Please use a PC Browser to access Register-Tadawul

Assessing Axcelis Technologies (ACLS) Valuation After The Purion H6 Product Launch

Axcelis Technologies, Inc. ACLS | 80.16 | -0.57% |

Purion H6 launch shifts focus to Axcelis Technologies stock

Axcelis Technologies (ACLS) has introduced its Purion H6 high current ion implanter, a new system aimed at next generation semiconductor manufacturing. This launch is putting fresh attention on how the product might influence the stock.

The Purion H6 announcement comes after a period of solid share price momentum, with a 1 day share price return of 4.43%, a 7 day return of 9.84% and a 90 day return of 17.41%. Over a longer horizon, Axcelis shows a 1 year total shareholder return of 54.85% and a 5 year total shareholder return of 137.86%. However, the 3 year total shareholder return decline of 22.46% suggests that sentiment around the story has shifted over time.

If this launch has you thinking about where the next semiconductor related opportunity might come from, it could be worth checking our screener of 34 AI infrastructure stocks as a starting list of ideas.

With the Purion H6 launch in the spotlight, the question now is whether Axcelis at around $94 is still trading below what its fundamentals and growth options might justify, or if the market is already pricing in future gains.

Most Popular Narrative: 4% Undervalued

At around $94.55, the most widely followed narrative pegs Axcelis Technologies' fair value at $98.50, leaving a small valuation gap that hinges on future cash flows.

Ongoing R&D investments and next-generation Purion platform enhancements are driving increased customer engagement, particularly around advanced node processes (trench and super junction devices), enabling Axcelis to win share in premium market segments and supporting future gross margin improvement.

Curious what sits behind that fair value? Revenue is expected to move in one direction, margins in another, and the final P/E assumption might surprise you.

Result: Fair Value of $98.50 (UNDERVALUED)

However, this depends on significant exposure to China and on the risk that slower adoption of advanced ion implantation could limit the earnings power implied in that fair value.

Another View: Cash Flows Paint A Tougher Picture

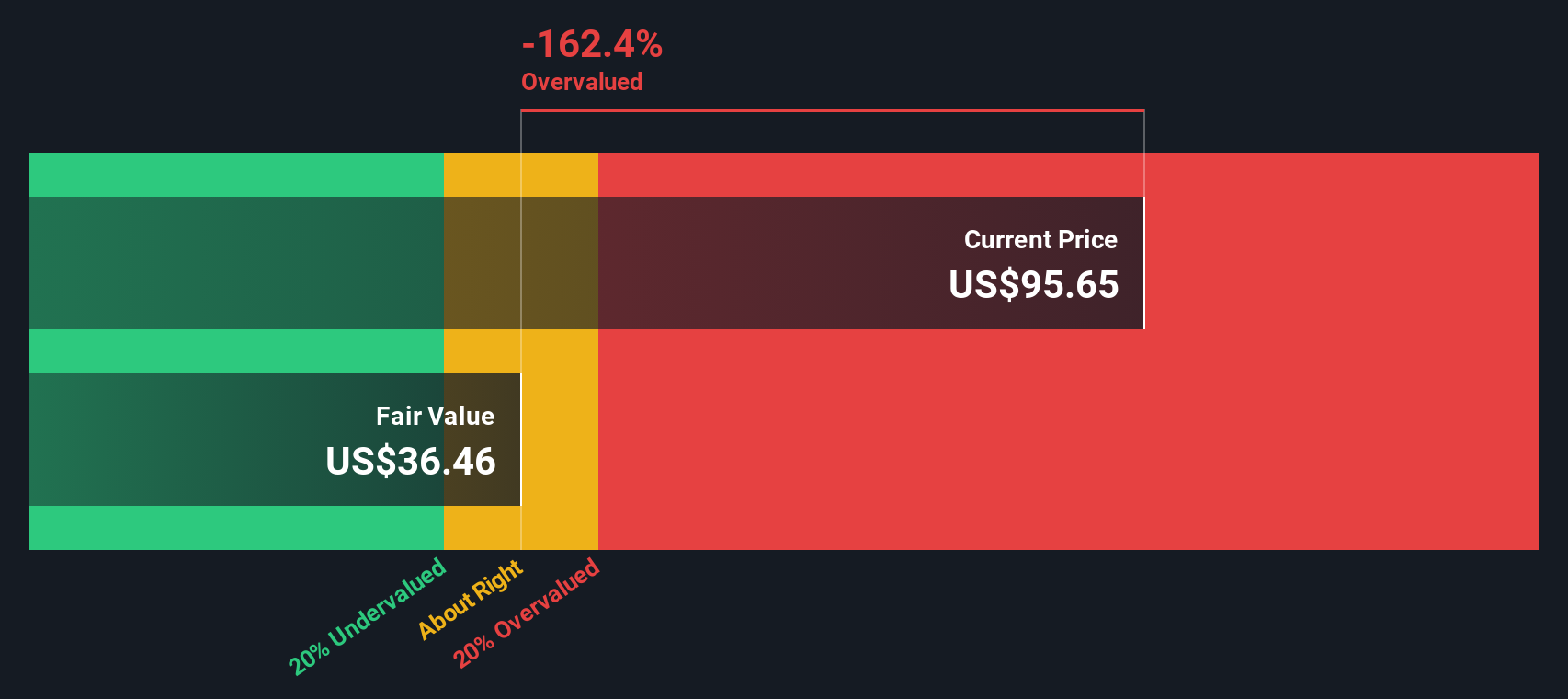

While the popular narrative sees Axcelis as around 4% undervalued at $98.50 fair value, our DCF model is far tougher. On that view, Axcelis at $94.55 trades well above an estimated future cash flow value of $35.67, so the gap cuts the other way. Which story do you think is closer to reality?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Axcelis Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Axcelis Technologies Narrative

If the numbers or story here do not quite match your view, you can pull up the same data, test your own assumptions, and Do it your way in just a few minutes.

A great starting point for your Axcelis Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Axcelis has sharpened your curiosity, do not stop here. The Screener can surface other opportunities that could fit your style before they move without you.

- Target stability first and shortlist companies through our 84 resilient stocks with low risk scores, which focuses on resilience when conditions change quickly.

- Hunt for potential bargains by scanning 53 high quality undervalued stocks, where quality businesses trade at valuations that may not match their fundamentals.

- Spot lesser known prospects by checking screener containing 23 high quality undiscovered gems to see which names other investors might not be watching yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.