Please use a PC Browser to access Register-Tadawul

Assessing BrightSpring Health Services (BTSG) Valuation After Fresh Bullish Analyst Interest

BrightSpring Health Services, Inc. BTSG | 40.60 | +3.39% |

What the fresh analyst interest signals for BrightSpring Health Services (BTSG)

Recent research updates from TD Cowen and a cluster of buy ratings have pushed BrightSpring Health Services (BTSG) further onto investors’ radar, with bullish sentiment and zero negative recommendations shaping the current conversation.

At a share price of $39.83, BrightSpring’s recent 30-day share price return of 5.82% and 90-day share price return of 20.51% sit alongside a 1-year total shareholder return of 64.32%. This points to building momentum around the stock as positive research updates keep attention on the name.

If this kind of interest in healthcare services has caught your eye, it may be a good moment to broaden your radar with healthcare stocks as potential next ideas.

With the shares at $39.83 and sitting about 11% below the average analyst target of $44.13, plus a flagged intrinsic discount of around 72%, you have to ask: is there real value left here, or is the market already baking in future growth?

Most Popular Narrative: 5% Undervalued

BrightSpring Health Services has a narrative fair value of $41.93 against a last close of $39.83, so the story prices in a modest upside built on future cash flows.

The analysts have a consensus price target of $28.708 for BrightSpring Health Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $25.0.

Want to see why the fair value sits above the consensus target? The narrative leans on higher growth, fatter margins, and a richer earnings multiple than many would expect.

Result: Fair Value of $41.93 (UNDERVALUED)

However, the fair value story only holds if BrightSpring manages staffing costs effectively and avoids pressure from government reimbursement changes that could squeeze margins and earnings.

Another angle on valuation

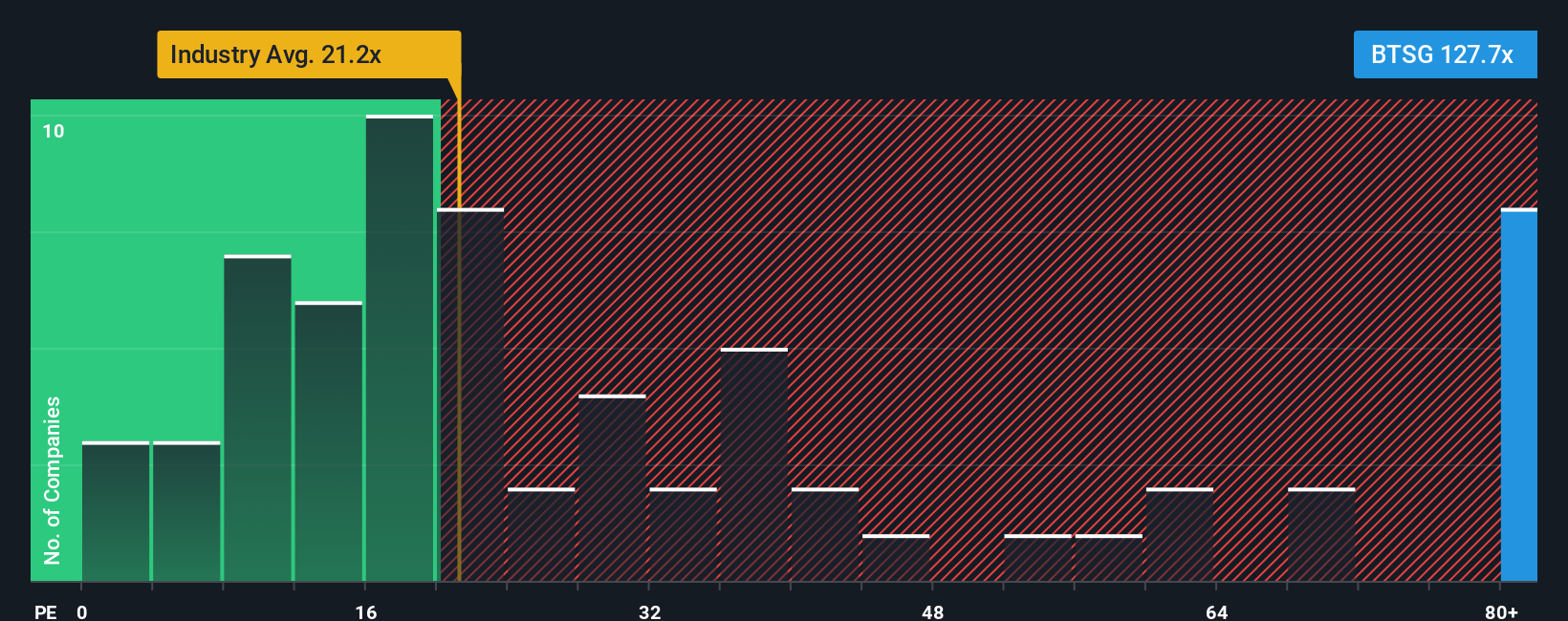

That 5% narrative undervaluation sits awkwardly against the current P/E of 74.6x. This is far above both the US Healthcare industry at 22x and peers at 27x, and is more than double the fair ratio of 33.1x. Is the premium signaling confidence, or stretching the risk/reward?

Build Your Own BrightSpring Health Services Narrative

If you see the numbers differently or just want to test your own assumptions, you can create a personalized BrightSpring story in minutes with Do it your way.

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at one stock, you risk missing better fits for your goals, so keep going and let the data help you spot your next opportunity.

- Spot potential value with these 865 undervalued stocks based on cash flows that line up with strong cash flow profiles and pricing that may not fully reflect them yet.

- Tap into fast moving themes around machine learning and automation by scanning these 23 AI penny stocks that are building real businesses on top of these technologies.

- Add a different angle to your watchlist by checking out these 18 cryptocurrency and blockchain stocks that sit at the intersection of equity markets and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.