Please use a PC Browser to access Register-Tadawul

Assessing CRISPR Therapeutics (CRSP) Valuation After Recent Short Term Share Price Momentum

CRISPR Therapeutics AG CRSP | 53.46 | -2.16% |

CRISPR Therapeutics stock snapshot

CRISPR Therapeutics (CRSP) has drawn attention after recent trading moves, with the stock closing at US$53.07 and showing mixed returns over the past year, including a 1 day gain of 8.5% and a 1 year total return of 6.7%.

That sharp 8.5% 1 day share price return and 6.8% 7 day share price return sit against a relatively flat 30 and 90 day share price performance. Longer term total shareholder returns mix a 6.7% 1 year gain with weaker 5 year results, suggesting momentum has been more short term than sustained.

If CRISPR Therapeutics has you thinking about the wider opportunity in gene editing and AI powered research tools, it could be a good moment to scan 25 healthcare AI stocks as a starting list of related names to review.

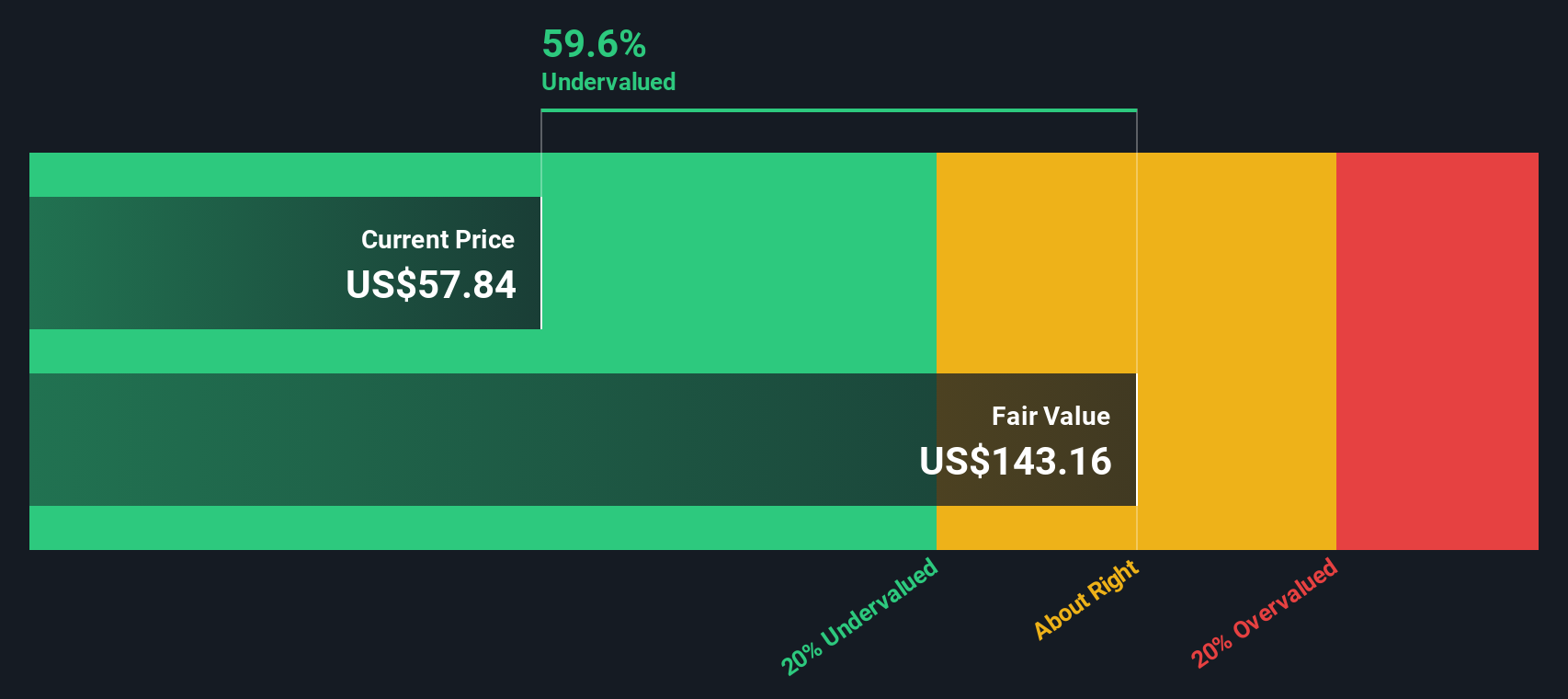

With CRISPR Therapeutics trading around US$53.07 and indicators like intrinsic estimates and analyst targets suggesting a gap, the question is simple: is there genuine undervaluation here, or is the market already pricing in future growth?

Price to book of 2.7x: Is it justified?

On one hand, CRISPR Therapeutics is flagged as trading at good value versus a peer group average P/B of 15x. On the other hand, it sits slightly above the broader US biotech industry at 2.7x versus 2.6x. That split picture is what makes the current US$53.07 share price interesting if you are comparing it with other gene editing or early stage biotech names.

P/B looks at the share price relative to the company’s net assets on the balance sheet, which is often a reference point for businesses that are not yet profitable. For CRISPR Therapeutics, a 2.7x P/B that is well below peers but fractionally higher than the wider industry suggests the market is assigning some premium to its specific pipeline and platform, but not to the same extent as certain comparables.

Against companies with an average P/B of 15x, CRISPR Therapeutics screens as far cheaper on this yardstick, which could appeal if you are focused on asset backed valuation metrics rather than earnings. However, compared with the US biotech industry average of 2.6x, that slight premium hints that investors may already be factoring in some expectations around its CRISPR/Cas9 programs and partnerships.

Result: Price to book ratio of 2.7x (ABOUT RIGHT)

However, there are clear risks too, including ongoing net losses of US$581.599 million and heavy reliance on successful outcomes from a concentrated set of pipeline programs.

Another angle on value

Our DCF model presents a very different picture. At a share price of $53.07, CRISPR Therapeutics is described as trading 72.5% below an estimated future cash flow value of $193.05. A gap of that size can either indicate a potential valuation opportunity or suggest that the cash flow assumptions are overly optimistic, so which side do you think it sits on?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CRISPR Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 54 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CRISPR Therapeutics Narrative

If you see the story differently or simply prefer working from your own numbers, you can pull the data together and shape your view in just a few minutes, then Do it your way.

A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If CRISPR Therapeutics is on your radar, do not stop there. Broaden your watchlist with curated stock ideas that match the way you like to invest.

- Target quality at a discount by reviewing 54 high quality undervalued stocks that pair solid fundamentals with prices that may not fully reflect their strengths.

- Prioritise resilience by checking 83 resilient stocks with low risk scores designed to highlight companies with lower overall risk profiles.

- Hunt for potential future standouts with our screener containing 24 high quality undiscovered gems where strong fundamentals have not yet attracted widespread attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.