Please use a PC Browser to access Register-Tadawul

Assessing Carvana (CVNA) Valuation After Strong Q3 2025 Results And Confident Growth Guidance

Carvana Co. Class A CVNA | 336.62 | +1.15% |

Carvana (CVNA) is back in focus after reporting a strong Q3 2025, with higher retail units sold, revenue growth, and record operating income. This performance has led management to offer confident guidance for Q4.

The Q3 update and the recent expansion of same day delivery into the Eugene area come against a backdrop of a volatile share price, with a 25.25% 90 day share price return but a 12.83% decline over 30 days, while total shareholder return over the past year is 52.86% and the 3 year figure is very large, all off a latest share price of $403.67.

If Carvana’s swings have caught your eye, this could be a good moment to see what else is moving in e commerce and logistics by checking our 22 top founder-led companies.

With Q3 profitability, a US$403.67 share price and only a modest 3.8% intrinsic discount indicated, is Carvana still undervalued, or are markets already pricing in everything investors expect from future growth?

Most Popular Narrative: 16.1% Undervalued

Carvana’s widely followed narrative pegs fair value at about $481 per share, above the recent $403.67 price, which puts a spotlight on what is driving that gap.

The acceleration in consumer preference for purchasing vehicles online and increased comfort with high-value e-commerce transactions positions Carvana to capture a larger share of the used vehicle retail market, supporting outsized long-term unit and revenue growth.

Ongoing advancements in Carvana's data-driven technology, including integration of AI for operational efficiency and customer-facing processes, enable continual process improvement, reducing per-unit costs and fueling net margin expansion.

Curious how this story translates into that higher fair value line? Revenue growth, margin expansion and a rich future earnings multiple all sit at the core. Want the full blueprint driving those assumptions and the tension between growth and execution risk? Read the complete narrative to see what underpins that $481 figure.

Result: Fair Value of $481.27 (UNDERVALUED)

However, there is still clear execution risk, ranging from ambitious unit growth targets and logistics scaling to competition from online auto channels that could pressure margins and volumes if expectations slip.

Another View: Rich Earnings Multiple Raises the Bar

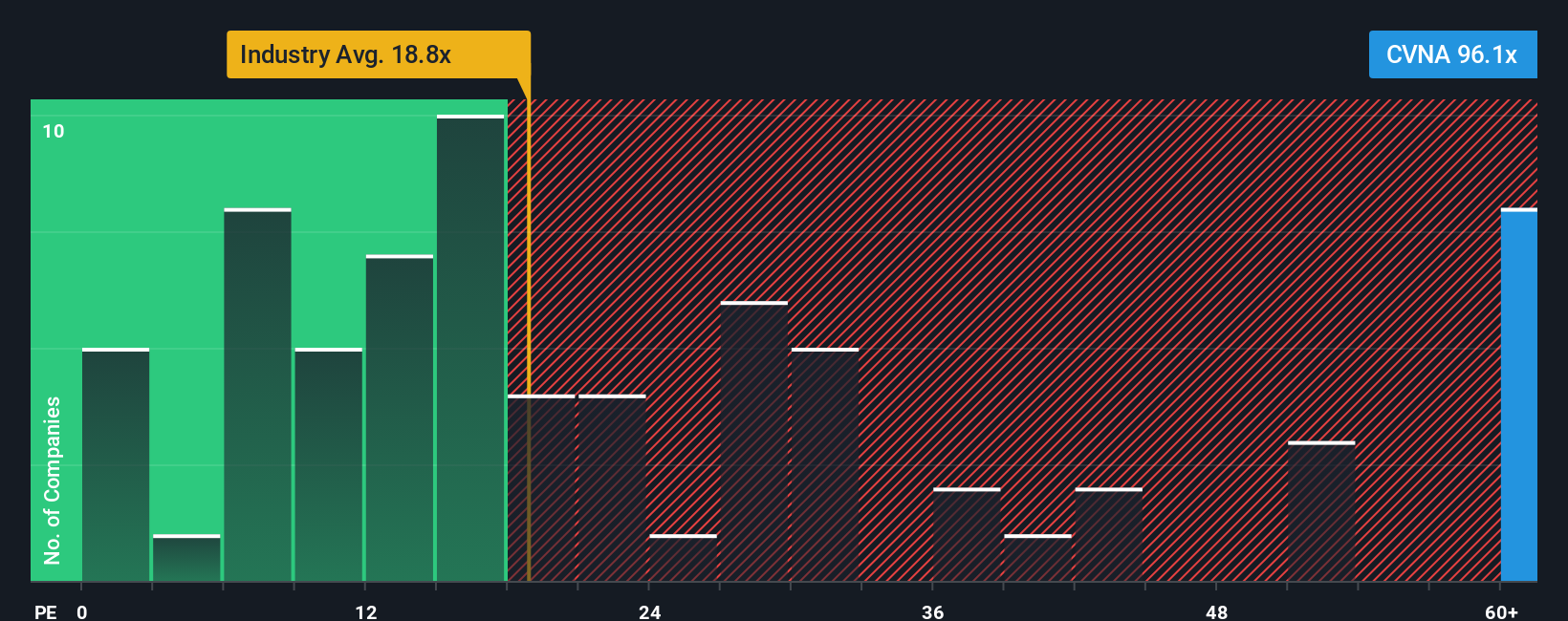

While the narrative and our SWS DCF model both point to Carvana trading about 3.8% below an estimated fair value, the picture looks very different when you look at the current P/E of 90.8x. The US Specialty Retail industry sits at 21.5x, peers sit at 19.2x, and the fair ratio model suggests 37.2x is a level the market could move towards. That kind of gap can leave less room for error if growth or margins fall short, so which signal do you think deserves more weight?

Build Your Own Carvana Narrative

If you see the numbers differently or prefer to stress test every assumption yourself, you can spin up a fresh Carvana story in just a few minutes, then Do it your way

A great starting point for your Carvana research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Carvana has sharpened your thinking, do not stop here. You will miss plenty of opportunities if you ignore what else the broader market is offering right now.

- Spot potential value opportunities early by scanning our list of 52 high quality undervalued stocks that pair quality fundamentals with attractive pricing signals.

- Prioritise resilience by focusing on companies in the solid balance sheet and fundamentals stocks screener (45 results) that may be better placed to handle financial stress.

- Hunt for future standouts by checking the screener containing 24 high quality undiscovered gems that most investors may not be watching yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.