Please use a PC Browser to access Register-Tadawul

Assessing CarGurus Value After Momentum Shift and Digital Acquisition Buzz

CarGurus, Inc. Class A CARG | 28.24 | -0.95% |

- Wondering if CarGurus is undervalued or sitting at the right price? This article will help you cut through the market noise and get to the real story behind the stock’s valuation.

- Over the last three years, CarGurus has shown major momentum with a 162.7% gain. However, over the past 12 months, the price dipped slightly, slipping -1.2%, and held nearly flat over the past month.

- Recently, acquisitions in the automotive space and an increased focus on digital transactions have generated fresh buzz around CarGurus. These trends have been making waves in industry news, fueling speculation that the company’s business model could catch a second wind or face new risks.

- On our valuation checks, CarGurus earns a 2 out of 6 score. This suggests the market may have already priced in a lot of the optimism. Next, we’ll look at what goes into this score and why there might be an even smarter way to approach valuation than the usual comparisons.

CarGurus scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

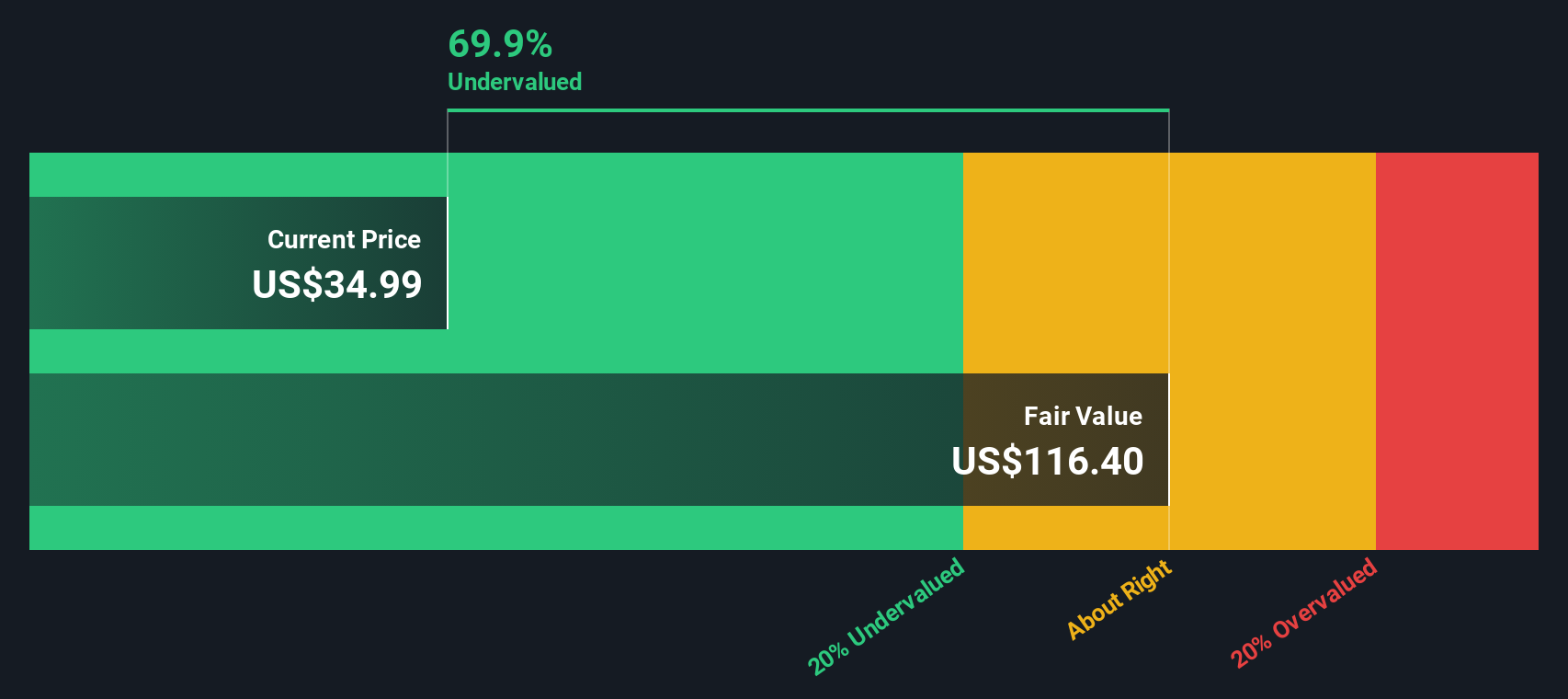

Approach 1: CarGurus Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those numbers back to today. This way, investors can get a clearer picture of what a business is truly worth based on what it may earn in the years ahead, rather than just current earnings.

For CarGurus, the most recent Free Cash Flow reported was $233.97 million. Analysts forecast steady growth, projecting that Free Cash Flow could reach $576.2 million by 2029, with estimates for the years in between provided by a mix of analyst consensus and careful extrapolation. After 2029, cash flow numbers continue to increase, thanks to Simply Wall St's extrapolated estimates. All figures remain denominated in $USD.

Running these projections through the DCF process yields a fair value estimate for CarGurus of $144.15 per share. Based on the model, this is roughly 75.7% higher than the current market price, which signals significant potential upside. In short, the model suggests CarGurus is deeply undervalued relative to its long-term prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CarGurus is undervalued by 75.7%. Track this in your watchlist or portfolio, or discover 899 more undervalued stocks based on cash flows.

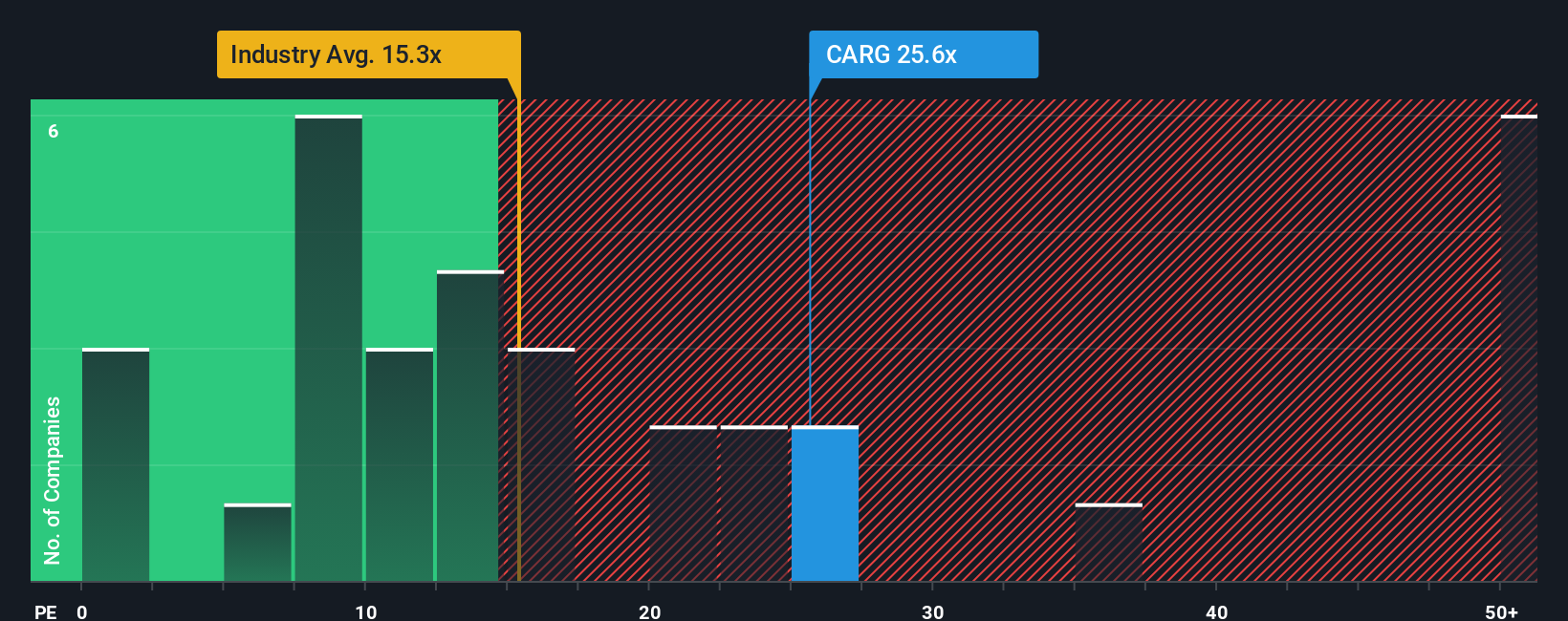

Approach 2: CarGurus Price vs Earnings

For established, profitable companies like CarGurus, the Price-to-Earnings (PE) ratio is one of the most widely used ways to gauge whether a stock is attractively valued. The PE ratio helps investors compare the market price of a stock to its recent earnings, providing insights into how much the market is willing to pay for each dollar of profit.

What is considered a “normal” or “fair” PE ratio varies by sector and company. High-growth companies often justify higher multiples, while businesses facing heightened risks or slowing earnings generally trade at lower ones. Risk appetite and growth expectations both play a big role in setting the bar for what counts as reasonable.

As of now, CarGurus trades at a PE ratio of 22x, which stands notably above its industry average of 16.6x and its peer group average of 12.7x. On the surface, this might suggest the stock is a bit expensive compared to its direct competition.

However, using Simply Wall St’s proprietary “Fair Ratio” takes the comparison a step further. This metric is not just a basic average; it factors in CarGurus' unique growth forecasts, profit margins, business risks, industry specifics, and even the company’s size in the market. For CarGurus, the Fair Ratio comes in at 21.9x, almost exactly in line with the company’s current valuation.

This close match between CarGurus’ 22x PE and its 21.9x Fair Ratio suggests the market’s pricing is spot on, balancing growth expectations and risk appropriately for today’s environment.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1418 companies where insiders are betting big on explosive growth.

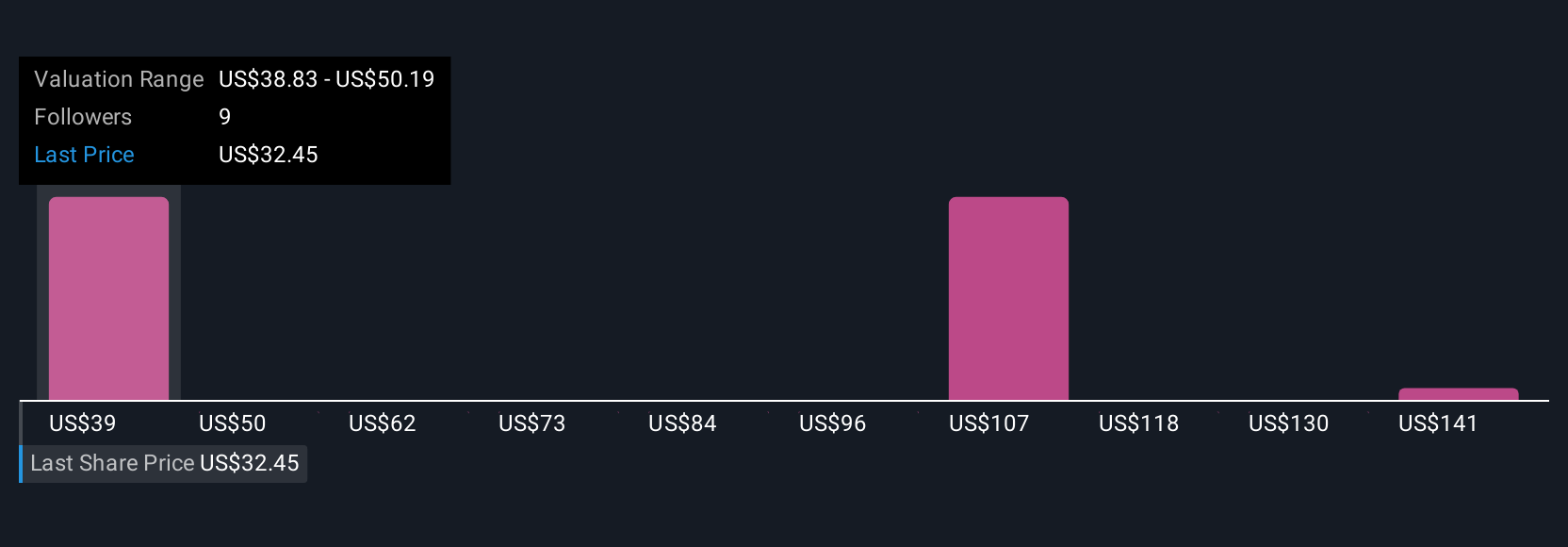

Upgrade Your Decision Making: Choose your CarGurus Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your story behind the numbers. It’s the perspective and assumptions you have about a company’s future, such as its fair value, estimates for revenue, profit margins, and growth rates, all linked into a single, clear investment thesis.

Narratives connect a company’s story to a forward-looking financial forecast and tie it directly to a fair value estimate. On Simply Wall St, millions of investors use Narratives within the Community page, making this approach not only powerful but also highly accessible.

By building a Narrative, you clarify what you believe will drive value for CarGurus, and you can easily compare your resulting Fair Value to the current share price. This process makes it simpler to decide when to buy or sell.

Narratives dynamically update as new information, like earnings reports or industry news, is released, ensuring your thesis always reflects the latest developments.

For CarGurus, one investor’s Narrative might factor in robust growth from international expansion and forecast a fair value above $44, while another, more cautious Narrative might see execution risk and assign a fair value closer to $33. This demonstrates how Narratives help you see the range of reasoned perspectives driving the stock price.

Do you think there's more to the story for CarGurus? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.