Please use a PC Browser to access Register-Tadawul

Assessing DT Midstream (DTM) Valuation As Growth Expectations Clash With Cyclical Risk Concerns

DT Midstream, Inc. DTM | 136.06 | +2.82% |

DT Midstream (DTM) is back in focus as recent commentary suggests the stock is priced for sustained high growth, even though its midstream business is tied to a cyclical upstream sector.

The recent announcement of DT Midstream’s upcoming 2026 Annual Meeting lands at a time when momentum has been building, with a 10.6% 1 month share price return, a 37.16% 1 year total shareholder return and a 191.73% 3 year total shareholder return from a share price now at $133.21.

If this kind of sustained interest in energy infrastructure has your attention, it could be a moment to widen your search with our 25 power grid technology and infrastructure stocks as potential comparison ideas.

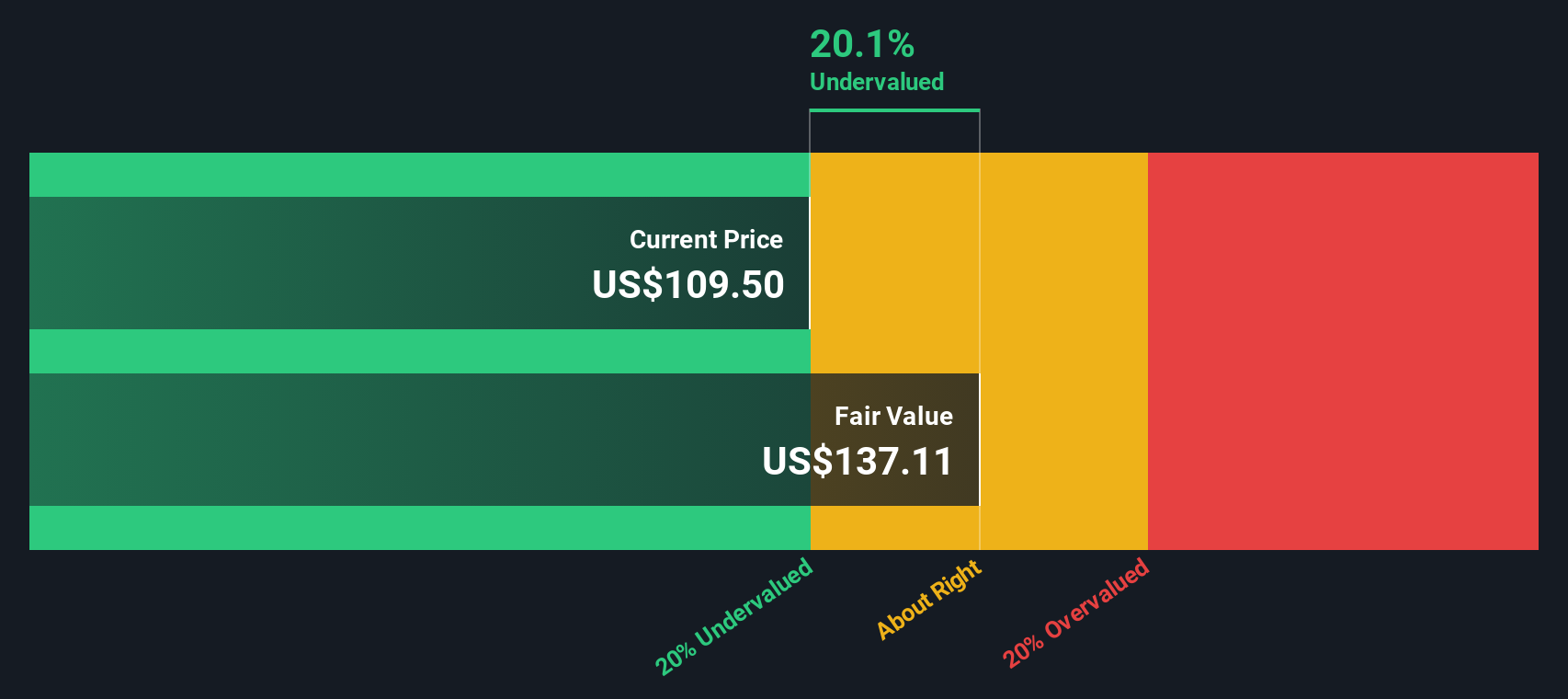

With the share price near $133.21, a value score of 2 and an estimated intrinsic value implying roughly 38% upside, you have to ask: Is DT Midstream still undervalued, or is the market already pricing in aggressive future growth?

Most Popular Narrative: 5.7% Overvalued

With DT Midstream last closing at $133.21 against a narrative fair value of $126.08, the current price sits above what that narrative suggests is reasonable, which raises a key question about how much future earnings strength is already reflected.

Recent research updates on DT Midstream point to a reassessment of what analysts see as the company’s earnings power and risk-reward profile. This feeds directly into their higher fair value estimates.

Revisions to the risk profile in recent research imply that some analysts view the balance between cash generation and operational risk as more attractive than before. This feeds into their target-setting framework.

Want to see what is sitting behind that upgraded earnings power story? Revenue expectations, margin assumptions and a premium earnings multiple all play a part, but the exact mix may surprise you.

Result: Fair Value of $126.08 (OVERVALUED)

However, those assumptions can come under pressure if long term gas demand softens faster than expected or if major customers push to renegotiate key contracts.

Another Angle: DCF Points to Underpriced Cash Flows

While the consensus narrative flags DT Midstream as about 5.7% overvalued at $133.21 versus a fair value of $126.08, our DCF model tells a different story. In that view, the stock trades roughly 38% below an estimated future cash flow value of $216.43. Which story do you find more convincing?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DT Midstream for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 54 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DT Midstream Narrative

If you are not fully on board with these conclusions or simply want to test your own assumptions against the same data, you can build a custom view of DT Midstream in just a few minutes and Do it your way

A great starting point for your DT Midstream research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If DT Midstream has sharpened your thinking, do not stop here. Use the Simply Wall St Screener to uncover fresh opportunities that fit your style.

- Spot potential mispricings early by scanning our 54 high quality undervalued stocks that combine quality metrics with discounted share prices.

- Lock in income focused ideas by reviewing a curated list of 13 dividend fortresses with yields that stand out.

- Sleep easier by shortlisting 83 resilient stocks with low risk scores designed to prioritise financial resilience and lower volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.