Please use a PC Browser to access Register-Tadawul

Assessing Exponent (EXPO) Valuation After UBS Turns More Constructive on 2026 Growth Prospects

Exponent, Inc. EXPO | 73.43 73.43 | -0.07% 0.00% Pre |

UBS came away more constructive on Exponent (EXPO) after recent management meetings, highlighting improving demand for its proactive Consumer Electronics work and a planned build out of full time staff that could support stronger 2026 revenue.

That brighter narrative contrasts with a tougher stretch for investors, with the share price at $73.69 and a year to date share price return of minus 16.2 percent and a one year total shareholder return of minus 17.5 percent. However, recent one month and three month share price gains suggest momentum is tentatively rebuilding as investors reassess Exponent's growth path into 2026.

If constructive outlooks like Exponent's have you rethinking your watchlist, it could be a good moment to discover fast growing stocks with high insider ownership.

Yet with the stock still below UBS's higher price target and long term returns lagging, investors face a key question: is Exponent quietly undervalued today, or is the market already baking in that 2026 rebound?

Most Popular Narrative Narrative: 13.8% Undervalued

With Exponent last closing at $73.69 versus a fair value near $85.50, the most followed narrative points to meaningful upside if its growth story plays out.

Ongoing expansion into high growth, innovation driven domains including artificial intelligence safety, distributed energy systems, and advanced medical technologies broadens Exponent's addressable market and client base, setting up an accelerating revenue trajectory as these industries scale.

Strengthening headcount growth, propelled by effective recruiting and a development focused culture, enables Exponent to capture more project volume and maintain its reputation driven pricing power, with positive implications for both top line growth and sustained high net margins.

Curious how steady mid single digit growth and firm margins can still support a richer earnings multiple? The narrative leans on confident forecasts, disciplined discounting, and an eye catching future valuation threshold. Want to see which assumptions really carry that price?

Result: Fair Value of $85.50 (UNDERVALUED)

However, softer utilization and potential automation driven fee pressure could still limit upside if Exponent fails to convert demand into sustained margin expansion.

Another Lens on Valuation

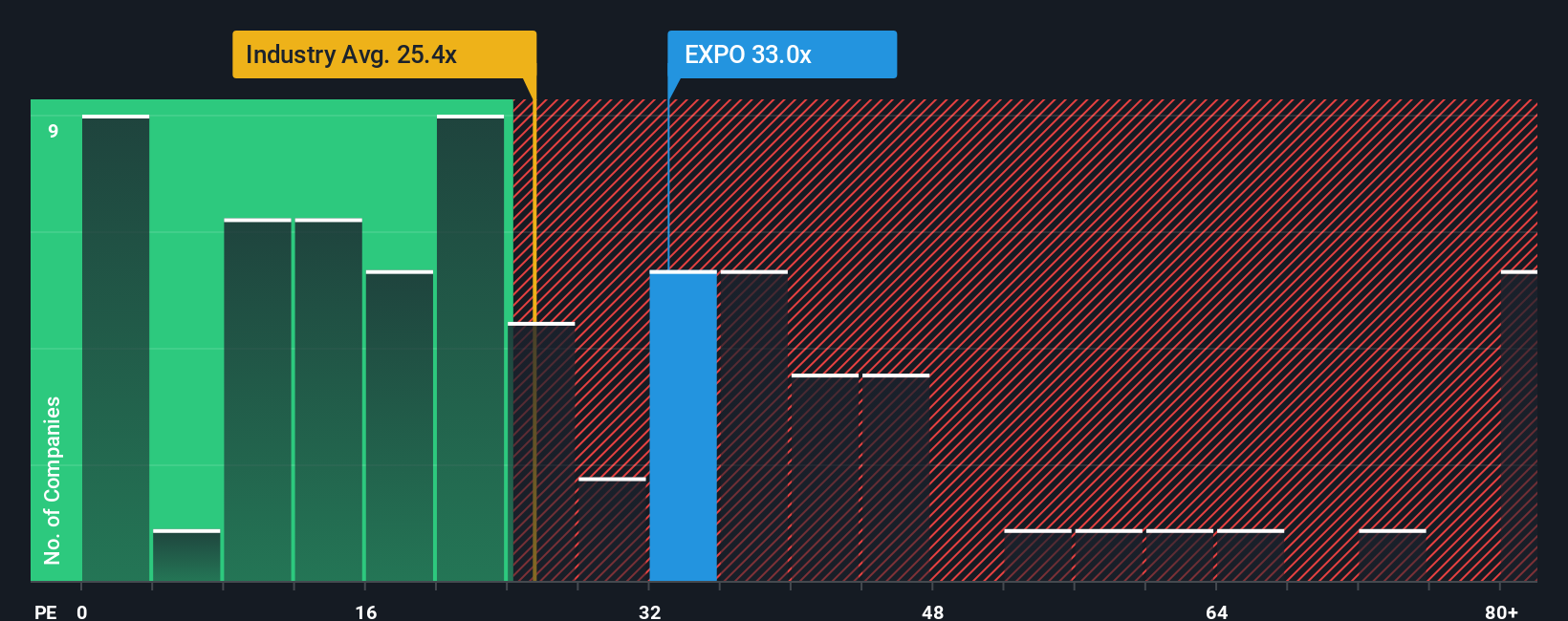

Step away from the narrative fair value and Exponent suddenly looks pricey. Its current P/E of 35.1 times dwarfs the Professional Services peer average of 18 times and sits well above a fair ratio of 21.3 times, raising the risk that good news is already in the price.

Build Your Own Exponent Narrative

If these conclusions do not quite match your view or you would rather interrogate the numbers yourself, you can build a narrative in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Exponent.

Ready for your next investing edge?

Before you move on, lock in your next potential winners by putting the Simply Wall Street Screener to work for you on fresh, data driven ideas.

- Capitalize on market mispricing by targeting companies trading below their intrinsic value through these 908 undervalued stocks based on cash flows.

- Position yourself at the forefront of the AI revolution with carefully filtered innovators using these 26 AI penny stocks.

- Strengthen your income strategy by screening for reliable cash generators via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.