Please use a PC Browser to access Register-Tadawul

Assessing Carpenter Technology (CRS) Valuation After Fitch Upgrade And US$700 Million Notes Offering

Carpenter Technology Corporation CRS | 389.73 | +1.50% |

Carpenter Technology (CRS) is back on investors’ radar after Fitch Ratings upgraded its Long-Term Issuer Default Rating and the company closed a $700 million senior notes offering at 5.625%, maturing in 2034.

Those credit and funding moves arrive alongside meaningful price momentum, with a 40.81% 3 month share price return and a very large 3 year total shareholder return, suggesting investors are reassessing growth prospects and risk for this specialty metals name.

If Carpenter Technology has caught your eye and you want to see what else is moving in similar areas, it could be worth scanning aerospace and defense stocks next.

With CRS up 40.81% in three months and analysts still seeing upside to a US$382.37 price target, the real question now is whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative: 12.3% Undervalued

Carpenter Technology's most followed valuation narrative places fair value at US$382.37 per share, compared with the last close of US$335.44. This frames the current debate around how much growth the market is already factoring in.

The brownfield expansion project is set to add high-purity melt capacity, allowing Carpenter to further leverage the industry supply-demand imbalance over the medium to long term. This will support higher volumes and sustained pricing power, translating into increased revenue and operating income beginning FY28.

Want to understand why this model still sees upside after a strong share price run, and how revenue growth, rising margins and a premium future P/E all fit together? The projected earnings path and valuation multiple tell a very specific story about what needs to go right.

Result: Fair Value of $382.37 (UNDERVALUED)

However, you still need to weigh risks such as heavy exposure to cyclical aerospace and defense demand, as well as the execution and payback of the US$400 million brownfield expansion.

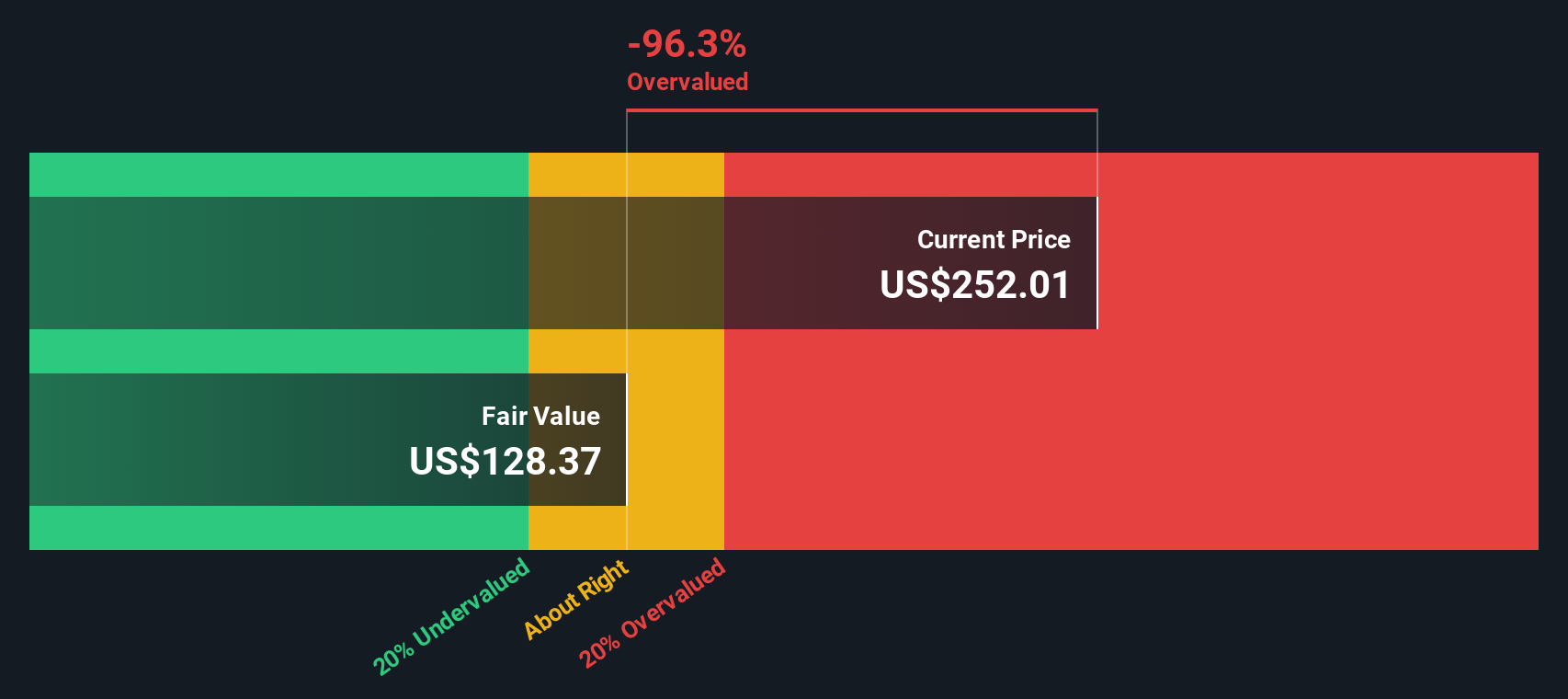

Another Angle: SWS DCF Flags Overvaluation

While the popular narrative sees Carpenter Technology as 12.3% undervalued, the SWS DCF model comes to a very different conclusion. On that view, CRS at US$335.44 screens as expensive relative to an estimated fair value of US$134.68, which puts a lot more pressure on future execution.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Carpenter Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 871 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Carpenter Technology Narrative

If you look at the numbers and reach a different conclusion, or just prefer your own work, you can build a custom view in minutes: Do it your way.

A great starting point for your Carpenter Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If CRS has you thinking bigger about your portfolio, do not stop here. Use the Screener to surface other names that might better suit your goals.

- Spot potential value candidates early by checking out these 871 undervalued stocks based on cash flows that currently screen as attractive based on their cash flow profiles.

- Ride the AI trend more deliberately by reviewing these 24 AI penny stocks with business models tied directly to artificial intelligence themes.

- Strengthen your income stream by scanning these 12 dividend stocks with yields > 3% that offer yields above 3% and may complement growth oriented positions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.