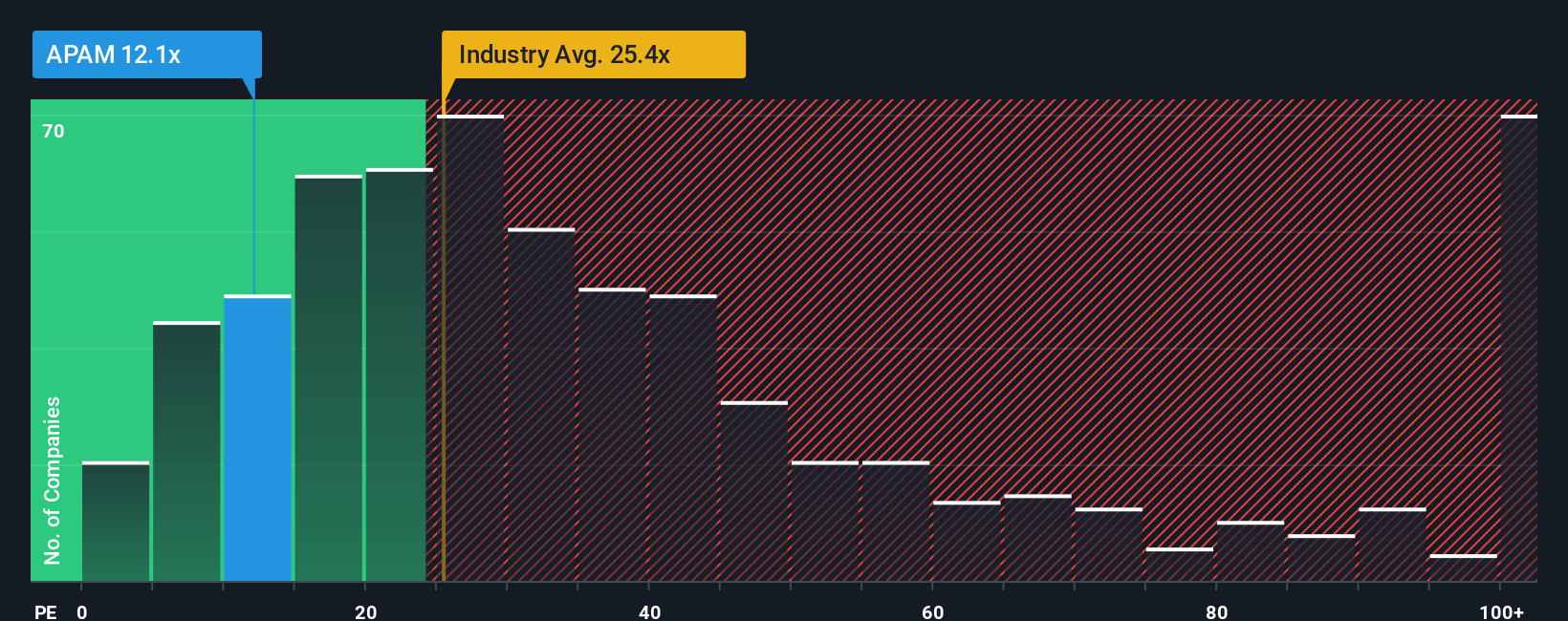

With earnings ahead of expectations, a rich dividend and a P/E that sits below the wider capital markets peer group, is Artisan Partners still trading at a discount, or has the market already priced in future growth?

Most Popular Narrative: 3% Overvalued

The most followed narrative puts Artisan Partners Asset Management’s fair value at US$43.25, slightly below the last close of US$44.55. This frames a relatively tight valuation gap.

The analysts have a consensus price target of $46.125 for Artisan Partners Asset Management based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $51.0, and the most bearish reporting a price target of just $41.5.

Want to see what sits behind that small valuation gap? The narrative leans on steady revenue build, firm margins and a future earnings multiple that needs to stretch only slightly further. Curious which of those inputs really carries the weight in the model, and how an 8% discount rate shapes the outcome over several years?

Result: Fair Value of $43.25 (OVERVALUED)

However, if new teams and products fail to gain traction, or if higher distribution and marketing spend erodes margins, that fair value view could quickly look outdated.

Another View: Multiples Point To Value Support

While the popular narrative sees Artisan Partners as about 3% overvalued on a fair value of $43.25, the current P/E of 12.9x tells a different story. It sits below peers at 14.5x, the US Capital Markets average at 23.8x, and even the fair ratio of 14.9x. This comparison suggests the market could move closer to these benchmarks. So is the crowd slightly ahead of itself, or is the multiple hinting at some remaining value support?

Build Your Own Artisan Partners Asset Management Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a personalised Artisan Partners view in minutes with Do it your way.

A great starting point for your Artisan Partners Asset Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Artisan Partners has sharpened your focus, do not stop here. The screener can quickly surface fresh ideas you might wish you had found earlier.

- Target potential mispricing by checking out these 867 undervalued stocks based on cash flows that may offer cash flow support for current prices.

- Spot emerging themes in healthcare by scanning these 108 healthcare AI stocks tying medical advances to data driven tools.

- Review these 19 cryptocurrency and blockchain stocks linked to blockchain, payments and related infrastructure within the digital assets space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.