Please use a PC Browser to access Register-Tadawul

Assessing Dominion Energy (D) Valuation After Outperformance And Ahead Of 2026 Earnings Report

Dominion Energy Inc D | 65.96 | +0.76% |

Dominion Energy (D) has been in focus after its shares outperformed broader benchmarks, as investors look ahead to the February 23, 2026 earnings report and reassess shifting analyst expectations.

The recent 1-month share price return of 10.39% and 12.27% year to date suggests momentum is building, while the 1-year total shareholder return of 25.34% points to a stronger longer run than the shorter term alone might imply.

If Dominion Energy’s recent move has you thinking about where infrastructure linked themes could go next, you may want to check out 25 power grid technology and infrastructure stocks as a starting list of ideas.

With the stock trading around $66.51, a value score of 2, and shares sitting slightly above the average analyst price target of $63.50, investors may ask whether Dominion Energy is undervalued at this level or if the market is already pricing in potential future growth.

Most Popular Narrative: 5% Overvalued

With Dominion Energy closing at $66.51 against a widely followed fair value estimate of $63.50, the current price sits modestly above that narrative anchor, which is built on detailed assumptions about future regulated earnings, margins, and capital spending.

Large-scale investments in regulated renewables, especially the Coastal Virginia Offshore Wind (CVOW) project, position Dominion to benefit from the accelerating energy transition, earning stable regulated returns and expanding rate base, with a positive impact on long-term earnings.

Curious what kind of revenue path and margin profile are baked into that fair value, and how much growth the narrative assumes for offshore wind and the wider grid? The full write up breaks down those building blocks, including the projected earnings step up and the future P/E that keeps the model in balance.

Result: Fair Value of $63.50 (OVERVALUED)

However, this narrative can still be knocked off course if CVOW faces further cost or tariff shocks, or if regulators push back on full cost recovery.

Another angle on value

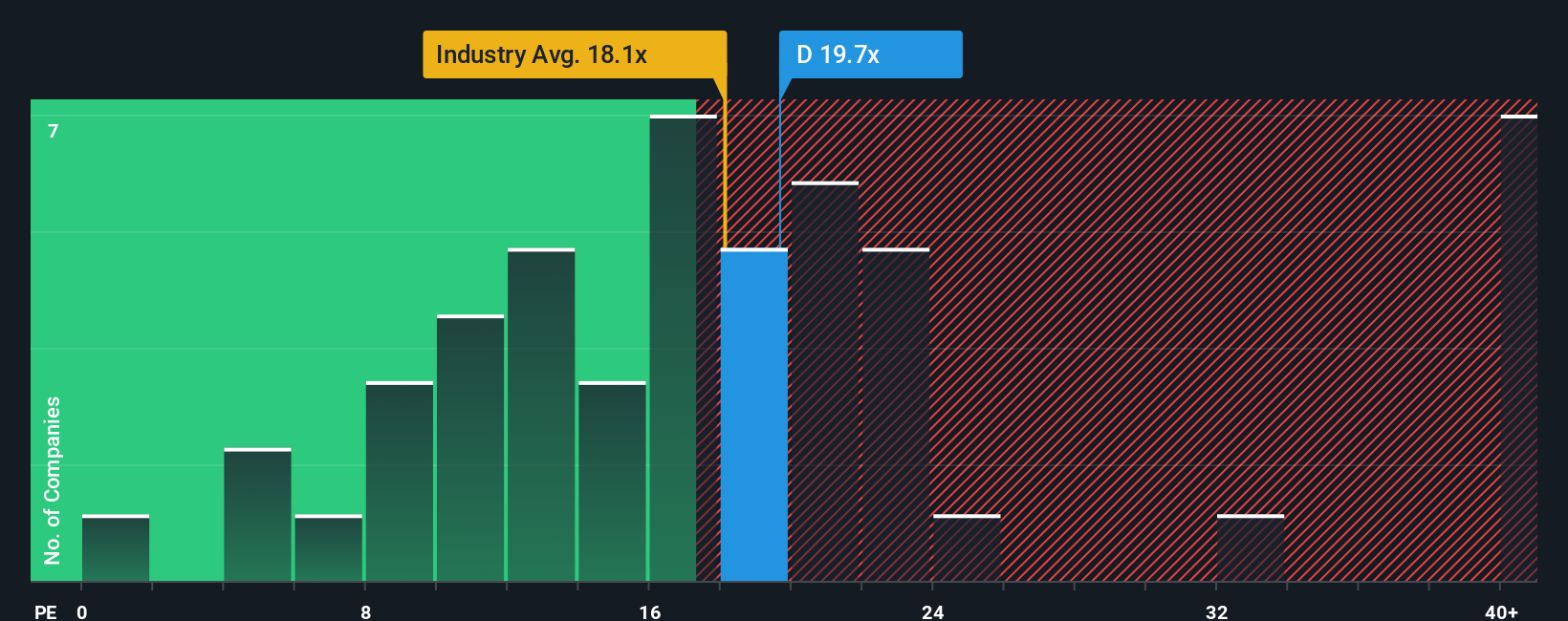

While the fair value narrative points to Dominion Energy looking about 5% overvalued at $66.51 versus $63.50, the earnings multiple sends a slightly different signal. The current P/E of 21.8x sits below a fair ratio of 24.1x, even though it is above the global Integrated Utilities average of 19.8x and below peer levels of 23.6x. That mix hints at some valuation risk if sentiment turns, but also some support if the market leans closer to the fair ratio or peers. Which signal do you think the market leans into next?

Build Your Own Dominion Energy Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom view of Dominion in just a few minutes, then Do it your way

A great starting point for your Dominion Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Dominion has sparked your interest, do not stop here. Put your research to work by lining up a few more companies that could suit your approach.

- Target potential mispriced opportunities by scanning our list of 53 high quality undervalued stocks that pair strong fundamentals with more modest expectations.

- Strengthen your income watchlist by checking out 13 dividend fortresses that focus on higher yields backed by solid business profiles.

- Prioritize resilience by reviewing 85 resilient stocks with low risk scores designed for investors who want steadier stories and fewer unpleasant surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.