Please use a PC Browser to access Register-Tadawul

Assessing Fifth Third After Recent Share Price Gains and Excess Returns Valuation Results

Fifth Third Bancorp FITB | 45.18 45.18 | -0.09% 0.00% Post |

- Wondering if Fifth Third Bancorp is still good value after this latest run, or if the easy money has already been made? Let us walk through what the numbers really say before you decide your next move.

- The stock has quietly pushed higher, with shares up 4.9% over the last week and 7.9% over the past month, while sitting about flat over the last year but still posting gains of 56.7% over 3 years and 97.3% over 5 years.

- Part of that move reflects the broader market warming back up to regional banks as credit risk fears ease, alongside steady progress in cleaning up balance sheets and tightening costs. At the same time, ongoing shifts in interest rate expectations and regulatory rhetoric have kept sentiment on edge, which makes a closer look at valuation especially timely.

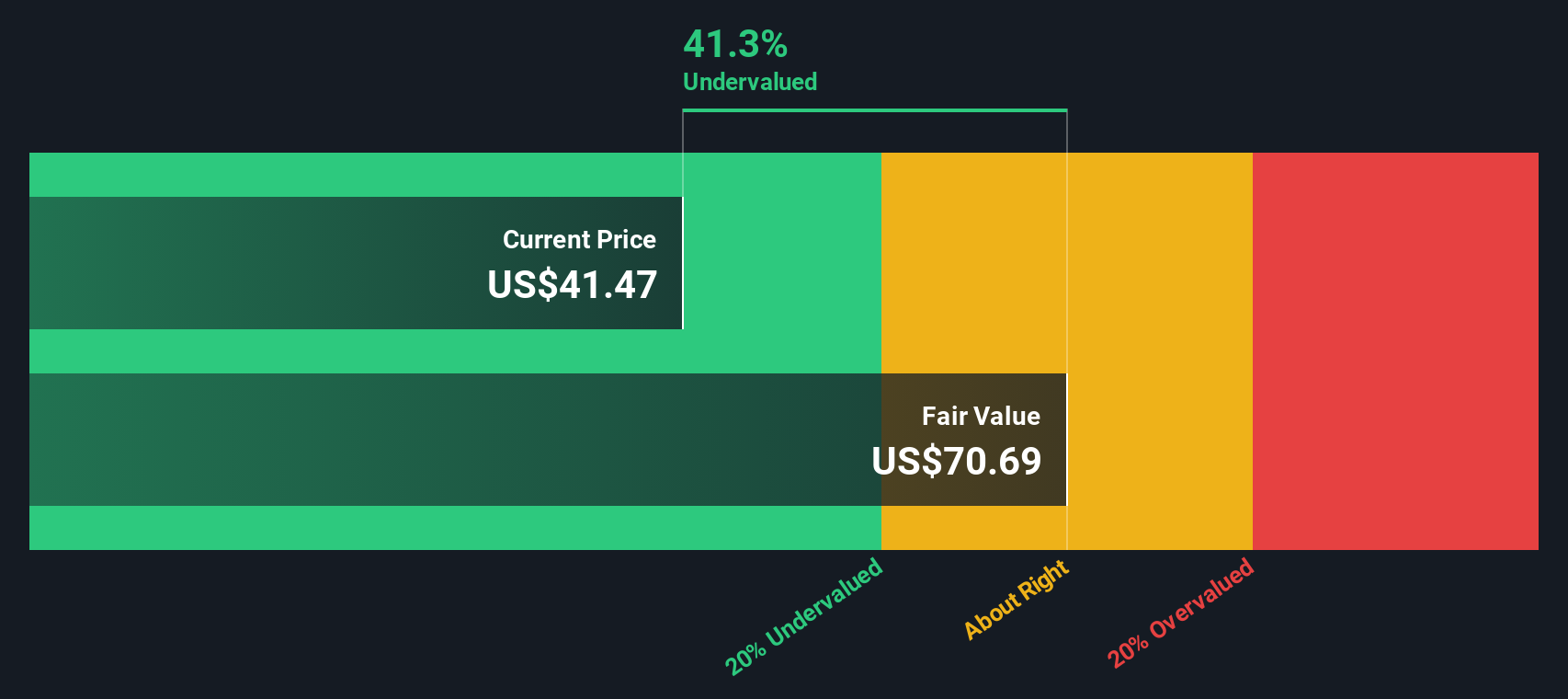

- Right now, Fifth Third Bancorp scores a 4 out of 6 on our valuation checks, suggesting it screens as undervalued on most but not all of the metrics we track. In the next sections we will unpack that score using different valuation approaches, and then finish by looking at a more complete way to think about what this bank is really worth.

Approach 1: Fifth Third Bancorp Excess Returns Analysis

The Excess Returns model looks at how efficiently Fifth Third Bancorp turns its equity base into profits above its cost of capital, then capitalizes those surplus returns into an intrinsic value per share.

In this framework, Fifth Third starts with a Book Value of $29.26 per share and a Stable EPS of $4.54 per share, based on weighted future Return on Equity estimates from 14 analysts. With an Average Return on Equity of 13.33% and a Cost of Equity of $2.51 per share, the bank is estimated to generate an Excess Return of $2.03 per share, meaning it is expected to earn meaningfully more than investors require for the risk they take.

Analysts also see Stable Book Value rising to about $34.08 per share, based on forecasts from 13 analysts, which supports a higher long term earnings base. Putting these inputs together, the Excess Returns model estimates an intrinsic value of roughly $83.72 per share, compared with the current market price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Fifth Third Bancorp is undervalued by 45.7%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

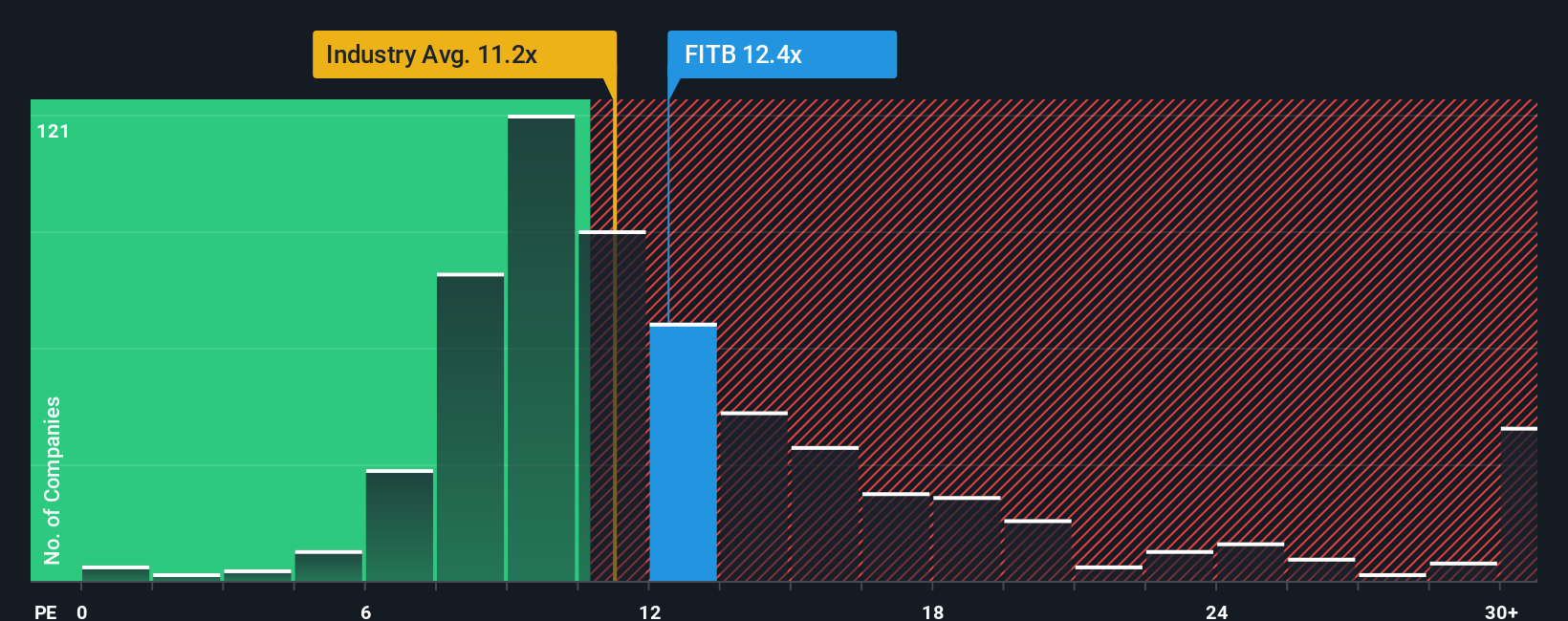

Approach 2: Fifth Third Bancorp Price vs Earnings

For a consistently profitable bank like Fifth Third, the price to earnings ratio is a practical way to judge value because it links what investors pay today to the profits the business is already generating. In general, faster growth and lower perceived risk justify a higher P E multiple, while slower growth or higher risk usually cap how far that multiple can stretch before it looks expensive.

Fifth Third currently trades on roughly 13.30x earnings, which is a bit above the broader Banks industry average of about 11.65x, but slightly below the peer group average of around 14.31x. To cut through those broad comparisons, Simply Wall St also calculates a proprietary Fair Ratio of 19.51x. This estimates the multiple the stock deserves given its specific earnings growth outlook, profitability, size and risk profile.

This Fair Ratio is more informative than a simple industry or peer comparison because it adjusts for Fifth Third’s own fundamentals rather than assuming all banks should trade alike. With the shares on 13.30x versus a Fair Ratio of 19.51x, the stock screens as attractively valued on this earnings based lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fifth Third Bancorp Narrative

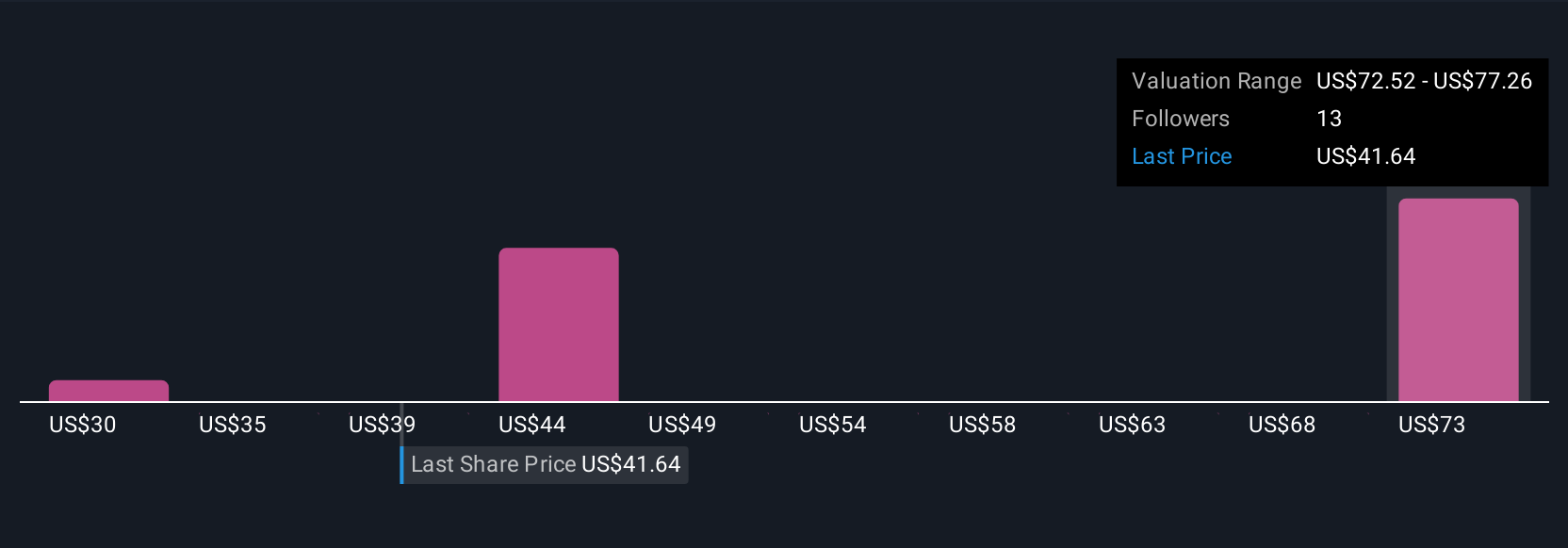

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your view of a company’s story to a concrete forecast and fair value. You can then compare that dynamically updated fair value to the current share price to help inform your own decisions about when to buy or sell. For example, you might lean toward a bullish case where Fifth Third Bancorp’s Comerica merger, Southeast expansion and tech investments justify something near the higher analyst target of about $55. Alternatively, you may prefer a more cautious view where competitive and regulatory risks keep you closer to the lower target near $43. Both perspectives can be clearly expressed through your own assumptions for future revenue, earnings and margins.

Do you think there's more to the story for Fifth Third Bancorp? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.