Please use a PC Browser to access Register-Tadawul

Assessing FactSet Research Systems’s Valuation as Analysts Grow Bullish After AI Product Updates and New Partnerships

FactSet Research Systems Inc. FDS | 292.47 292.47 | +0.32% 0.00% Pre |

FactSet Research Systems (FDS) Piques Investor Curiosity Amid New Product Integrations and Earnings Buzz

If you follow FactSet Research Systems (FDS), recent headlines have offered plenty to chew on. The company just rolled out an exclusive integration of MarketAxess’ AI-powered bond pricing data directly into its Workstation platform, targeting the core of institutional trading workflows. In addition, FactSet announced a partnership with Hebbia to further enhance data accessibility for its clients. These developments are landing at a time when analysts are showing renewed optimism ahead of the company’s upcoming earnings, with the narrative building that FactSet could once again outperform profit expectations.

All this arrives against a backdrop of a stock that has been on a softer trajectory this year. FactSet’s share price has slipped over the past month and quarter and remains down over the year, reflecting a cooling of investor enthusiasm despite modest annual growth in both revenue and net income. Still, the integration of new data capabilities and the company’s steady earnings performance have caught the attention of those wondering whether momentum could turn if value gets unlocked through these innovations.

With investors digesting new product launches and sizing up the coming earnings report, the big question is whether FactSet’s current valuation leaves room for upside if growth accelerates, or if the stock already reflects all of its future promise.

Most Popular Narrative: 15% Undervalued

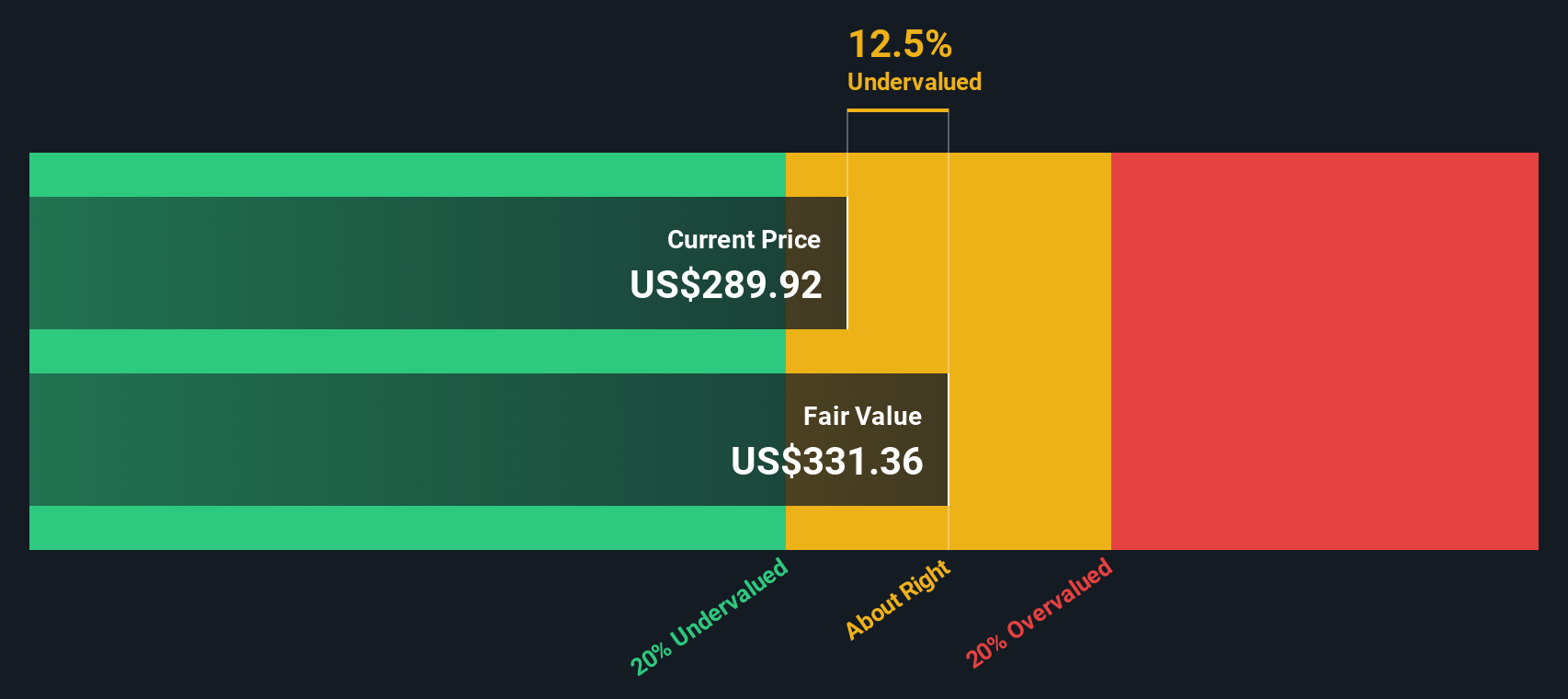

The prevailing narrative points to FactSet Research Systems as undervalued, with a fair value notably higher than the current share price, based on assumptions around future growth and profitability.

FactSet is integrating new acquisitions like Irwin and LiquidityBook, adding immediate cross-sell opportunities and expanding services across buy-side and banking workflows. This will support revenue growth. The launch of new GenAI products, including Pitch Creator and conversational API, is expected to provide additional services that drive adoption and increase ASV growth. This may positively impact future revenue.

Curious how FactSet’s strategy could unlock this hidden value? The narrative’s projections rely on strong assumptions about accelerating earnings, widening profit margins, and a future profit multiple that could outpace the market. Want to see what numbers analysts are betting on and what it would take for the stock to break out higher? Dive into the full narrative for the key growth levers and the ambitious financial targets driving this valuation case.

Result: Fair Value of $428.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing revenue growth due to muted price increases and persistent challenges in the banking sector could hinder FactSet’s expected earnings acceleration.

Find out about the key risks to this FactSet Research Systems narrative.Another View: Discounted Cash Flow Model

While analyst targets suggest FactSet looks undervalued, our DCF model presents a different perspective and indicates the stock might actually be trading close to its fair value. Does the market already account for all future growth?

Build Your Own FactSet Research Systems Narrative

If you have a different perspective or prefer to dig into the numbers yourself, you can easily craft your own narrative in just a few minutes. Do it your way.

A great starting point for your FactSet Research Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for the next opportunity to pass you by. Unlock your potential returns by searching for stocks with the attributes you care about most using the Simply Wall Street Screener.

- Spot high-yield opportunities and boost your portfolio’s income by uncovering dividend stocks with yields > 3% that reward you with robust payouts and real staying power.

- Capture tomorrow’s breakthroughs by backing AI penny stocks that leverage intelligent tech to shape entire industries and redefine future growth.

- Zero in on exceptional value and get ahead of the crowd with undervalued stocks based on cash flows offering attractive price tags based on strong cash flows and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.