Please use a PC Browser to access Register-Tadawul

Assessing Banc Of California (BANC) Valuation As Q4 Earnings Arrival Nears

Banc of California, Inc. BANC | 20.07 | +1.31% |

What Banc of California’s upcoming earnings mean for shareholders

Banc of California (BANC) reports its Q4 2025 results after the market closes today, and this earnings release is in focus after recent quarters where the bank outpaced revenue and earnings expectations.

Analysts are looking for Q4 revenue growth of 9.2% year on year and adjusted earnings of $0.37 per share, so tonight’s update will show how the bank is tracking against those expectations.

At a share price of $20.22, Banc of California has had a 19.79% 90 day share price return and a 27.46% 1 year total shareholder return. This points to positive momentum heading into tonight’s results despite some recent day to day softness.

If earnings are on your radar this week, it can be useful to see what is happening elsewhere in financials too, including fast growing stocks with high insider ownership as a way to spot other ideas with strong owner alignment.

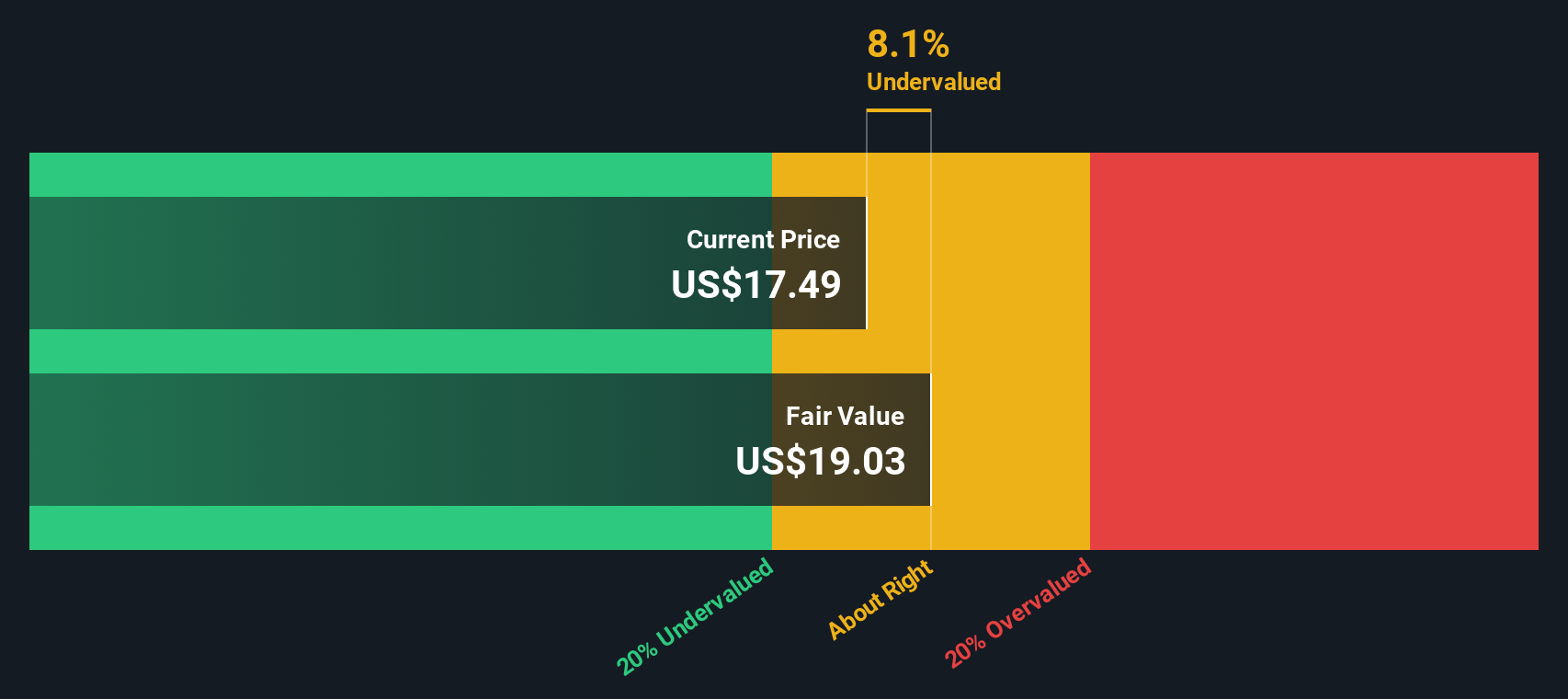

With shares up 27.46% over the past year and trading about 10% below the average analyst price target, the key question now is whether Banc of California is still undervalued or if the market is already pricing in future growth.

Price-to-Earnings of 18.6x: Is it justified?

On our numbers, Banc of California trades on a P/E of 18.6x at a last close of $20.22, while our DCF model points to a fair value of $28.14 and a discount of about 28% to that estimate.

The P/E ratio compares the current share price to earnings per share, so it reflects how much you are paying for each dollar of current earnings. For banks, this often captures how the market is pricing earnings power, business mix and perceived risk compared with other lenders.

For BANC, the 18.6x P/E sits above the US Banks industry average of 11.9x and above the peer average of 13.7x. This suggests the market is putting a higher price on its earnings than on many other banks. It is also above the SWS estimated fair P/E of 17.4x, a level the market could move towards if sentiment or earnings expectations change.

Result: Price-to-Earnings of 18.6x (OVERVALUED)

However, there is still the risk that current expectations prove too optimistic if earnings growth slows or if Banc of California’s higher P/E ratio attracts profit taking.

Another view using our DCF model

The P/E of 18.6x presents BANC as expensive relative to banks and peers, but our DCF model suggests a different interpretation. On that view, the fair value sits at US$28.14 per share, which puts the current US$20.22 price at roughly a 28% discount.

This gap between an expensive P/E and a discounted DCF raises a simple question for you: are earnings multiples too high, or is the cash flow view too optimistic about Banc of California’s future?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Banc of California for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Banc of California Narrative

If you see the numbers differently or want to test your own view against the data, you can build a full narrative in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Banc of California.

Ready to hunt for more ideas?

If Banc of California is on your watchlist, it may be a good time to broaden your scope and line up a few more candidates worth tracking closely.

- Target potential mispricings by scanning these 874 undervalued stocks based on cash flows that may offer more attractive entry points based on their cash flow profiles.

- Tap into thematic growth by reviewing these 23 AI penny stocks that are linked to artificial intelligence adoption across different parts of the economy.

- Consider a different source of potential income by looking at these 13 dividend stocks with yields > 3% that meet a yield threshold of more than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.