Please use a PC Browser to access Register-Tadawul

Assessing Boston Properties (BXP) Valuation After Mixed Recent Share Price Performance

BXP Inc BXP | 60.88 | -2.15% |

BXP (BXP) has been drawing attention after recent share price moves, with the stock showing a 4.1% gain over the past day but negative returns over the past week, month, and past 3 months.

That one day 4.1% share price gain stands against weaker recent momentum, with a 30 day share price return decline of 7.35% and a year to date share price return decline of 9.33%. The 1 year total shareholder return decline of 8.94% contrasts with a modest 3 year total shareholder return gain of 3.77%.

If this move in BXP has you rethinking where you look for opportunities, it could be worth scanning our list of 23 top founder-led companies as a fresh starting point.

So with BXP trading at a discount to both its analyst price target and an estimated intrinsic value, yet showing mixed recent returns, are you looking at an undervalued REIT or a stock where the market already prices in expectations for future growth?

Most Popular Narrative: 19.6% Undervalued

With BXP last closing at $61.49 against a narrative fair value of $76.50, the current pricing gap raises clear questions about how future cash flows are being framed.

BXP's aggressive capital recycling and asset sales strategy (targeting $600 million in non-core dispositions), along with redevelopment and adaptive reuse of assets for mixed-use and multifamily, is expected to unlock higher-yielding income streams, fortify net margins, and provide non-dilutive funding for growth, supporting future FFO and earnings resilience.

For readers curious about the revenue pacing and margin rebuild that sit behind that fair value, and the time horizon the narrative uses for BXP to reach those targets, the full story connects those dots.

Result: Fair Value of $76.50 (UNDERVALUED)

However, that story can break if occupancy remains under pressure, or if large projects like 343 Madison strain funding and keep earnings and cash flow below expectations.

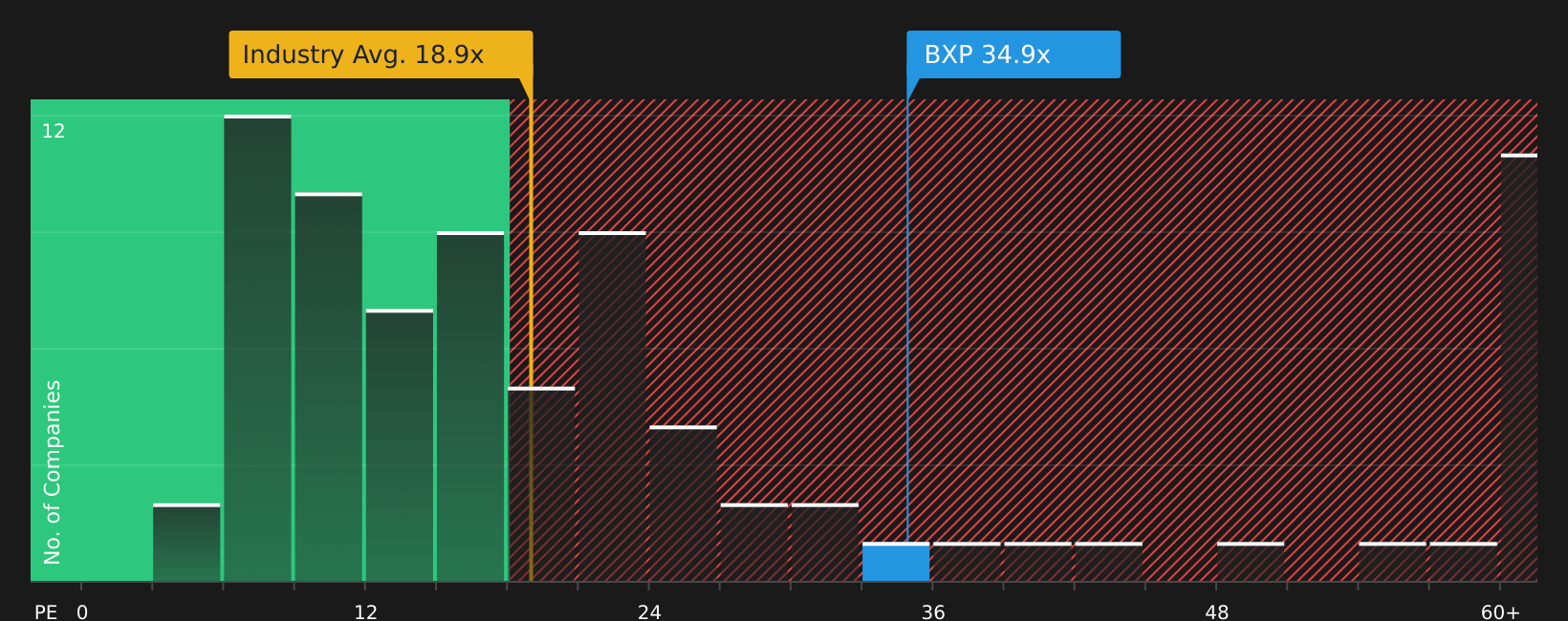

Another View: What The P/E Ratio Is Saying

That 19.6% “undervalued” narrative sits alongside a very different signal from the P/E. BXP trades on a P/E of 35.2x, above the peer average of 34.2x and well above the global Office REITs average of 21.1x, even though its fair ratio is 36.4x. So is this a genuine discount? Or is execution risk already stretching what you are paying for earnings today?

Build Your Own BXP Narrative

If you are not fully sold on this view or prefer to rely on your own research, you can build a custom thesis in minutes: Do it your way.

A great starting point for your BXP research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one stock. Use the screeners below to uncover opportunities other investors might miss.

- Target potential value by reviewing companies our tool flags as 53 high quality undervalued stocks, and see which ones deserve a closer look on your watchlist.

- Prioritise resilience by checking out 85 resilient stocks with low risk scores, a set of companies that score well on our risk filters and may help steady your portfolio.

- Get curious about future standouts with our screener containing 23 high quality undiscovered gems, where lesser known names with solid fundamentals could offer fresh ideas.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.