Please use a PC Browser to access Register-Tadawul

Assessing Enterprise Products Partners After Strong Five Year Return and Latest Dividend Hike

Enterprise Products Partners L.P. EPD | 35.15 35.34 | +0.67% +0.55% Post |

If you have been keeping an eye on Enterprise Products Partners, it is only natural to ask what is next for this standout player in the midstream energy sector. The company’s story is one hopeful investors and cautious observers alike are following closely, with Enterprise’s unit price painting a picture of both resilience and potential opportunity. Short-term fluctuations might catch the eye; after giving back 2.1% in the past week, the stock has been almost flat over the last month. However, big-picture thinkers will notice something much more compelling: over the last five years, Enterprise Products Partners has delivered a remarkable 168.4% return, with a solid 16.9% gain in just the past year. That kind of long-term strength certainly deserves a closer look.

Market watchers recently noted shifts in investor risk tolerance and renewed interest in steady, income-generating assets. These are factors that have played a part in the recent stock movement. There is also the company’s valuation score to consider. Enterprise Products Partners scores a 5 out of a possible 6 on our value assessment, meaning it is considered undervalued in five major valuation metrics. This strong score sets the stage for a deeper dive.

But numbers alone never tell the whole story. Let us break down which valuation tests Enterprise Products Partners passes, where it falls short, and most importantly, explore an even better way to think about valuation that could give you an edge.

Enterprise Products Partners delivered 16.9% returns over the last year. See how this stacks up to the rest of the Oil and Gas industry.Approach 1: Enterprise Products Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value, reflecting the time value of money. This approach seeks to determine what Enterprise Products Partners is worth right now based on expectations for its future cash generation.

Enterprise Products Partners currently generates a Free Cash Flow (FCF) of $4.95 Billion. Analysts project steady growth in the business, with FCF expected to rise to $7.22 Billion by 2029. While detailed analyst consensus is only available for the next five years, Simply Wall St extrapolates additional years based on historical trends and industry context. This layered approach helps investors see both the near and long-term outlook for the company's cash flows.

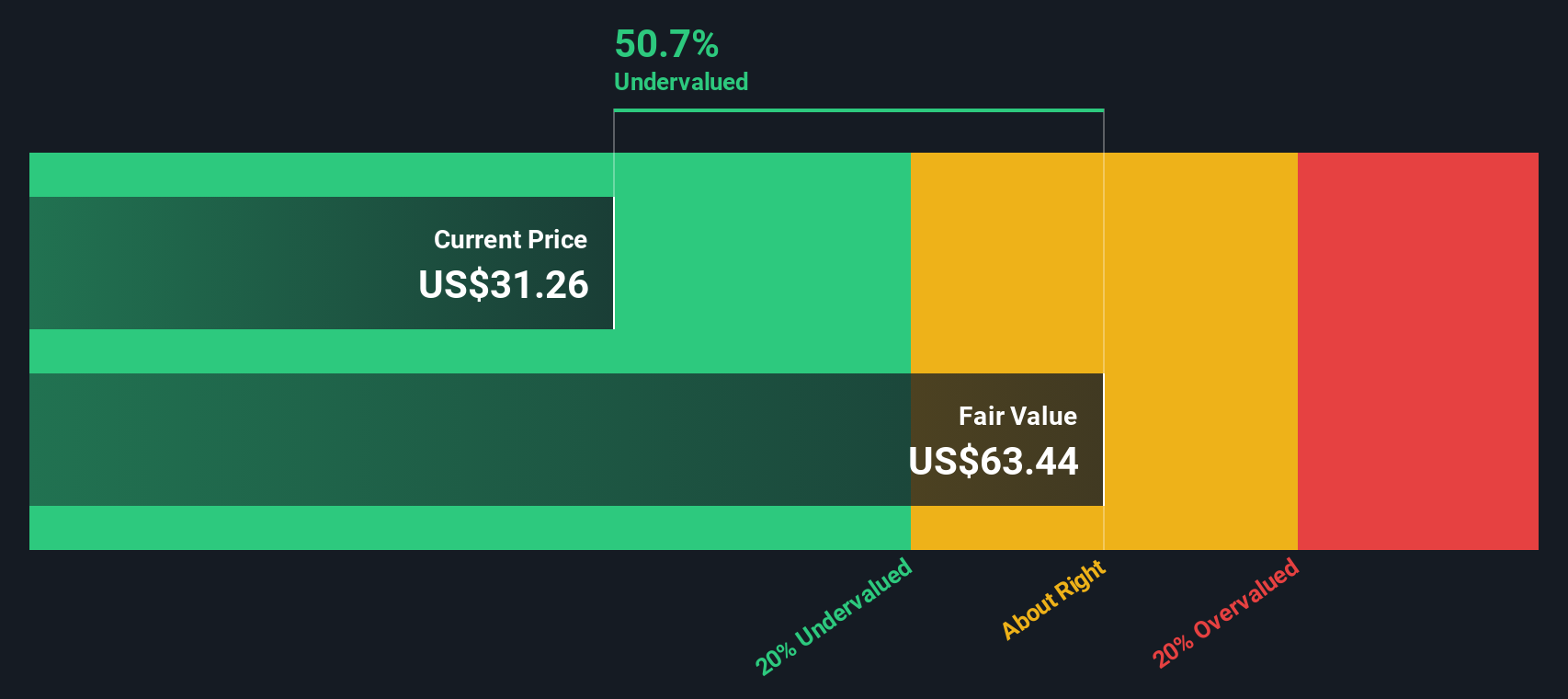

With these projections, the DCF model calculates an estimated fair value of $62.34 per share for Enterprise Products Partners using the 2 Stage Free Cash Flow to Equity method. Compared to current trading levels, this suggests the stock is 49.5% undervalued at present.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Enterprise Products Partners.

Approach 2: Enterprise Products Partners Price vs Earnings

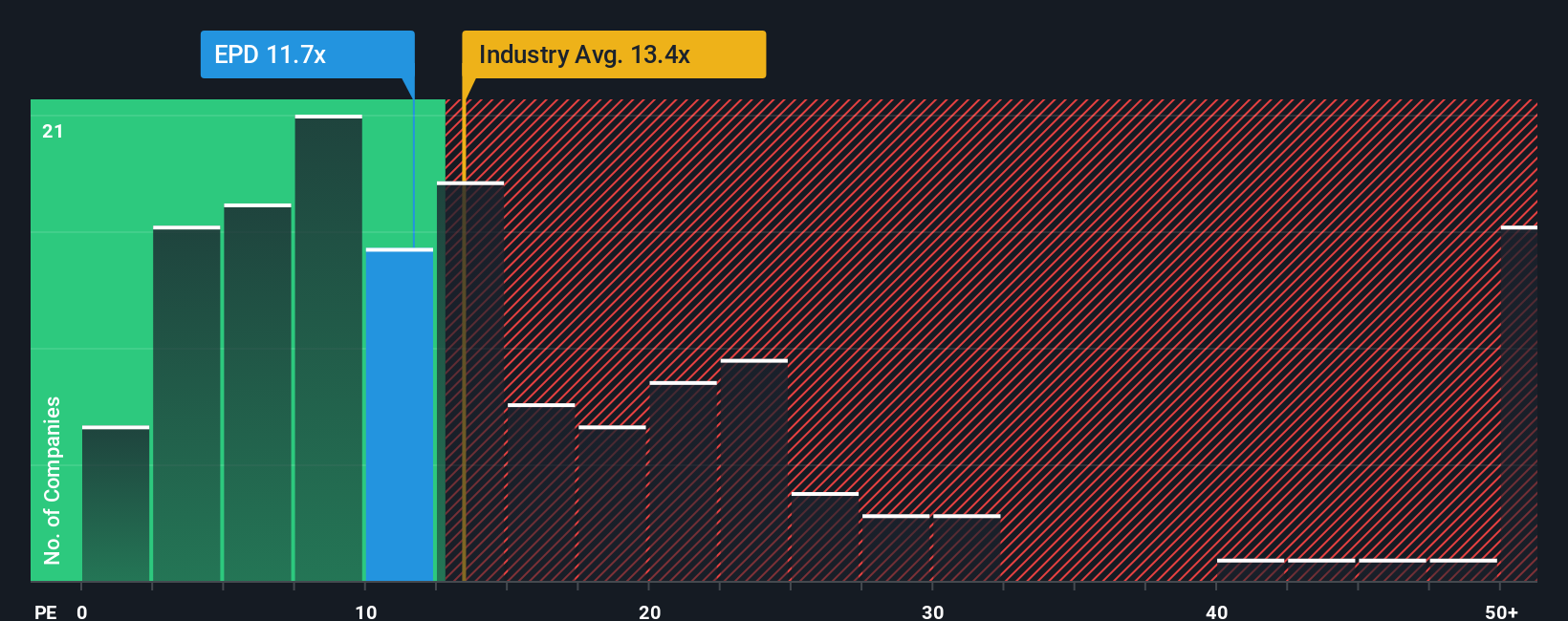

For profitable businesses like Enterprise Products Partners, the price-to-earnings (PE) ratio provides a clear snapshot of how the market values each dollar of company earnings. It is a widely used and trusted metric because it connects a company’s financial performance directly to its valuation, making it easier for investors to compare across similar companies.

The appropriate or “normal” PE ratio for a stock depends heavily on expectations for future earnings growth and the level of risk investors associate with the business. Companies that are expected to grow rapidly or are seen as having steadier earnings streams usually command a higher PE ratio, while those viewed as riskier or slower-growing tend to trade at lower multiples.

Currently, Enterprise Products Partners trades at an 11.73x PE ratio. This compares favorably to the industry average of 12.65x and is meaningfully lower than the peer average of 18.85x. While this could imply the stock is undervalued, Simply Wall St’s proprietary Fair Ratio adds an extra layer of context. The Fair Ratio for Enterprise Products Partners is 18.97x, which factors in the company’s profit margins, future earnings outlook, industry environment, market capitalization, and specific risk profile.

This Fair Ratio is a more nuanced benchmark than raw industry or peer averages, as it incorporates Enterprise’s growth prospects and the risks it faces. In other words, it provides a more personalized “fair value” for the company based on comprehensive data, not just broad averages.

With Enterprise Products Partners trading at 11.73x compared to a Fair Ratio of 18.97x, the stock appears undervalued based on the PE approach.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Enterprise Products Partners Narrative

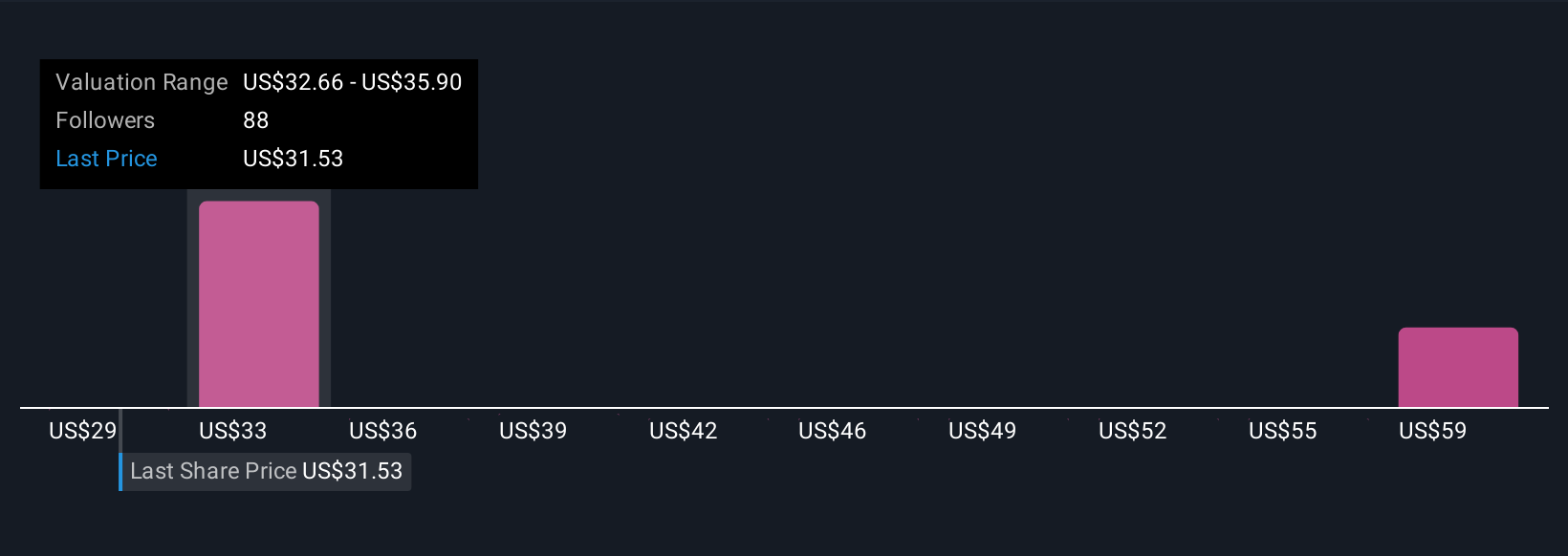

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a clear, easy-to-follow story about a company. It is your perspective on what the business will achieve, backed up by your own assumptions about future revenue, earnings, margins, and ultimately, fair value.

Narratives connect the dots between a company's story, a forecast for its performance, and what you believe a share is truly worth. On Simply Wall St’s platform, millions of investors share Narratives on the Community page, making it simple to compare perspectives, track assumptions, and see how the crowd is thinking.

With Narratives, you decide when to buy or sell by comparing your fair value calculation to the current price. If your story paints a bullish future and the price is below your fair value, it may suggest a buying opportunity.

Narratives also update automatically whenever new information such as news or earnings is released, so your valuation stays current without extra effort.

- For Enterprise Products Partners, one Narrative might expect export growth and strong infrastructure leading to a $40.00 price target. Another Narrative might highlight operational risks and see just $32.00 as fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.