Please use a PC Browser to access Register-Tadawul

Assessing Evercore (EVR) Valuation After Middle East Expansion And Senior Leadership Hires

Evercore Inc. Class A EVR | 362.00 | -2.69% |

Evercore (EVR) has been active on the corporate development front, securing an Arranging License in Saudi Arabia for a new Riyadh office while also adding senior managing directors to its financial sponsors group in London and New York.

These hires and the Riyadh expansion sit alongside a strong price move, with the share price at US$383.12 and a 30 day share price return of 13.61%, helping to extend a 1 year total shareholder return of 38.83% and a very large 3 year total shareholder return. This suggests that momentum has been building rather than fading.

If Evercore’s recent moves have caught your attention, it could be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

With revenue of US$3.54b, net income of US$528.40m and a share price already above the average analyst target, the key question is whether Evercore still trades at a discount or if the market is already pricing in expectations for the business.

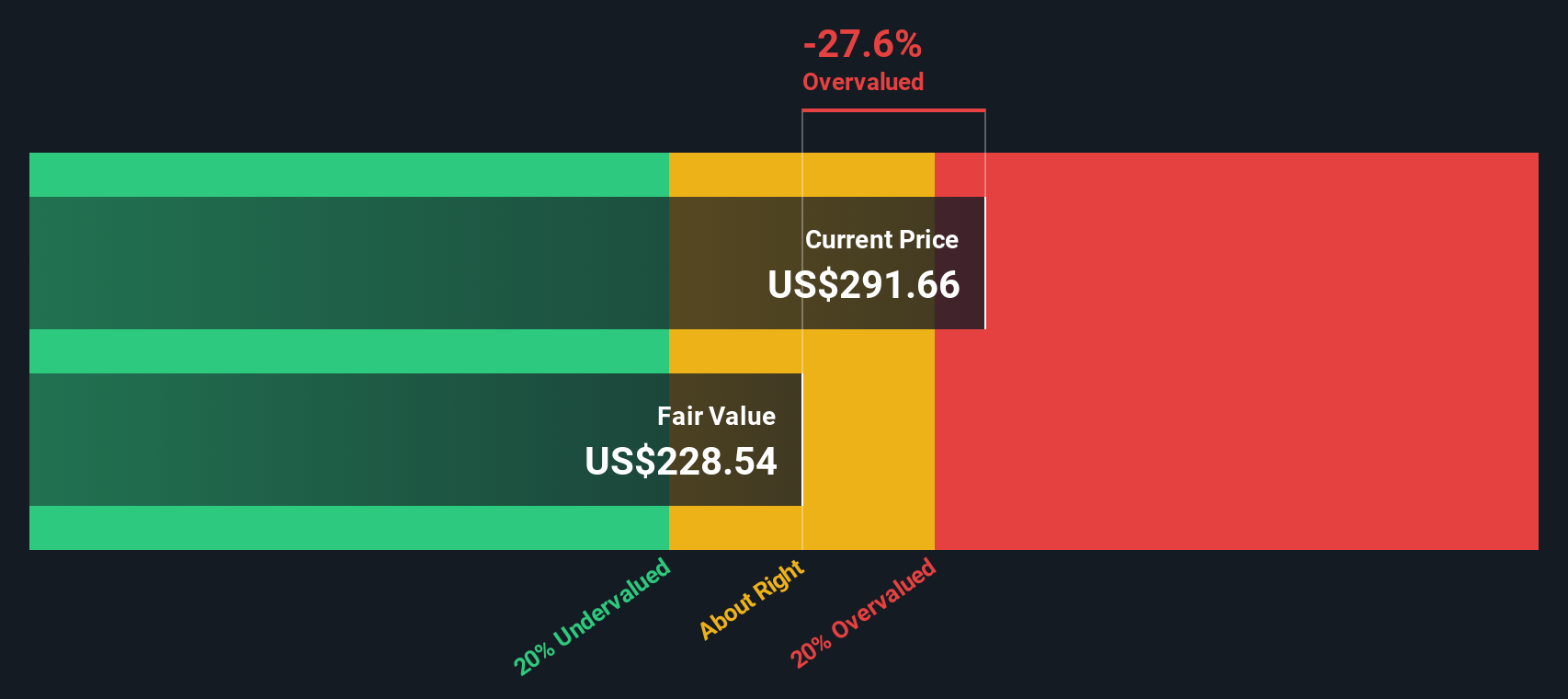

Most Popular Narrative: 8% Overvalued

Evercore’s most followed narrative points to a fair value of about US$353.56, which sits below the recent US$383.12 share price, creating a valuation gap worth unpacking.

The analysts have a consensus price target of $364.2 for Evercore based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $5.4 billion, earnings will come to $953.1 million, and it would be trading on a PE ratio of 19.9x, assuming you use a discount rate of 8.2%.

Curious what underpins that valuation gap? The narrative leans heavily on compounding revenue, a step up in margins, and a future earnings multiple that assumes meaningful execution.

Result: Fair Value of $353.56 (OVERVALUED)

However, there is still a risk that high compensation and other fixed costs, or softer M&A volumes, could limit the margin and earnings progress that this narrative assumes.

Another View: DCF Points To A Different Story

While the popular narrative tags Evercore as about 8% overvalued versus an intrinsic value of US$353.56, the Simply Wall St DCF model suggests something different. On that framework, Evercore at US$383.12 sits around 5% below an estimated fair value of US$403.22. This raises an important question for you: which valuation do you trust more?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Evercore for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Evercore Narrative

If these viewpoints do not quite fit how you see Evercore, you can review the same data yourself and build a tailored thesis in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Evercore.

Looking for more investment ideas?

If Evercore is on your radar, do not stop there, use the Simply Wall St Screener to spot other opportunities that could fit your portfolio just as well.

- Boost your income focus by checking out these 12 dividend stocks with yields > 3% that may suit investors who want steadier cash returns.

- Tap into future tech themes with these 24 AI penny stocks that link artificial intelligence to real business models.

- Hunt for potential mispriced opportunities through these 868 undervalued stocks based on cash flows that might trade below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.