Please use a PC Browser to access Register-Tadawul

Assessing Evolv Technology (EVLV) Valuation Following Recent Share Price Momentum

EVINE Live Inc. Class A EVLV | 6.67 | -0.60% |

Most Popular Narrative: 12.1% Undervalued

According to the most widely followed narrative, Evolv Technologies Holdings is currently undervalued by just over 12%, with analysts expecting further potential upside in the share price as key business drivers support continued growth.

The increasing prevalence of large multi-year contracts with public school systems and hospitals, driven by heightened public safety concerns in high-density environments, is expanding Evolv's total addressable market and is expected to support significant revenue growth over the coming years. Growing customer adoption and frequent upgrades to newer platforms such as Gen2 and eXpedite reflect a successful technology roadmap that is boosting customer retention rates and fostering longer-term subscription commitments. This positively impacts both ARR and net margins.

What is behind this bullish outlook? Discover which bold financial levers and notable shifts in recurring revenue are reflected in the consensus. There is a story of rapid expansion and optimism about substantial market opportunities, but the real surprise lies in the future profit transformation this narrative assumes. Ready to unpack the assumptions fueling that eye-catching fair value?

Result: Fair Value of $9.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, future gross margins remain uncertain, and a slowdown in expansion across key verticals could quickly dampen the current bullish outlook.

Find out about the key risks to this Evolv Technologies Holdings narrative.Another View: Our Model Tells a Different Story

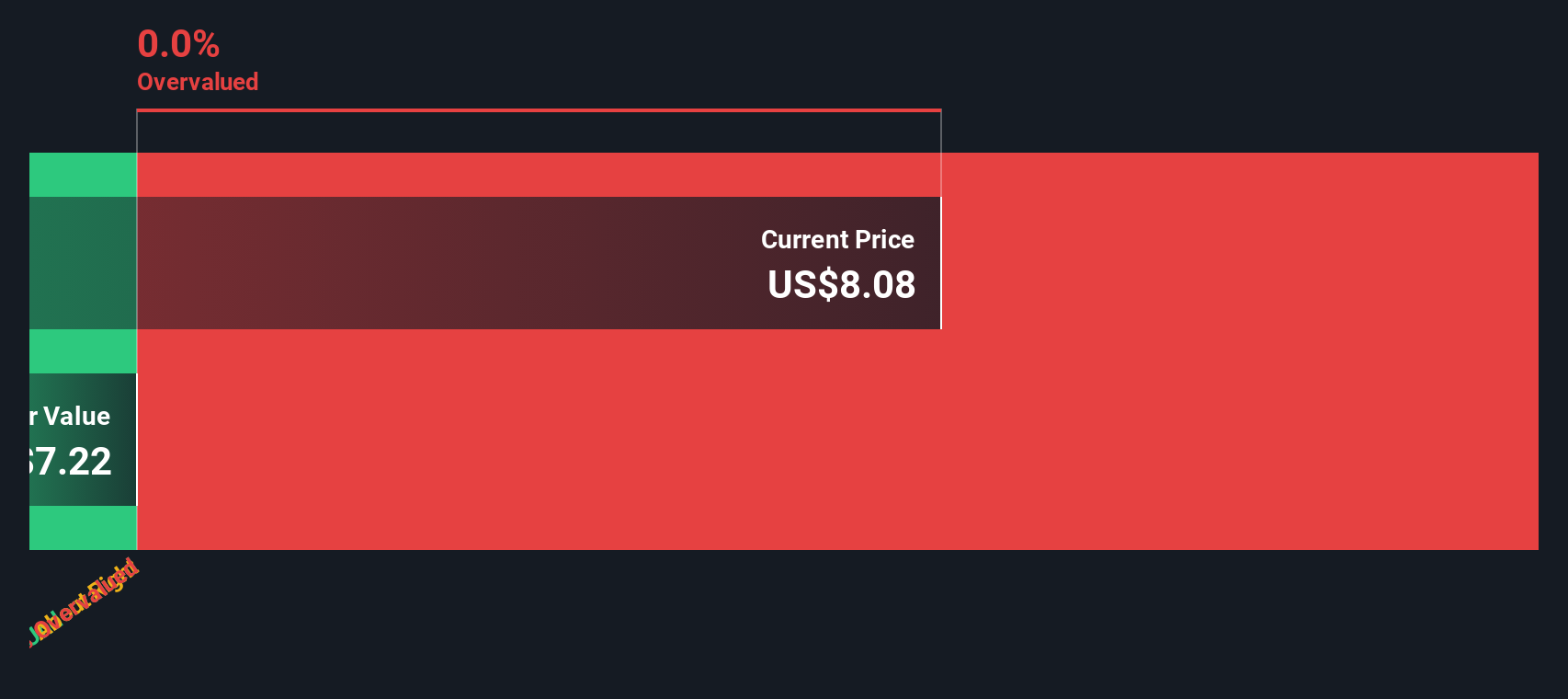

While the analyst price target leans optimistic, our SWS DCF model comes to a much more cautious conclusion. It suggests Evolv Technologies Holdings could be overvalued based solely on cash flow projections. Both methods use different lenses, but which resonates with you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Evolv Technologies Holdings Narrative

If these conclusions do not align with your perspective, or if a hands-on approach suits you better, crafting your own detailed narrative takes just minutes. Do it your way.

A great starting point for your Evolv Technologies Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to take charge of your investment strategy? Now is the perfect time to find tomorrow's winners and spot exceptional opportunities others might miss. Act quickly and give yourself the edge by using these tools:

- Supercharge your growth portfolio by tapping into AI penny stocks that are shaping industries with artificial intelligence breakthroughs and cutting-edge machine learning solutions.

- Unlock the potential of steady income streams as you handpick dividend stocks with yields > 3% trusted by investors seeking reliable and attractive yields above 3%.

- Jump on market inefficiencies by sourcing undervalued stocks based on cash flows primed for value-seekers and positioned for upside based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.