Please use a PC Browser to access Register-Tadawul

Assessing Custom Truck One Source (CTOS) Valuation After Recent Share Price Momentum

Custom Truck One Source Inc CTOS | 6.67 | +5.46% |

Event overview and recent share performance

Custom Truck One Source (CTOS) has been drawing attention after recent share price moves, with the stock last closing at $6.40 and posting positive returns over the past week, month, and past 3 months.

Looking beyond the recent uptick, Custom Truck One Source has a year to date share price return of 10.34%, while the 1 year total shareholder return of 25.98% contrasts with a 3 year total shareholder return decline of 9.60% and a 5 year total shareholder return decline of 19.80%. This suggests momentum has picked up more recently even though longer term holders have experienced weaker results.

If this kind of move has your attention, it could be a moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Custom Truck One Source posting double digit returns over 1 year yet still trading at $6.40, the key question is whether recent momentum leaves upside on the table or if the market is already pricing in future growth.

Most Popular Narrative: 1.5% Undervalued

At a last close of $6.40 against a widely followed fair value of $6.50, the current pricing sits very close to that narrative estimate while still reflecting a small discount.

The assumed bearish price target for Custom Truck One Source is $5.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Custom Truck One Source's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

Want to see how a small gap between fair value and price is justified by the narrative? Revenue, margins and a punchy future earnings multiple all sit at the core of this story. Curious how those moving parts add up to that fair value.

Result: Fair Value of $6.50 (UNDERVALUED)

However, there are still a couple of watchpoints, including pressure from tighter emissions rules on diesel fleets and the risk that heavier fleet spending could hurt results if rental demand softens.

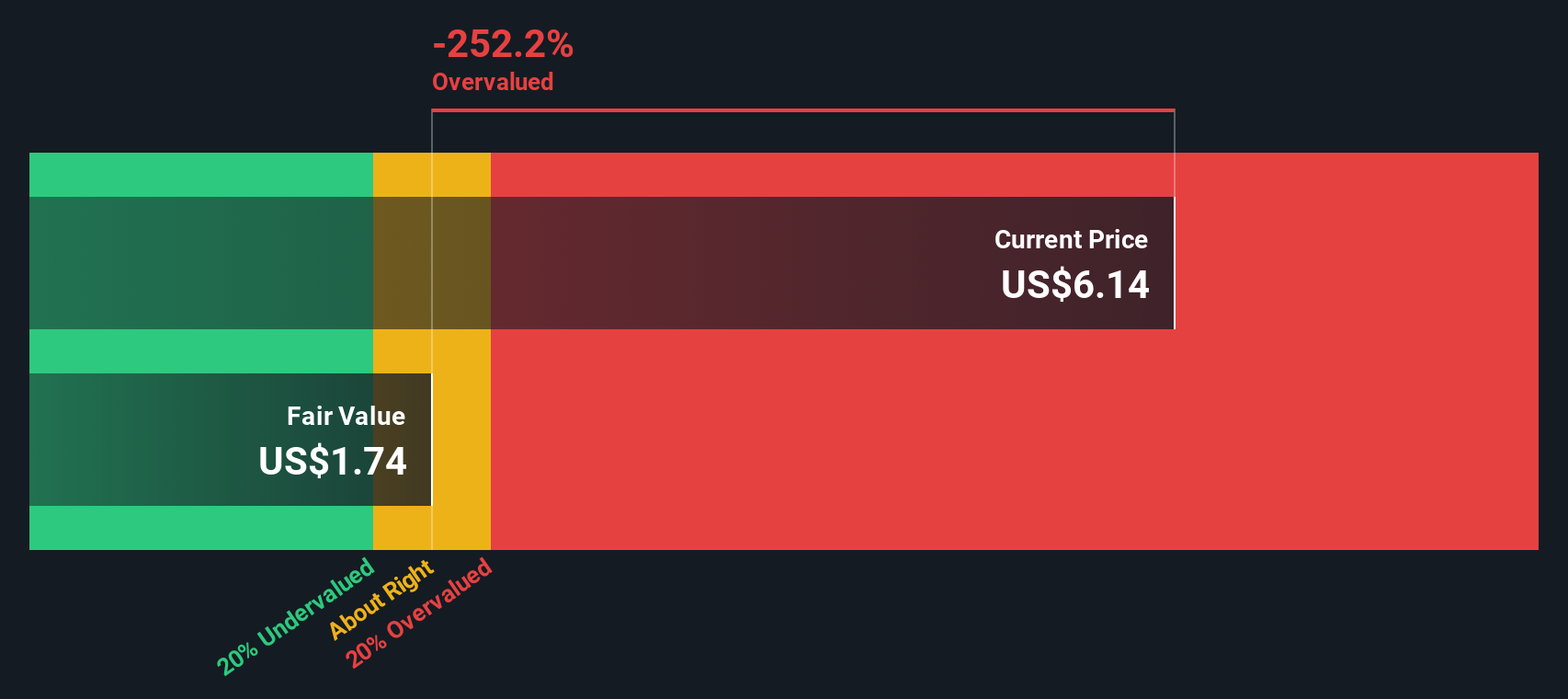

Another View: DCF Puts a Tighter Cap on Upside

While the narrative fair value sits at $6.50, our DCF model comes in slightly lower at $6.22, which is below the current $6.40 share price. That points to a small premium rather than a discount, so the question is whether you think the story or the cash flows deserve more weight.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Custom Truck One Source for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Custom Truck One Source Narrative

If parts of this view do not quite fit how you see Custom Truck One Source, you can review the numbers yourself and shape a narrative that matches your own research with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Custom Truck One Source.

Looking for more investment ideas?

If Custom Truck One Source is on your radar, do not stop there. Use the screener to quickly surface fresh ideas instead of waiting for them to find you.

- Target income first by checking out these 13 dividend stocks with yields > 3% that could add more yield potential to your watchlist.

- Spot potential mispricing by scanning these 881 undervalued stocks based on cash flows that might still be trading below what their cash flows suggest.

- Get ahead of emerging themes with these 19 cryptocurrency and blockchain stocks that are tied to blockchain, payments, and digital asset trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.