Please use a PC Browser to access Register-Tadawul

Assessing Bank of New York Mellon Corporation (BK) Valuation After New FOMO Pay Cross-Border Payments Deal

Bank of New York Mellon Corp BK | 117.74 | +2.46% |

Bank of New York Mellon Corporation (BK) stock is back in focus after BNY and FOMO Pay agreed to use BNY’s Virtual Reference Number solution to support same-day settlement of eligible USD cross-border payments.

BNY’s push into faster cross-border payments with FOMO Pay comes on top of fresh marketing and client initiatives, including a new Formula 1 partnership and recent leadership changes. It also coincides with a 90-day share price return of 11.75% and a 5-year total shareholder return of 241.41%, indicating that momentum has been building over both the short and long run.

If this kind of payment and infrastructure theme interests you, it could be worth broadening your search with our screener of 24 power grid technology and infrastructure stocks as another way to find potential opportunities linked to global financial plumbing and transaction rails.

With Bank of New York Mellon Corporation shares up 49.28% over the past year and trading at $124.32 against an average analyst target of $132.60, the key question now is whether there is still an opportunity for investors or whether the market is already fully reflecting expectations for the company.

Most Popular Narrative: 6.2% Undervalued

With Bank of New York Mellon Corporation shares at $124.32 against a narrative fair value of $132.60, the current price sits below that long term estimate and puts more attention on how its digital payments and assets story could play out.

Leadership in digital assets and stablecoin custody (with early wins such as Societe Generale and Ripple) positions the firm to capture emerging fee pools as institutional adoption of blockchain, tokenized assets, and digital solutions accelerates, supporting future revenue growth and diversification.

The fair value call rests on a specific mix of projected revenue growth, margin expansion and a future earnings multiple that sits below many peers. Curious which assumptions really move that $132.60 figure and how much earnings power the narrative is baking in over the next few years?

Result: Fair Value of $132.60 (UNDERVALUED)

However, you still need to weigh up risks such as fee pressure from passive investing and the possibility that early stage efficiency gains take longer to materialise.

Another Angle on Valuation

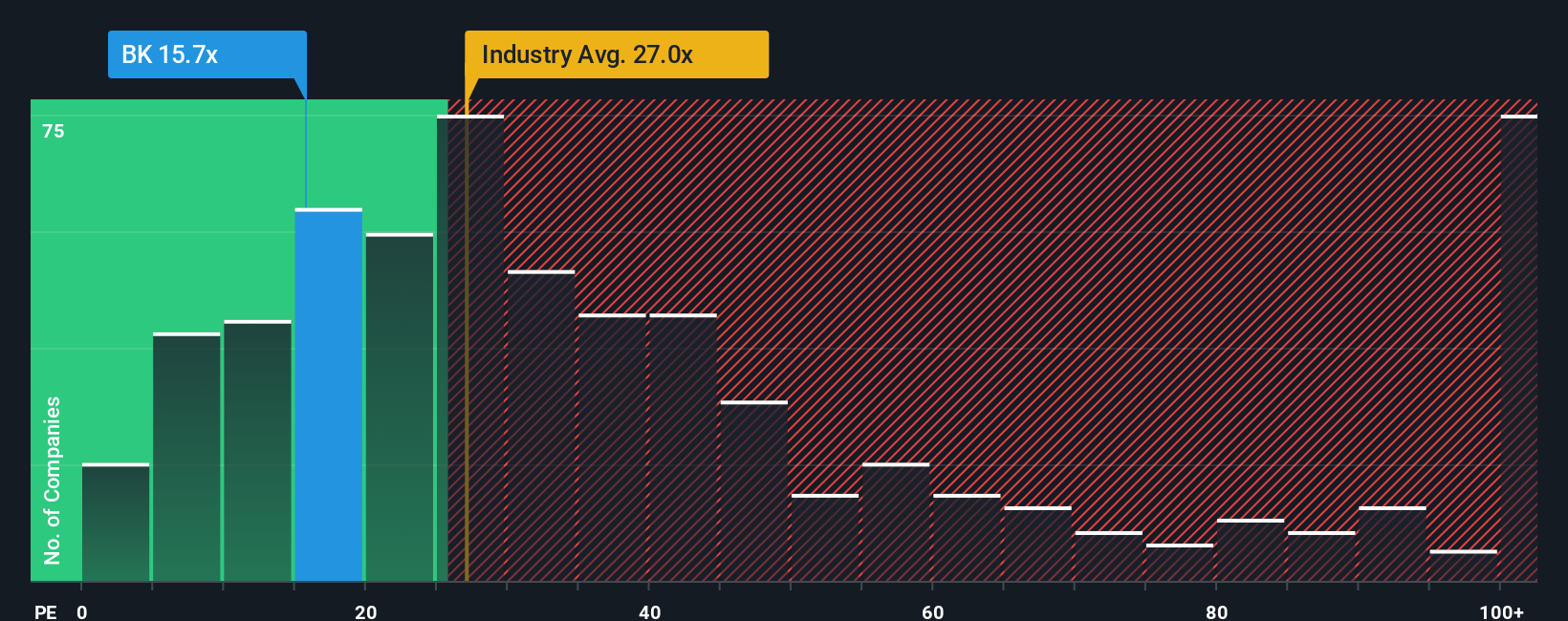

That 6.2% undervalued narrative is one lens. On plain earnings, BNY trades on a P/E of 16.1x, which sits below both its peer average of 29.5x and a fair ratio of 16.8x that the market could gravitate toward. This raises the question of whether sentiment is still catching up.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of New York Mellon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of New York Mellon Narrative

If you see the numbers differently or prefer to lean on your own research, you can shape a personalised view of Bank of New York Mellon Corporation in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Bank of New York Mellon.

Looking for more investment ideas?

Before you move on, give yourself a wider view of the market. A few minutes with the right stock lists now could save you a lot of second guessing later.

- Target quality at a discount by scanning our 52 high quality undervalued stocks that combine solid fundamentals with prices the market may not be fully appreciating.

- Strengthen your focus on resilience through a solid balance sheet and fundamentals stocks screener (45 results) that can help you spot companies with room to handle tougher conditions.

- Get ahead of the crowd by checking a screener containing 24 high quality undiscovered gems that most investors may not be watching yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.