Please use a PC Browser to access Register-Tadawul

Assessing Badger Meter (BMI) Valuation: Is There More Upside After Recent Share Price Drop?

Badger Meter, Inc. BMI | 184.80 | +1.33% |

Badger Meter’s share price has taken a sharp turn in recent months, dropping over 26% in the past quarter following a period of relative steadiness. Its long-term story remains impressive, as total shareholder return has climbed by 83% over three years and nearly 148% over five years. This signals that momentum may be pausing, but the big picture still looks robust for patient investors.

If you’re searching for the next standout, now’s a great moment to broaden your perspective and check out fast growing stocks with high insider ownership.

With the share price now trading at a sizable discount to analyst targets and earnings still growing, are investors overlooking a buying opportunity? Or is the market already pricing in Badger Meter’s future prospects?

Most Popular Narrative: 24% Undervalued

With Badger Meter’s analyst consensus fair value sitting notably above the last close price, attention turns to the growth and sector tailwinds driving this valuation. The narrative points to technology leadership and market trends as crucial ingredients shaping the outlook.

The increasing emphasis on water conservation and sustainable infrastructure is driving elevated demand from utilities for advanced metering and monitoring solutions. Badger Meter's continued success with its BEACON SaaS platform, BlueEdge suite, and recent SmartCover acquisition positions the company to capture a larger share of this growing market, supporting high single-digit revenue growth targets over the long run.

Curious what financial leap could justify such a big upside? One quantitative forecast is a real eye-opener. The narrative projects future profitability multiples reserved for elite market leaders. Want to see which bold earnings targets anchor this valuation? The full narrative reveals all.

Result: Fair Value of $237.43 (UNDERVALUED)

However, persistent supply chain pressures and project delays could still derail Badger Meter’s earnings momentum. This could challenge the bullish case in the near term.

Another View: What Do Valuation Ratios Say?

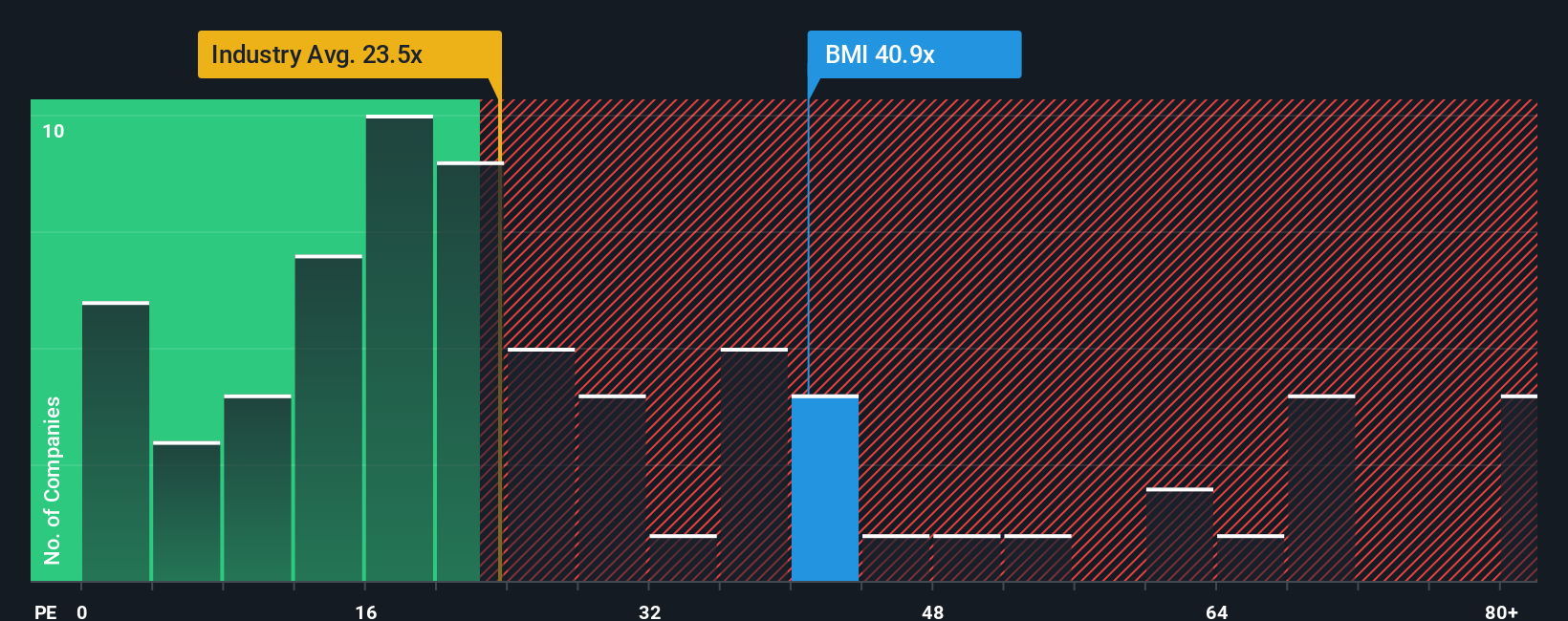

Looking at Badger Meter from a valuation ratio perspective presents a different story. The company trades at a price-to-earnings ratio of 39.1x, which is much higher than both the US Electronic industry average of 25.4x and its own fair ratio at 25.5x. This wide gap could signal caution for new investors, as it suggests the current price already reflects optimism. Could the stock’s premium be justified by future growth, or does it leave little margin for error?

Build Your Own Badger Meter Narrative

Feel like the story should head in another direction? Dive into the numbers and craft your own narrative in just a few quick minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Badger Meter.

Looking for More Investment Ideas?

Why let opportunity pass you by? Supercharge your strategy by targeting stocks poised for growth, innovation, or reliable income using these smart tools:

- Capitalize on rapid tech breakthroughs by tapping into these 24 AI penny stocks, which are shaping the AI-driven future from medicine to automation.

- Boost your income potential by browsing these 18 dividend stocks with yields > 3% with attractive yields above 3%, tailored for investors who value steady returns.

- Add cutting-edge exposure to your portfolio by selecting these 26 quantum computing stocks, unlocking tomorrow's advancements in quantum computing today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.